Legal Release of Promissory Note Form

When a borrower successfully pays off a loan, a significant document comes into play, ensuring that the transaction progresses smoothly to its conclusion. This document, known as the Release of Promissory Note form, serves as a formal acknowledgment that the borrower has fulfilled their financial obligation under the terms initially agreed upon. Its main purpose is to officially release them from any further payments, providing a clean slate and peace of mind for both the lender and the borrower. This form is crucial in the world of finance and personal lending, acting as a legal receipt that the loan has been fully repaid. Whether for large bank loans or private lending agreements, understanding the nuances of this form can save parties from future disputes, showcasing its importance in successfully concluding lending agreements.

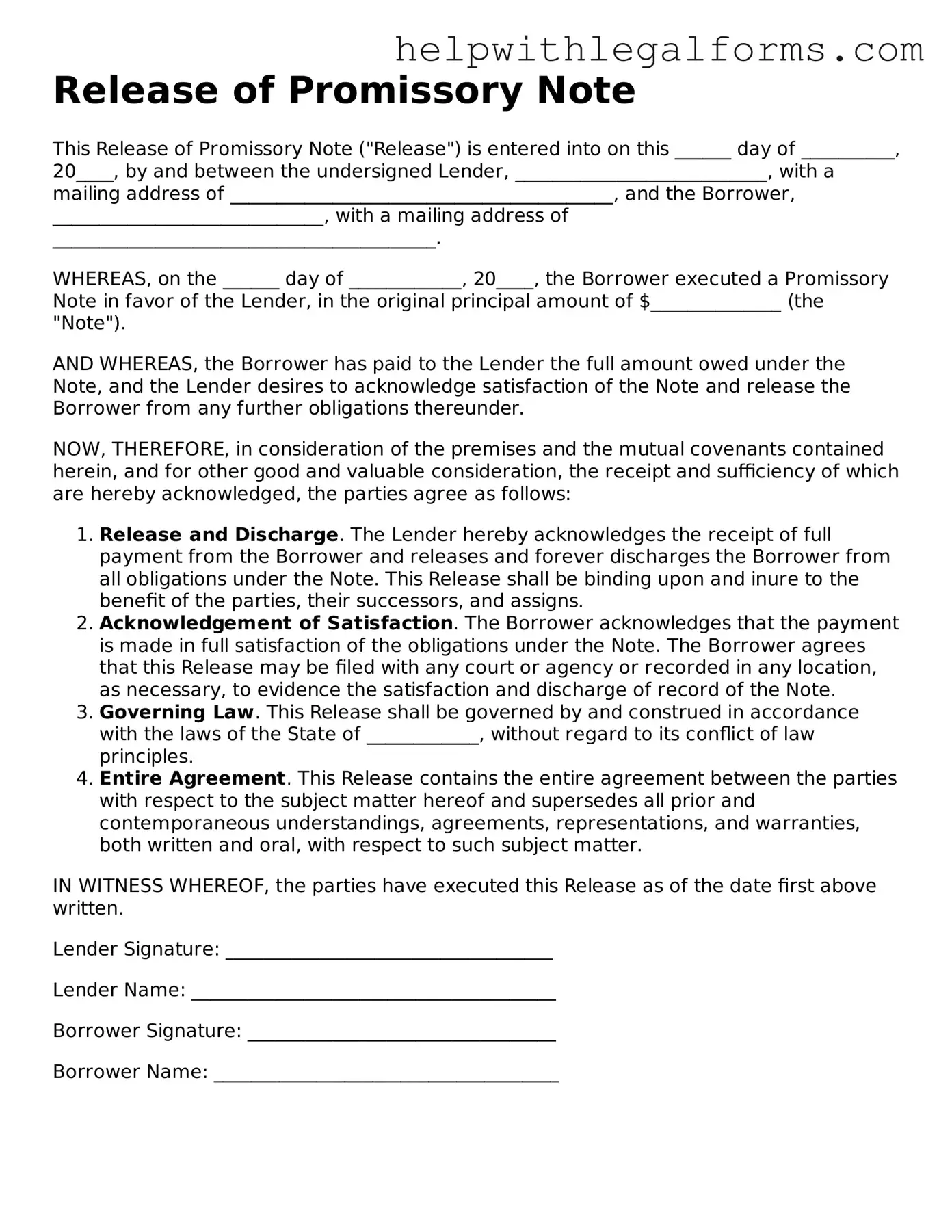

Example - Release of Promissory Note Form

Release of Promissory Note

This Release of Promissory Note ("Release") is entered into on this ______ day of __________, 20____, by and between the undersigned Lender, ___________________________, with a mailing address of _________________________________________, and the Borrower, _____________________________, with a mailing address of _________________________________________.

