Blank Promissory Note Form for Texas

In the state of Texas, individuals entering into a loan agreement often utilize a Promissory Note to outline the terms of the financial transaction. This legally binding document serves not only to establish the amount of money borrowed and the interest rate applied but also specifies the repayment schedule that the borrower must adhere to. Tailored to meet the specific needs of both parties involved, the Texas Promissory Note form can vary significantly in its structure and stipulations. From personal loans between family members to more complex transactions requiring collateral, this form is instrumental in providing a clear and enforceable framework for repayment. By clearly stating the obligations of the borrower and the rights of the lender, it minimizes potential misunderstandings and conflicts, making it an essential tool in financial agreements within the state. Moreover, it provides a solid foundation upon which legal recourse can be taken if the terms are not met, ensuring that all parties are protected under the law.

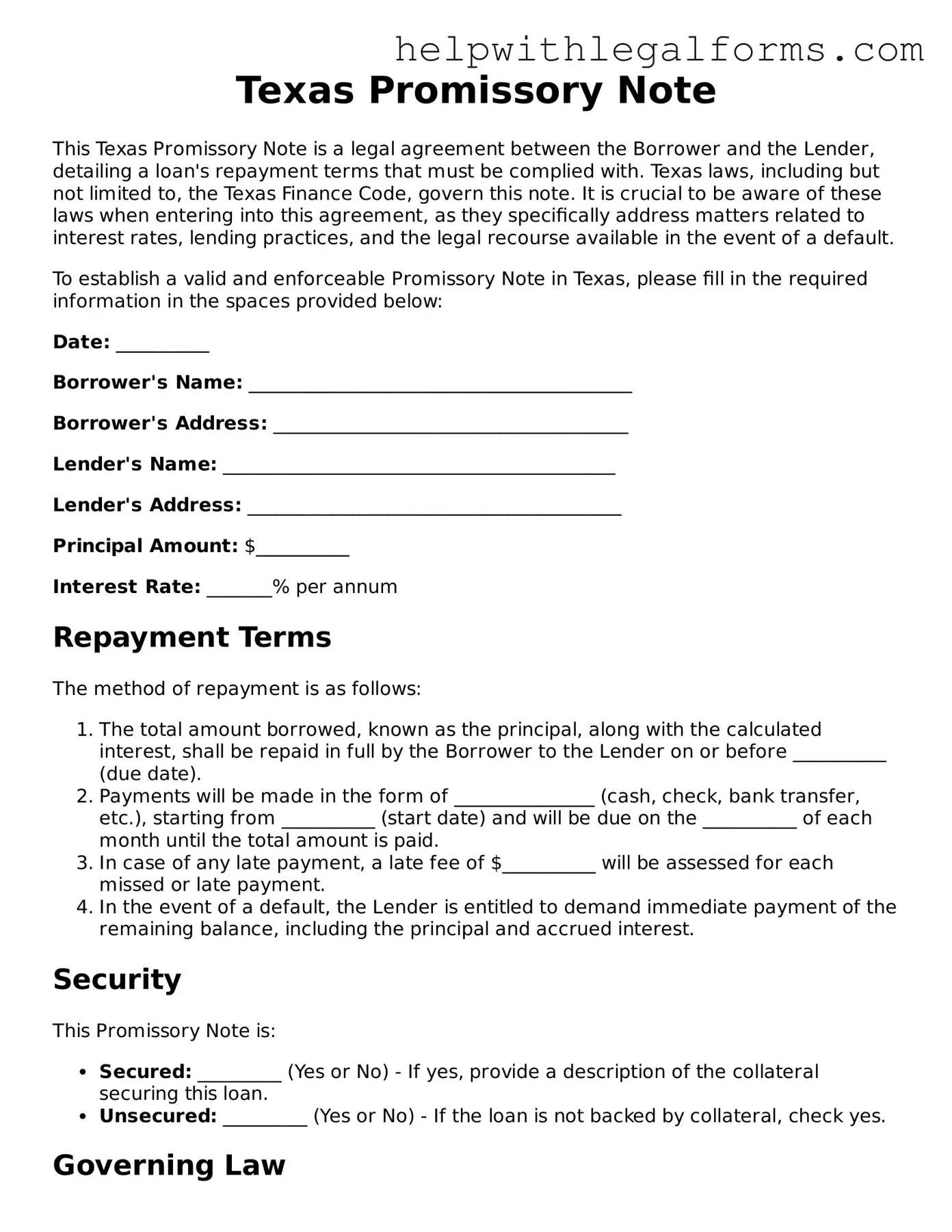

Example - Texas Promissory Note Form

Texas Promissory Note

This Texas Promissory Note is a legal agreement between the Borrower and the Lender, detailing a loan's repayment terms that must be complied with. Texas laws, including but not limited to, the Texas Finance Code, govern this note. It is crucial to be aware of these laws when entering into this agreement, as they specifically address matters related to interest rates, lending practices, and the legal recourse available in the event of a default.

