Legal Real Estate Purchase Agreement Form

Embarking on the journey of buying or selling property is both exciting and daunting, with the Real Estate Purchase Agreement form serving as a pivotal component in this intricate process. This essential document not only signifies the buyer's intention to purchase real estate but also outlines the conditions under which the sale will proceed. It covers a broad spectrum of details including, but not limited to, the agreed-upon purchase price, a description of the property being sold, and any contingencies that must be met before the sale can finalize. Key elements such as earnest money deposits, closing dates, and specific terms regarding who will bear the costs of inspections and closing costs are meticulously detailed. Moreover, the agreement provides legal protection for both parties involved, ensuring that rights are safeguarded and obligations clearly defined. The form acts as a roadmap, guiding both the buyer and seller through the legal landscape of property transfer, making it a critical document for ensuring a smooth and transparent transaction.

State-specific Real Estate Purchase Agreement Forms

Real Estate Purchase Agreement Document Subtypes

Example - Real Estate Purchase Agreement Form

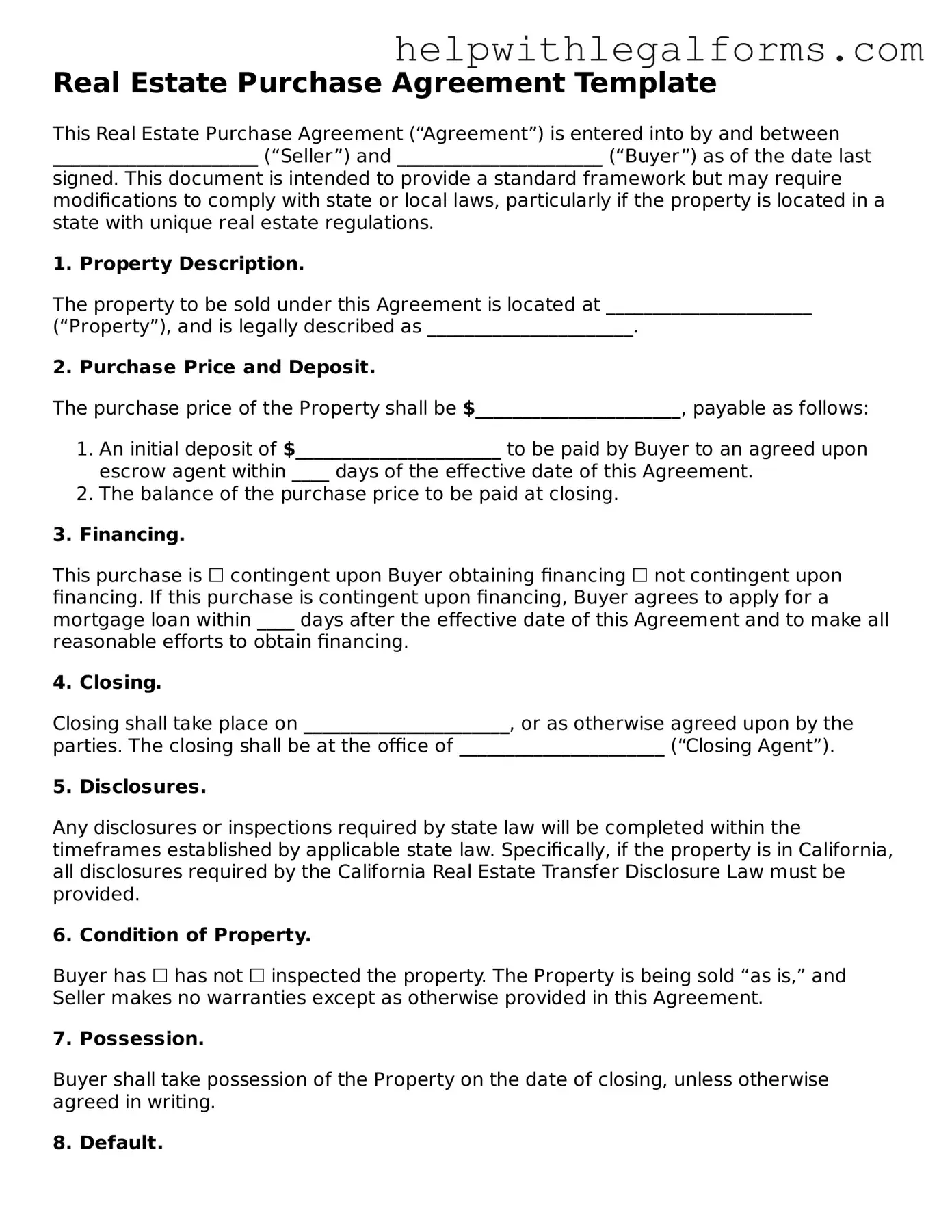

Real Estate Purchase Agreement Template

This Real Estate Purchase Agreement (“Agreement”) is entered into by and between ______________________ (“Seller”) and ______________________ (“Buyer”) as of the date last signed. This document is intended to provide a standard framework but may require modifications to comply with state or local laws, particularly if the property is located in a state with unique real estate regulations.

1. Property Description.

The property to be sold under this Agreement is located at ______________________ (“Property”), and is legally described as ______________________.

2. Purchase Price and Deposit.

The purchase price of the Property shall be $______________________, payable as follows:

- An initial deposit of $______________________ to be paid by Buyer to an agreed upon escrow agent within ____ days of the effective date of this Agreement.

- The balance of the purchase price to be paid at closing.

3. Financing.

This purchase is ☐ contingent upon Buyer obtaining financing ☐ not contingent upon financing. If this purchase is contingent upon financing, Buyer agrees to apply for a mortgage loan within ____ days after the effective date of this Agreement and to make all reasonable efforts to obtain financing.

4. Closing.

Closing shall take place on ______________________, or as otherwise agreed upon by the parties. The closing shall be at the office of ______________________ (“Closing Agent”).