WHEREAS, on the ______ day of ____________, 20____, the Borrower executed a Promissory Note in favor of the Lender, in the original principal amount of $______________ (the "Note").

AND WHEREAS, the Borrower has paid to the Lender the full amount owed under the Note, and the Lender desires to acknowledge satisfaction of the Note and release the Borrower from any further obligations thereunder.

NOW, THEREFORE, in consideration of the premises and the mutual covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

- Release and Discharge. The Lender hereby acknowledges the receipt of full payment from the Borrower and releases and forever discharges the Borrower from all obligations under the Note. This Release shall be binding upon and inure to the benefit of the parties, their successors, and assigns.

- Acknowledgement of Satisfaction. The Borrower acknowledges that the payment is made in full satisfaction of the obligations under the Note. The Borrower agrees that this Release may be filed with any court or agency or recorded in any location, as necessary, to evidence the satisfaction and discharge of record of the Note.

- Governing Law. This Release shall be governed by and construed in accordance with the laws of the State of ____________, without regard to its conflict of law principles.

- Entire Agreement. This Release contains the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior and contemporaneous understandings, agreements, representations, and warranties, both written and oral, with respect to such subject matter.

IN WITNESS WHEREOF, the parties have executed this Release as of the date first above written.

Lender Signature: ___________________________________

Lender Name: _______________________________________

Borrower Signature: _________________________________

Borrower Name: _____________________________________

PDF Form Attributes

| Fact Number | Detail |

|---|---|

| 1 | A Release of Promissory Note is a legal document indicating that a loan has been fully paid off and the borrower is released from their debt obligations. |

| 2 | This document serves as evidence that the borrower has fulfilled the terms of the promissory note, and the lender acknowledges the completion of payment. |

| 3 | The release should include information such as the date of the original promissory note, the names of both the lender and borrower, and the full amount of the loan. |

| 4 | For state-specific Release of Promissory Note forms, the governing law will usually be the law of the state where the note was executed or where the lender or borrower resides. |

| 5 | This document is crucial for the borrower as it legally frees them from any further payments and prevents the lender from taking future legal action for the same debt. |

| 6 | The release form can also be used in situations where the loan is forgiven, significantly paid off ahead of schedule, or when the loan terms have been met under a settlement agreement. |

| 7 | Having a notary public or witness sign the Release of Promissory Note can add a layer of authenticity and may prevent disputes about the document's validity in the future. |

| 8 | Upon the release, all original documents related to the promissory note should be returned to the borrower, and both parties should keep copies of the release for their records. |

Instructions on How to Fill Out Release of Promissory Note

Upon the full repayment of the debt encapsulated by a promissory note, a Release of Promissory Note form is utilized to formally relieve the borrower from their obligations under the note. It signifies the end of the agreement, ensuring that all parties acknowledge the satisfaction of the debt. Filling out this form correctly is crucial for both the lender and the borrower, as it serves as legal proof that the debt has been paid in full and that the borrower is released from any further payments. Below are the steps necessary to complete this form accurately.

- Locate the Original Promissory Note: Before filling out the Release of Promissory Note form, ensure you have the original promissory note on hand. This will provide necessary details such as the date of the note, the principal amount, and the names of the borrower and lender.

- Fill in the Date of Release: At the top of the form, enter the current date to indicate when the release is being executed.

- Enter the Names of the Borrower and Lender: Clearly print the full legal names of both the borrower and the lender as they appear on the original promissory note. This ensures there is no confusion about the parties involved.

- Reference the Original Promissory Note: Include details of the original promissory note, such as its date and the principal amount. This information ties the release directly to the specific agreement being satisfied.

- Input the Repaid Amount: Specify the total amount that was repaid by the borrower, confirming that the debt has been fulfilled in accordance with the terms of the original promissory note.

- Acknowledge the Satisfaction of Debt: The form should include a statement that the lender acknowledges the full repayment of the debt by the borrower and releases them from any further obligations under the promissory note.