To establish a valid and enforceable Promissory Note in Texas, please fill in the required information in the spaces provided below:

Date: __________

Borrower's Name: _________________________________________

Borrower's Address: ______________________________________

Lender's Name: __________________________________________

Lender's Address: ________________________________________

Principal Amount: $__________

Interest Rate: _______% per annum

Repayment Terms

The method of repayment is as follows:

- The total amount borrowed, known as the principal, along with the calculated interest, shall be repaid in full by the Borrower to the Lender on or before __________ (due date).

- Payments will be made in the form of _______________ (cash, check, bank transfer, etc.), starting from __________ (start date) and will be due on the __________ of each month until the total amount is paid.

- In case of any late payment, a late fee of $__________ will be assessed for each missed or late payment.

- In the event of a default, the Lender is entitled to demand immediate payment of the remaining balance, including the principal and accrued interest.

Security

This Promissory Note is:

- Secured: _________ (Yes or No) - If yes, provide a description of the collateral securing this loan.

- Unsecured: _________ (Yes or No) - If the loan is not backed by collateral, check yes.

Governing Law

This Promissory Note will be governed under the laws of the State of Texas, regardless of the conflict of laws principles.

Signatures

This document, once signed by both the Borrower and the Lender, is a testimony to their agreement to the terms prescribed herein.

Borrower's Signature: _______________________________

Date: __________

Lender's Signature: ________________________________

Date: __________

PDF Form Attributes

| Fact | Description |

|---|---|

| Purpose | A Texas promissory note form is used to document a loan between two parties, outlining the terms of repayment. |

| Governing Law | It is governed by Texas law, including but not limited to the Texas Finance Code. |

| Types | There are two main types: secured and unsecured. Secured notes require collateral, while unsecured notes do not. |

| Components | Key components include the principal amount, interest rate, repayment schedule, collateral (if secured), and signatures. |

| Interest Rate | Texas law caps interest rates to prevent usury; the maximum rate is specified in the Texas Finance Code. |

| Default Terms | The form must specify what constitutes default and the subsequent actions, ensuring clarity for both parties. |

| Signatories | Both the borrower and the lender must sign the promissory note, making it a legally binding document. |

| Notarization | Notarization is not required by Texas law but is recommended to add an extra layer of legal authenticity. |

Instructions on How to Fill Out Texas Promissory Note

After deciding to create a promissory note in Texas, it's important to understand the proper steps to take. This document acts as a formal agreement involving the borrowing and lending of money. Although drafting one might seem straightforward, careful attention must be paid to ensure all necessary details are correctly filled out. This guide aims to streamline the process, focusing on clarity and correctness, leading to a legally binding agreement between the parties involved.

- Start by entering the date the promissory note is created at the top of the form. This ensures the agreement's effectiveness is clear from the outset.

- Write the full name and address of the borrower. It's crucial these details are accurate to precisely identify the party taking on the debt.

- Enter the full name and address of the lender next. Just like with the borrower's information, accuracy here is vital for identifying the party providing the loan.

- Detail the amount of money being loaned. This should be written in both words and numbers to avoid any confusion about the loan amount.

- Specify the interest rate per annum. Texas law may limit the maximum interest that can be charged, so ensure this rate complies with state regulations.

- Outline the repayment schedule. Include the number of payments, the amount of each payment, and the due date for the first payment and subsequent payments. Clearly stating these terms helps both parties understand the expectations and obligations.

- Choose a security method if applicable. If the loan is secured with collateral, describe the collateral in detail within the document. This provides the lender with assurance of asset recovery if the borrower defaults.

- Include any co-signer information, if a co-signer is part of the agreement. This step adds an additional layer of security for the loan, listing another individual as responsible for the debt should the primary borrower fail to make payments.