5. Disclosures.

Any disclosures or inspections required by state law will be completed within the timeframes established by applicable state law. Specifically, if the property is in California, all disclosures required by the California Real Estate Transfer Disclosure Law must be provided.

6. Condition of Property.

Buyer has ☐ has not ☐ inspected the property. The Property is being sold “as is,” and Seller makes no warranties except as otherwise provided in this Agreement.

7. Possession.

Buyer shall take possession of the Property on the date of closing, unless otherwise agreed in writing.

8. Default.

If Buyer defaults by failing to comply with the terms of this Agreement, Seller may retain the deposit as liquidated damages. If Seller defaults, Buyer may seek specific performance or return of the deposit as their sole remedy.

9. Governing Law.

This Agreement shall be governed by and construed in accordance with the laws of the State in which the Property is located, without regard to its conflict of laws principles.

Please consult a local real estate attorney to ensure this Agreement complies with all relevant state-specific laws.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the last date signed below.

Seller’s Signature: ______________________ Date: ______________________

Buyer’s Signature: ______________________ Date: ______________________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | A Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions of the purchase and sale of real estate between a buyer and a seller. |

| Components Included | It typically includes details such as the purchase price, property description, financing terms, closing date, and any contingencies that must be met before the deal is finalized. |

| Governing Laws | Real estate transactions are subject to state laws where the property is located. Each state may have distinct requirements for the content and execution of a purchase agreement. |

| Importance of Accuracy | The accuracy of the information within the agreement is crucial as any errors or omissions can lead to disputes or legal challenges between the parties involved. |

Instructions on How to Fill Out Real Estate Purchase Agreement

After finding the perfect home and reaching a verbal agreement with the seller, the next step is to formalize the agreement through a Real Estate Purchase Agreement. This legal document outlines the terms and conditions of the sale, from the purchase price to the closing date, ensuring both parties understand their obligations. Filling out this form might seem daunting, but by following these simple steps, you can complete it accurately and ensure a smooth transition towards owning your dream home.