- Signatures: Both the borrower and the lender must sign the Release of Promissory Note form. Depending on your state's laws, you may also need to have the document witnessed or notarized. Check local regulations to ensure compliance.

- Date the Signatures: Finally, ensure that both parties date their signatures next to or beneath their names to document when the agreement to release the promissory note was signed.

After completing these steps, it's important to distribute copies of the signed Release of Promissory Note form to all involved parties. Keeping this document in a safe place is also advised, as it serves as legal proof of the debt's satisfaction and the borrower's release. This finalizes the process, bringing closure to the financial agreement between the lender and the borrower.

Crucial Points on This Form

What is a Release of Promissory Note form?

A Release of Promissory Note form is a document used when a borrower has fulfilled the conditions of a promissory note, effectively freeing them from their obligations under the agreement. It serves as proof that the debt has been fully paid and that the lender releases any claim against the borrower regarding the promissory note.

When should a Release of Promissory Note form be used?

This form should be used once the borrower has paid off the debt in full according to the terms of the promissory note. It is a crucial step in ensuring that there is formal acknowledgment of the debt being cleared, protecting both parties in future disputes.

Who needs to sign the Release of Promissory Note form?

The lender or the legal representative of the lender is required to sign the form. In some cases, it may also be advisable for the borrower to sign the form, acknowledging the release from the debt.

Is notarization required for a Release of Promissory Note form?

While not always legally required, having the form notarized can add an extra layer of validity. This process ensures that the document is more likely to be recognized by courts or other parties if any disputes arise.

What information is included in a Release of Promissory Note form?

Typically, this form includes details such as the names of the borrower and lender, the date the original promissory note was signed, the amount of debt, and a statement declaring that the debt has been fully satisfied. The form will also include the signature of the lender or their authorized representative.

What happens after the Release of Promissory Note form is signed?

After the form is signed, the borrower should keep the original document in a safe place. It is concrete evidence that the debt has been settled, which can be crucial in the event of any future legal challenges or credit disputes.

Can a Release of Promissory Note form be revoked?

Once the form is signed by the lender and if full payment has been made, the release form cannot typically be revoked. It represents a final settlement of the debt. However, if there was a mistake or if the release was signed under fraudulent conditions, legal advice should be sought.

How does a Release of Promissory Note form affect my credit score?

While the release form itself does not directly impact your credit score, it indirectly affects it by signaling that you have successfully paid off a debt. Lenders may report the settled debt to credit bureaus, potentially improving your credit standing. Keeping a copy of the form can help you dispute any inaccuracies on your credit report relating to the fulfilled obligation.

Common mistakes

Filling out the Release of Promissory Note form may seem straightforward, but it's easy to make mistakes without realizing it. Here is an expanded list of common errors that people often make, which can lead to delays or complications in releasing the obligations under a promissory note.

-

Not confirming full payment: People sometimes forget to verify that all payments have been fully received before releasing the promissory note. This oversight can lead to releasing the borrower from their obligation too early.

-

Incorrect information: Entering inaccurate details about the borrower, lender, or the loan itself, such as loan number or the date the note was signed, is a common error. Accuracy is crucial to avoid invalidating the release.

-

Leaving blanks: Skipping sections or leaving blanks is risky. Each part of the form is essential for its validity and completeness.

-

Not dating the release: Forgetting to put the date when the release is signed can lead to disputes about when the borrower was officially released from their obligations.

-

Lack of witness or notary: While not always required, failing to have the release witnessed or notarized can sometimes result in its legitimacy being questioned, depending on state laws.

-

Misunderstanding the form’s purpose: Some people use the form without fully understanding what it is for, possibly thinking it alters the terms of the note instead of releasing it completely once paid off.

-

Ignoring state-specific requirements: Each state may have unique requirements for the release of a promissory note to be recognized. Overlooking these can mean the release isn't legally effective where it needs to be.

-

Not keeping copies: After completing and sending off the release, not keeping a copy for personal records is a mistake. If any questions or disputes arise, having a copy is vital for reference.

-

Failing to communicate with the borrower: Not informing the borrower that the release has been completed can lead to confusion or unnecessary worry about their obligations.

-

Using a generic form without customization: Each promissory note might have specific terms or conditions. Using a one-size-fits-all release form without making necessary adjustments can fail to account for these unique aspects.