- Both the borrower and the lender must sign the document. Ensure this is done in the presence of a notary public to provide an additional layer of legal validity to the agreement.

Upon completing these steps, the promissory note becomes a legally binding document that outlines the terms of the loan. It's important for both the borrower and the lender to keep a signed copy of the note. This ensures that both parties have access to the agreed terms and conditions, serving as a point of reference throughout the duration of the loan. Remember, the specifics of the repayment, interest rate, and any collateral must be carefully reviewed to ensure they comply with Texas law and the mutual agreement between the lender and borrower.

Crucial Points on This Form

What is a Texas Promissory Note?

A Texas Promissory Note is a legal document that records a loan agreement between two parties - the borrower and the lender. This written promise obligates the borrower to repay the money borrowed, often with interest, by a certain date. It serves as a formal acknowledgment of the debt and the terms of repayment.

Is a Texas Promissory Note legally binding?

Yes, a Texas Promissory Note is legally binding when properly executed. This means it must contain clear terms of the loan, including the loan amount, interest rate, repayment schedule, and signatures of both the borrower and the lender. Having these elements can ensure the enforceability of the note in a court of law, should disputes arise.

Do I need a witness or notary for a Texas Promissory Note?

While it is not strictly required to have a Texas Promissory Note witnessed or notarized, doing so can add an extra layer of legal protection. Having a notary or witnesses can help verify the authenticity of the document and the identity of the signatories, making it more difficult to dispute in court.

What are the consequences of not repaying a Promissory Note in Texas?

If a borrower fails to repay according to the terms of a Promissory Note in Texas, the lender has the legal right to seek repayment through court action. This could result in a judgment against the borrower, leading to wage garnishment, liens on property, or other legal remedies to recover the debt.

Can the terms of a Texas Promissory Note be modified?

Yes, the terms of a Texas Promissory Note can be modified, but any changes must be agreed upon by both the borrower and the lender in writing. The modified agreement should be signed by both parties and ideally witnessed or notarized, reflecting the change in terms and ensuring continued legality of the document.

How should a Texas Promissory Note be stored?

Both the borrower and the lender should keep original copies of the Texas Promissory Note in a safe and secure location. This could be a fireproof safe or a secure filing system. Storing the document properly ensures that it can be easily accessed for reference or proof of the debt obligation should any disputes arise or a need for legal recourse become necessary.

What happens if a signer dies before the Promissory Note is repaid in Texas?

If a signer of a Promissory Note dies before the debt is fully repaid in Texas, the obligation to repay the loan typically passes to the borrower's estate. The executor of the estate must then manage the repayment from the estate's assets according to the terms of the note. If the borrower was the sole person obligated on the note and there are insufficient assets in the estate to cover the debt, the lender may face challenges in recovering the full amount owed.

Common mistakes

In Texas, filling out a Promissory Note requires careful attention to detail. This financial document is legally binding and outlines the terms under which money is borrowed and must be repaid. Mistakes can lead to misunderstandings, disputes, and legal issues. Below are four common errors people often make when filling out this form:

Not specifying the payment schedule. A clear payment schedule is crucial. Without it, there can be confusion about when payments are due, including the start date, frequency, and number of payments. This can lead to disagreements between the borrower and lender.

Forgetting to include the interest rate. The interest rate affects the total amount the borrower will pay back. Failing to specify the rate can lead to disputes about the cost of borrowing. In Texas, not stating an interest rate can default the note to the state's legal interest rate, which may not be favorable for either party.

Omitting late fees and penalties. If the promissory note doesn't detail the consequences of late payments, enforcing penalties can become problematic. This could potentially result in financial losses for the lender if the borrower repeatedly makes late payments without repercussions.

Inadequate or unclear terms for the default. The note should clearly define what constitutes a default, such as missing a certain number of payments. It should also outline the steps to be taken or remedies available if the borrower fails to meet their obligations. Inadequate or vague terms can make it challenging to address non-payment issues legally.

Each of these mistakes can undermine the legal enforceability of the agreement. Both parties should review the Promissory Note thoroughly before signing to ensure all terms are clear, fair, and legally binding. An accurately completed form is a step toward protecting the interests and rights of both the lender and the borrower.