- Gather the necessary information: Before starting, ensure you have all the relevant information, including the legal names of the buyer(s) and seller(s), the property address, and the agreed-upon purchase price.

- Enter the parties' details: Fill in the full legal names of both the buyer(s) and seller(s) at the top of the form to identify the parties involved in the transaction.

- Describe the property: Include a detailed description of the property being sold. This should cover the physical address and may also include the legal description found in the property's current deed.

- Specify the purchase price: Clearly state the agreed-upon purchase price in the designated section. This is a crucial detail that should be accurately recorded.

- Outline the terms of payment: Indicate how the purchase will be financed. Whether it's through a mortgage, as a cash purchase, or another financing method, the terms should be clearly outlined, including any deposit amount and when it is due.

- Set the closing date: Decide and agree upon a closing date, which is when the transaction will be officially completed, the sale will be finalized, and the property will change hands.

- Detail any included personal property: If the sale includes items like appliances, light fixtures, or furniture, list these items to ensure they are understood to be part of the purchase.

- Address inspections and repairs: The agreement should detail who is responsible for home inspections and how any necessary repairs will be handled or negotiated.

- Review contingency clauses: These clauses can include financing, inspection, and sale of the buyer's current home. Ensure all agreed-upon contingencies are clearly stated in the agreement.

- Sign and date the agreement: Both the buyer(s) and seller(s) must sign and date the form to signify their understanding and agreement to the terms laid out. Witness signatures may also be required, depending on local laws.

Completing the Real Estate Purchase Agreement is a significant step towards finalizing the sale of a property. With the document filled out, it will be submitted for review by both parties and their legal advisors. Following this review, any necessary negotiations or adjustments can be made. Once everyone is satisfied, the agreement will guide the remainder of the transaction through to the closing date, leading up to the exciting moment when the keys change hands and a new chapter begins for the buyer.

Crucial Points on This Form

What is a Real Estate Purchase Agreement?

A Real Estate Purchase Agreement is a legally binding document between a buyer and seller outlining the terms of a property sale. This agreement covers details such as purchase price, property description, inspection rights, closing conditions, and any contingencies that either party wants to include.

Why do I need a Real Estate Purchase Agreement?

Having a Real Estate Purchase Agreement is crucial because it formally records the terms and conditions of the sale, protecting both parties' interests. It ensures clarity and commitment from both the buyer and seller, and helps prevent misunderstandings that can lead to disputes. Furthermore, it outlines the steps to be taken towards the sale’s completion and provides a roadmap of the transaction from beginning to end.

What should be included in a Real Estate Purchase Agreement?

Typically, a Real Estate Purchase Agreement should include the names of the parties, property details, purchase price, deposit amount, financing details, inspection rights and results, closing and possession dates, and details of who pays for inspections, taxes, and other fees. It should also outline any contingencies like the sale being subject to the buyer obtaining financing or the results of a home inspection.

Can I write a Real Estate Purchase Agreement myself?

While it is possible to draft a Real Estate Purchase Agreement on your own, especially with available templates, it is advisable to seek the guidance of a professional. Real estate transactions can be complex, and a professional can help ensure that the agreement is legally sound and adequately protects your interests.

How do contingencies in a Real Estate Purchase Agreement work?

Contingencies are conditions that must be met for the sale to proceed. They provide a way for either the buyer or seller to back out of the contract under specific circumstances. Common contingencies include obtaining financing, satisfactory results from a home inspection, and the ability of the buyer to sell their current home. Each contingency must be met by a specified date, and failure to meet them can result in the termination of the agreement or renegotiation of its terms.

What happens if either party breaches the Real Estate Purchase Agreement?

If either party fails to fulfill their obligations under the terms of the Real Estate Purchase Agreement, it is considered a breach of contract. Depending on the agreement's specifics and state laws, remedies for a breach can include suing for specific performance (requiring the breaching party to fulfill their obligations) or seeking monetary damages. In some cases, the injured party may also be entitled to terminate the agreement and potentially recover any deposits or costs incurred.

Is a Real Estate Purchase Agreement legally binding once signed?