To avoid these mistakes, careful review and thorough understanding of the form and its requirements are essential. When in doubt, consulting with a professional can help ensure that the process goes smoothly and that all legal obligations are correctly fulfilled.

Documents used along the form

When a promissory note has been fully paid off, the document that signifies the end of the borrower's obligation to repay the loan is the Release of Promissory Note form. However, this document is rarely used in isolation. Several other documents and forms play crucial roles throughout the lifespan of a loan, from its inception to full repayment. These documents ensure that the rights and responsibilities of all parties involved are clearly defined and protected. The Release of Promissory Note, therefore, often represents the final piece in a comprehensive and multifaceted documentation process related to personal or business financing.

- Loan Agreement: This foundational document details the terms and conditions of the loan, including the interest rate, repayment schedule, and any collateral involved. It serves as the formal agreement between the lender and borrower, establishing the initial framework for the loan.

- Amendment Agreement: If any terms of the original loan agreement need to be modified, an Amendment Agreement is used. This could be for extending the loan term, changing the interest rate, or modifying the repayment schedule.

- Promissory Note: A promissory note is an essential document wherein the borrower promises to repay the lender a certain amount of money under specified conditions. It is a more detailed pledge than the broader terms outlined in the loan agreement.

- Deed of Trust or Mortgage: For loans that involve real estate, a Deed of Trust or Mortgage secures the loan by using the property as collateral. These documents are recorded with the local government to prioritize the lender's interest in the property in case of default.

- Guaranty: A guaranty is used when a third party agrees to be responsible for loan repayment if the original borrower defaults. This provides an additional layer of security for the lender.

- Security Agreement: Similar to a Deed of Trust but for personal property, a Security Agreement delineates the borrower's pledged assets—excluding real estate—as collateral for the loan.

- UCC Financing Statement: Often linked with a Security Agreement, the UCC Financing Statement is filed to perfect the lender's interest in the borrower's personal property (collateral), making it a public record.

- Default Notice: Should the borrower fail to meet the terms of the loan agreement, a Default Notice is issued. This document outlines the nature of the default and the steps needed to cure it, serving as a formal warning before any legal actions are taken.

Each of these documents plays a vital role in the lifecycle of a loan, providing clarity, security, and legal enforceability for both borrower and lender. Together with the Release of Promissory Note, they form a comprehensive structure that supports the lending process from beginning to end. Understanding and properly managing these documents can help ensure that all parties' interests are protected, and that the loan remains in good standing until its conclusion.

Similar forms

-

Mortgage Satisfaction Form: This document, similar to the Release of Promissory Note, is used when a mortgage loan on a property has been fully paid off. It acknowledges that the borrower has fulfilled their payment obligations and the lien on the property is removed, allowing clear title to be transferred. Both documents serve as legal proof that a debt has been satisfied and are critical for updating public records.

-

Lien Release Form: Often used in the construction industry, this form is similar to the Release of Promissory Note because it signifies that a debt or obligation has been fully paid, leading to the removal of a lien. Whether it’s for a mechanic's lien, a judgment lien, or some other form, its purpose is to clear the title or property from claims or encumbrances, analogous to how a promissory note release evidences the satisfaction of a loan.

-

Deed of Reconveyance: This document is used when a homeowner pays off their mortgage in states that use deeds of trust instead of mortgages. It transfers the title of real property from the trustee back to the borrower, signifying that the debt secured by the deed of trust has been paid in full. It parallels the function of the Release of Promissory Note by evidencing the fulfillment of repayment obligations.

-

Loan Satisfaction Letter: This letter is issued by a lender to a borrower indicating that a loan has been fully repaid. Like the Release of Promissory Note, it serves as proof that the borrower has settled all debt obligations, removing any claims the lender has on the borrower’s assets or property used as collateral. It’s a critical document for borrowers to obtain as evidence of their freedom from the loan’s encumbrance.

-

Car Title Release: In the context of auto loans, once the loan is fully repaid, a car title release, similar to the Release of Promissory Note, is issued by the lender to the borrower. This document is critical for proving ownership free of liens and is required to update the vehicle’s title to reflect that the lienholder no longer has a legal claim on the vehicle, showcasing the completion of payment obligations.