Documents used along the form

When entering into a financial agreement in Texas, particularly one involving the creation of a promissory note, several additional forms and documents are often used to ensure clarity, legality, and compliance. A promissory note is a financial instrument that outlines the borrower's promise to pay back a sum of money to the lender. Alongside this, various documents supplement and strengthen the agreement, providing a comprehensive framework protecting both parties' interests. Some of these documents include:

- Loan Agreement: This is a detailed document that specifies the terms and conditions of the loan. It includes the interest rate, repayment schedule, and what happens in case of default. It's more comprehensive than a promissory note and is used alongside it for more significant loans.

- Security Agreement: If the loan is secured with collateral, a security agreement outlines the details of this collateral. This document gives the lender a security interest in the specified asset, allowing them to seize it if the loan is not repaid.

- Mortgage or Deed of Trust: For loans secured by real estate, a mortgage or deed of trust is used to place a lien on the property. This document is recorded with the county to publicly declare the lien, giving the lender the right to foreclose on the property if the borrower defaults on the loan.

- Guaranty: A guaranty involves a third party who agrees to repay the loan if the original borrower cannot. This document is essential when the borrower's ability to repay the loan is in question.

- Amortization Schedule: This is a table detailing each payment on the loan over time, showing how much of each payment goes toward the principal and how much goes toward interest. It helps both lender and borrower keep track of payments and remaining balance.

- Disclosure Statement: Required by federal and state laws, this document outlines the key terms of the loan, including the annual interest rate, finance charges, amount financed, total repayment amount, and payment schedule.

- Release of Promissory Note: After the loan is fully paid off, this document is issued by the lender to the borrower. It serves as a legal receipt acknowledging that the borrower has fulfilled their repayment obligations under the promissory note.

Together, these documents create a robust legal framework around financial agreements, ensuring both parties are well-informed and protected throughout the transaction. Understanding the purpose and details of each document is crucial for anyone entering into a loan agreement, as it ensures all legal bases are covered and the agreement is carried out smoothly.

Similar forms

Loan Agreement: Both the promissory note and the loan agreement outline the terms under which money is borrowed and must be repaid. However, the loan agreement generally includes more detailed provisions, such as clauses related to default, collateral, and early repayment.

Mortgage Note: A mortgage note is a type of promissory note specifically used in real estate transactions. It details the amount owed on a mortgage and the repayment terms but is secured against the property being purchased, which differentiates it from a standard unsecured promissory note.

IOU (I Owe You): An IOU is a simple acknowledgment of debt, similar to a promissory note. However, it lacks formalities and detailed terms of repayment found in promissory notes, making it less enforceable and more informal.

Personal Loan Agreement: This document is similar to a promissory note in that it is used between individuals to record a loan's specifics. The main difference usually lies in the detail and formality of the agreement, with a personal loan agreement potentially being more detailed and covering wider aspects of the loan.

Bill of Exchange: Often used in international trade, a bill of exchange requires one party to pay a fixed amount to another party on a predetermined date or upon demand. Like a promissory note, it is a written promise to pay and is negotiable, but it involves three parties (the drawer, drawee, and payee) instead of two.

Line of Credit Agreement: Similar to a promissory note in its function of documenting a loan, a line of credit agreement differs by offering access to funds up to a specified limit over a period of time, rather than a single lump sum. Terms for repayment and interest apply here as well, but with the flexibility of repeated withdrawals.

Installment Agreement: An installment agreement shares the promissory note's characteristic of outlining terms for repayment of a debt. The key similarity is the schedule for payments, but in the case of an installment agreement, the focus is explicitly on regular, fixed amounts over time, often with interest included.

Dos and Don'ts

When filling out a Texas Promissory Note form, individuals enter into a legally binding contract that outlines the terms under which one party, the borrower, agrees to repay a certain amount of money to another party, the lender. This document is pivotal for ensuring clarity, legality, and the expectations of both parties are met. Below are some essential do's and don'ts to consider:

- Do read the entire form carefully before filling it out to ensure you understand all the terms and conditions.

- Do use clear and concise language that leaves no room for interpretation to avoid potential disputes in the future.

- Do verify the accuracy of all names, addresses, and other personal information included in the note to prevent any issues related to the identities of the parties involved.

- Do specify the loan amount in words and figures for clarity and to avoid any discrepancies between the numerical value and the value written out.

- Do outline the repayment plan in detail, including the due dates, the number of installments, and the interest rate, if applicable.

- Don't leave out any relevant information such as late fees, collateral (if any), and what constitutes a breach of the agreement. These details are crucial for protecting both parties.