Yes, once the Real Estate Purchase Agreement is signed by both the buyer and seller, it becomes a legally binding document. Both parties are then obligated to complete the transaction according to the terms outlined in the agreement, unless contingencies are not met or the agreement is legally terminated through other means.

Can changes be made to a Real Estate Purchase Agreement after it is signed?

Changes to a Real Estate Purchase Agreement after it has been signed require the agreement of both parties. Any amendments should be made in writing and signed by both the buyer and seller to be legally valid. This ensures that the agreement reflects the latest understanding and agreement between the parties.

How long does the buyer have to inspect the property?

The period for property inspection, often referred to as the inspection contingency period, is typically negotiated between the buyer and seller and detailed in the Real Estate Purchase Agreement. This period usually ranges from a few days to a couple of weeks after the agreement is signed but before the final sale, giving the buyer time to conduct a thorough inspection of the property.

What is the closing process in a real estate transaction?

The closing process in a real estate transaction is the final step in the sale, during which the legal transfer of the property from the seller to the buyer occurs. This process involves completing all agreed-upon terms, paying closing costs, signing necessary documents, and recording the deed. Closing typically takes place at a title company or an attorney's office and results in the official transfer of ownership to the buyer.

Common mistakes

Filling out a Real Estate Purchase Agreement is a critical step in the process of buying or selling property. This legally binding document outlines the terms and conditions of the sale, making the accuracy and completeness of the information it contains paramount. Here are seven common mistakes people often make when completing this form:

Not Reviewing the Entire Form: This may seem basic, but it’s crucial. People often overlook certain sections or fail to read the fine print, which can lead to misunderstandings or assumptions that aren't legally sound.

Incorrect Information: Errors such as misspelled names, incorrect property addresses, or wrong legal descriptions can invalidate the agreement or cause delays. Attention to detail is key.

Omitting Important Addenda: Depending on the nature of the property or the specifics of the deal, additional documents or addenda may need to be attached. Forgetting these can lead to incomplete agreements.

Overlooking Contingencies: Buyers and sellers sometimes fail to correctly detail the conditions under which the deal can be renegotiated or voided. This could include inspection issues, financing, or sale of a current home.

Inaccurate Financial Details: Misstating the sale price, down payment amount, or terms of financing can lead to significant issues. Both parties need to carefully review these figures.

Skipping Disclosures: Sellers might omit necessary disclosures about the property’s condition or history. This oversight can lead to legal problems down the line.

Forgetting to Specify Fixtures and Fittings: Without clear identification of what stays with the property and what goes, disputes can arise. This includes appliances, light fixtures, and any other moveable items.

Making sure that the Real Estate Purchase Agreement is filled out completely and accurately is indispensable. Both parties should take their time to review every section, seek clarification when needed, and possibly consult a professional to ensure that all legal requirements are met. This meticulous approach can prevent future disputes and ensure a smooth transaction.

Documents used along the form

When diving into the process of acquiring real estate, the Real Estate Purchase Agreement form is crucial, but it's just one of several documents that come into play during the transaction. Each document serves a unique purpose and contributes to a seamless process, ensuring all legalities are met and both parties are well-informed. Here's a look at four other essential forms and documents often used in conjunction with the Real Estate Purchase Agreement form.

- Addendum to Purchase Agreement: This document comes into play when both parties need to modify or add any terms to the original Purchase Agreement. Sometimes, after an inspection or due to unforeseen circumstances, adjustments are necessary. This addendum allows for those changes to be made formally and agreed upon by both the buyer and seller.

- Disclosure Forms: Depending on the state, there are various disclosure forms that the seller must fill out. These documents provide the buyer with important information about the property's condition, including any known defects or issues that could affect the property's value or livability. They're vital for transparency and protecting the buyer's interests.

- Contingency Clauses: Often included within the Real Estate Purchase Agreement, contingency clauses can also exist as standalone documents that outline specific conditions needing to be met before the transaction can finalize. Common contingencies include those for financing, inspections, and the sale of the buyer's current home.