Dos and Don'ts

When it comes to dealing with the Release of Promissory Note form, ensuring that everything is done correctly is key. This document is an official declaration that the borrower has fulfilled the conditions of the promissory note, clearing any remaining debt to the lender. To assist you in navigating this process smoothly, here are seven dos and don'ts to keep in mind:

Do:Review the original promissory note to confirm all terms and conditions have been met by the borrower.

Ensure that the release form includes all necessary information, such as date of release, names of the lender and borrower, and the promissory note reference number.

Verify that both the lender and the borrower agree on the debt being fully paid and that there are no outstanding amounts before signing the release.

Use clear and concise language to avoid any potential misunderstandings or legal loopholes.

Keep copies of the completed form for both the lender's and borrower's records, ensuring that both parties have evidence of the debt being cleared.

Forget to check the state laws that may affect the release form. State laws can differ, and it's important to ensure that your release form complies with local regulations.

Sign the release form without verifying that every payment has been made and received. This includes checking bank statements or payment records for confirmation.

Following these steps can greatly smooth the process of releasing a promissory note. It's all about ensuring that the documents accurately reflect the completion of the agreement and protecting the interests of both parties involved.

Misconceptions

When it comes to the Release of Promissory Note form, there are several misconceptions that need to be addressed to ensure everyone understands its purpose and implications.

- It automatically cancels the debt. A common misconception is that this form immediately nullifies the debt. In reality, it is a document that officially acknowledges the debt has been paid in full and releases the borrower from further obligations.

- Only the borrower needs to sign it. Both parties involved—the borrower and the lender—must sign the Release of Promissory Note to make it valid, ensuring that the agreement to release the debt is mutual.

- No need for witnesses or notarization. Depending on the state laws, having the document witnessed or notarized can add an extra layer of legal protection and authenticity to the document.

- It's unnecessary if you trust the borrower or lender. Trust is valuable, but having a formal release protects both parties and ensures clarity and peace of mind, preventing potential disputes in the future.

- The same form works in every state. State laws can vary greatly, so it's crucial to use a form that complies with the specific legal requirements of the state in which the promissory note was issued.

- It serves as a legal receipt only. Beyond serving as a receipt that the debt has been paid, this document legally releases the borrower from the obligations outlined in the initial agreement, preventing any future claims.

- The document's effectiveness is immediate. While the release can be signed soon after the debt is fully repaid, the agreement's effectiveness might be subject to certain conditions or timelines as stipulated by state law or the original agreement.

- A Release of Promissory Note is not necessary for informal loans. Regardless of whether a loan is between friends or family members, having a formal release can prevent misunderstandings and provide legal clarity.

- All debts can be released using this form. This form specifically pertains to debts structured under a promissory note. Other types of debts and obligations may require different procedures and documentation for release.

- Creating and signing the form is complicated. While legal documents can be intimidating, the Release of Promissory Note is relatively straightforward. It's essential, however, to ensure that it includes all necessary information and follows state-specific guidelines.

Understanding these misconceptions can help prevent potential issues and ensure that both parties are fully informed about the implications of signing a Release of Promissory Note.

Key takeaways

When navigating the process of utilizing a Release of Promissory Note form, there are several critical aspects to bear in mind. This document plays a vital role in signifying that a borrower has fulfilled their payment obligations under a promissory note, effectively releasing them from further responsibility. The following keypoints offer guidance to ensure the process is handled accurately and effectively.

- Complete the form accurately: It's imperative to fill out the Release of Promissory Note form with precise details, ensuring all information regarding the promissory note, such as the date of issue, the amount, and the names of the involved parties, is correct. Inaccuracies can lead to disputes or legal complications down the line.

- Obtain necessary signatures: The release must be signed by the lender or an authorized representative. This acts as formal acknowledgment that the debt owed by the borrower has been paid in full. Without this signature, the release is not considered valid.

- Keep thorough records: Both parties should keep a copy of the signed release for their records. This document serves as a legal receipt, evidencing the borrower's discharge from debt. In any future disputes or for financial auditing purposes, this document will be crucial.

- Understand state laws: The legal requirements for a Release of Promissory Note can vary by state. It's crucial to be aware of and comply with any state-specific regulations that may apply to the promissory note and its release. This might include notarization or specific filing procedures with local government offices.

Discover Other Types of Release of Promissory Note Documents

Promissory Note Car Loan - It represents a mutual trust between the buyer and seller but with a legal framework to address any breaches of that trust.