- Don't overlook the necessity of having signatures from both the borrower and the lender, as well as a witness or notary public, to validate the promissory note.

- Don't assume a verbal agreement or handshake is enough. The promissory note must be documented in writing and signed to be legally binding.

- Don't hesitate to seek legal advice if there are any terms or clauses within the promissory note that you do not understand. A professional can provide clarity and ensure your interests are protected.

Filling out a promissory note with accuracy and thoroughness is key to establishing a trustworthy relationship between the lender and borrower. It serves as a legal document that can be used in court if any disputes arise, making it imperative that both parties pay close attention to the details. By following these guidelines, individuals can ensure that their financial transactions are securely documented and enforceable under Texas law.

Misconceptions

Understanding legal forms is essential to performing transactions correctly. One common document in financial transactions is the promissory note. In Texas, some misconceptions about the promissory note form may lead individuals to make errors. Let's clear up these misunderstandings.

All Texas promissory notes are identical. This is not true. While certain legal requirements must be met for a promissory note to be valid in Texas, the specific terms can vary widely depending on the agreement between the lender and borrower. This includes interest rates, repayment schedules, and consequences of default.

A handshake is enough to enforce a promissory note. Although verbal agreements can be binding, a written promissory note is crucial for enforceability in Texas, especially in disputes. It provides a clear record of the loan's terms.

Only the borrower needs to sign the promissory note. While the borrower's signature is essential, having a witness or notary sign can add legal weight and help in the enforcement of the note, particularly if the matter goes to court.

Promissory notes require complicated legal language to be valid. The truth is, clarity is key. A promissory note should be straightforward, outlining the loan's terms clearly so that both parties understand their obligations. Overly complex language is not necessary and can sometimes lead to misunderstandings.

You can’t modify a promissory note once it's signed. Modifications can be made if both the lender and borrower agree. Any changes should be documented in writing, and both parties should sign any amendments to ensure they are legally binding.

Secured and unsecured promissory notes are essentially the same. This is incorrect. A secured promissory note is backed by collateral, meaning the lender can seize the collateral if the note is not paid. An unsecured promissory note does not have this backing, which presents a greater risk to the lender.

It’s vital to understand these nuances to ensure that promissory notes serve their intended purpose effectively and legally. Consultation with a legal professional when drafting or signing a promissory note can help avoid these common pitfalls.

Key takeaways

When tackling the task of filling out and using the Texas Promissory Note form, it is crucial to be thorough and informed. Given its legal importance, understanding the essentials can safeguard both the borrower and lender. Below are six key takeaways everyone should be aware of:

- Accurate Information is Essential: Ensure all personal information, including names, addresses, and identification numbers of both the lender and the borrower, is accurately recorded. This detail ensures there's no ambiguity regarding the parties involved.

- Clear Terms: The promissory note must clearly outline the loan's amount (principal), interest rate, and repayment schedule. Misunderstandings down the line can be avoided by clearly stating whether the interest rate is fixed or variable.

- Choose the Right Type: Texas law recognizes both secured and unsecured promissory notes. A secured note requires collateral as a security for the loan, while an unsecured note does not. Selecting the appropriate type is crucial based on the agreement between the borrower and the lender.

- Legal Requirements: Complying with Texas legal standards is integral when drafting your promissory note. This includes adhering to the state's maximum allowed interest rate to avoid the note being classified as usurious.

- Signatures Matter: For the promissory note to be legally binding, it must be signed by both the borrower and the lender. It’s advisable to have the signatures witnessed or notarized to add an extra layer of legal validity.

- Keep Records: After the promissory note is fully executed, it's critical for both parties to keep a copy of the document. This ensures that both the borrower and the lender can refer back to the agreed terms in case of any disputes or misunderstandings.

Understanding these key takeaways when dealing with a Texas Promissory Note can prevent potential legal issues and ensure a smoother lending process. Both parties are encouraged to review all information carefully and seek legal guidance if necessary to ensure compliance with Texas laws and regulations.

Create Other Promissory Note Forms for US States

Oklahoma Promissory Note - Acts as a safeguard for both parties, ensuring clarity and preventing misunderstandings related to the loan.

Promissory Note New York - It can be a valuable tool in estate planning, helping to document loans between family members clearly.

Promissory Note Colorado - It is a vital tool for financing agreements in both personal and business contexts, ensuring transparency and accountability.