- Closing Disclosure: Near the end of the buying process, the Closing Disclosure is issued by the lender to the buyer. This form provides the final details about the mortgage loan, including the interest rate, monthly payments, and closing costs. It's essential for ensuring that the terms initially agreed upon have been honored.

While navigating through real estate transactions, having a comprehensive understanding and collection of these documents, alongside the Real Estate Purchase Agreement, ensures a smoother, more transparent process for everyone involved. Each document plays a pivotal role in moving the transaction forward, safeguarding the interests of both the buyer and seller, and helping to avoid any legal complications down the line.

Similar forms

- Bill of Sale: This document, similar to a Real Estate Purchase Agreement, formalizes the transfer of ownership of personal property, such as vehicles or office equipment, from a seller to a buyer. Both outline the terms of sale and specify the items being transferred.

- Rental Agreement: Although it pertains to leasing rather than buying, a Rental Agreement shares similarities by specifying terms between two parties over property use. It includes details about payments, duration, and responsibilities, akin to how a Real Estate Purchase Agreement outlines terms for property purchase.

- Land Contract: A Land Contract directly correlates with real estate transactions by offering a means to purchase land through installment payments. It details the agreement's terms, payment schedules, and ownership transfer, similar to the structure of a Real Estate Purchase Agreement.

- Deed of Trust: Used in some states in place of mortgages, a Deed of Trust involves a trustee, borrower, and lender in property transactions. It secures a loan for property purchase, sharing the aspect of legally binding property transfer documentation with a Real Estate Purchase Agreement.

- Lease-Purchase Agreement: This hybrid agreement combines lease and purchase features, allowing renters to buy the property they're leasing at a later date. It outlines terms similar to those in a Real Estate Purchase Agreement but adds rental specifics and a path to ownership.

- Mortgage Agreement: This document is pivotal for buyers financing their purchase, detailing the loan terms from a lender to buy property. Like a Real Estate Purchase Agreement, it is crucial in transactions but focuses on financing terms rather than sale specifics.

- Property Disclosure Statement: Sellers use this form to disclose the condition of the property being sold, which complements a Real Estate Purchase Agreement by providing crucial information to the buyer about the property's state, ensuring informed consent.

- Earnest Money Agreement: Often a precursor to a full Real Estate Purchase Agreement, it involves a deposit that shows the buyer's good faith. Terms around this deposit are detailed, showing commitment before the final purchase agreement is signed.

- Option to Purchase Agreement: This gives a buyer the option, but not the obligation, to buy real estate for a specified period. It shares the aspect of detailing terms and conditions for property transactions with a Real Estate Purchase Agreement, though it allows more flexibility for the buyer.

- Quitclaim Deed: This document is used to transfer any ownership interest a person might have in a property without specifying the nature of the interest or guaranteeing it. It's related to a Real Estate Purchase Agreement in that it can finalize the transfer of property ownership, but it carries less guarantee about the property's title.

Dos and Don'ts

When filling out a Real Estate Purchase Agreement form, it's crucial to approach this task with precision and knowledge. This document is a legally binding contract that outlines the terms and conditions of the purchase or sale of property. To help you navigate this process smoothly, here are essential do's and don'ts:

Do's:

- Read every section carefully before you start filling out the form to ensure you understand the requirements and implications.

- Use clear and precise language to avoid any misunderstandings or ambiguity that could affect the terms of the agreement.

- Verify all parties' information, including full names and addresses, ensuring accuracy to prevent future disputes.

- Include a detailed description of the property, covering everything from the physical address to legal descriptions and any included fixtures or exclusions.

- Clearly state the purchase price and terms, including any deposit required and financial arrangements, to confirm agreement from both parties.

- Review contingencies carefully, such as financing or inspection requirements, to understand your obligations and rights.

- Consult with a legal professional if there are any doubts or unfamiliar terms, to ensure your interests are fully protected.

Don'ts:

- Don’t rush the process; taking the time to carefully review and fill out each section can prevent significant legal issues down the road.

- Avoid leaving blank spaces; if a section doesn’t apply, note it as “N/A” or “not applicable” to demonstrate that it was considered and intentionally left empty.

- Don’t rely solely on verbal agreements; make sure all terms and conditions are written down in the agreement to have a legal standing.

- Avoid using ambiguous terms that can be interpreted in multiple ways; clarity is key in legal documents.

- Don’t hesitate to ask for clarification on any terms or conditions you don’t fully understand before you sign.

- Don’t skip the final review. Go through the agreement multiple times to catch any errors or omissions.

- Don’t forget to keep a signed copy of the agreement for your records once all parties have signed.

Misconceptions

The Real Estate Purchase Agreement form is a vital document in the buying and selling of real estate, yet it is often surrounded by misconceptions that can lead to confusion. Understanding the true nature of this agreement is essential for both buyers and sellers to ensure that the process is conducted fairly and legally. Here are four common misconceptions about the Real Estate Purchase Agreement, clarified to provide a better understanding of its importance and functionality.

-

The agreement is standard and not open to negotiation. Many people believe that the Real Estate Purchase Agreement is a standardized form that cannot be altered. This is not true. In fact, the agreement is highly customizable. Both buyers and sellers have the opportunity to negotiate the terms of the agreement, including prices, closing dates, and contingencies. This flexibility ensures that the needs and concerns of both parties can be addressed effectively.

-

Only the price matters in the agreement. While the sale price of the property is certainly a crucial aspect of the agreement, it is not the only important element. The agreement covers a wide range of other important factors, including but not limited to, financing conditions, inspection rights, repair obligations, and closing and possession dates. These elements are vital for a comprehensive understanding of the terms of sale and protect both parties from potential misunderstandings or disputes.

-

Oral agreements are just as binding as written ones. This is a dangerous misconception. In real estate transactions, oral agreements are not legally binding. The Real Estate Purchase Agreement must be in writing and signed by both parties to be considered legally enforceable. Depending on the jurisdiction, this requirement ensures clarity, reduces the risk of fraud, and provides a clear record of the agreed-upon terms and conditions.

-

Signing the agreement commits you to the purchase or sale. While signing the Real Estate Purchase Agreement is a significant step towards completing a real estate transaction, it doesn't conclusively commit the buyer or seller to finalize the deal. The agreement usually contains several contingencies that must be met prior to closing, such as satisfactory home inspections, obtaining financing, and clear title searches. If these contingencies are not satisfied, the involved parties may have the right to renegotiate or even terminate the agreement.

Key takeaways

A Real Estate Purchase Agreement is a vital document in the process of buying and selling property. It outlines the terms and conditions of the sale, protecting both the buyer and the seller from potential misunderstandings. Here are key takeaways about filling out and using this form:

Accuracy is crucial: Every detail in the agreement needs to be accurate, including names, property addresses, and the offered price. Mistakes can lead to delays or legal complications down the line.

Understand the terms: Both parties should fully understand every clause and condition within the agreement. If there's anything unclear, seek clarification or legal advice before signing.

Amendments and contingencies: The agreement can include contingencies that protect the buyer, such as an inspection contingency or a mortgage approval contingency. Any changes or amendments to the agreement should be made in writing and signed by both parties.

Legal and Binding: Once signed, the Real Estate Purchase Agreement is a legally binding contract. Both the buyer and the seller are obligated to comply with its terms, or they may face legal repercussions.

Filling out and understanding a Real Estate Purchase Agreement is a critical part of the property transaction process. It safeguards the interests of both parties and ensures a smoother transaction. Paying close attention to detail and being well-informed can prevent potential disputes and financial losses.

Other Forms

Intent to Sue Letter Template - Preparation of this document usually involves a detailed recounting of events leading to the dispute, supported by relevant laws and statutes, aiming to demonstrate a clear cause of action.

Llc Membership Purchase Agreement - Facilitates the expansion of the LLC’s ownership base in a structured and legal manner.