Blank Real Estate Purchase Agreement Form for California

Embarking on the journey of buying or selling a home in California marks a significant milestone, often filled with excitement and, sometimes, a bit of apprehension. Central to this process is the California Real Estate Purchase Agreement, a crucial document that outlines the terms and conditions of the property transaction. This legally binding contract sets forth the sale price, closing details, contingencies, and other important terms agreed upon by both parties, the buyer and the seller. It serves not just as a roadmap guiding the transfer of ownership, but also as a safeguard, ensuring that both parties' interests are protected throughout the transaction. Understanding the components, requirements, and implications of this agreement is fundamental for anyone looking to navigate the complexities of real estate transactions in California with confidence and clarity.

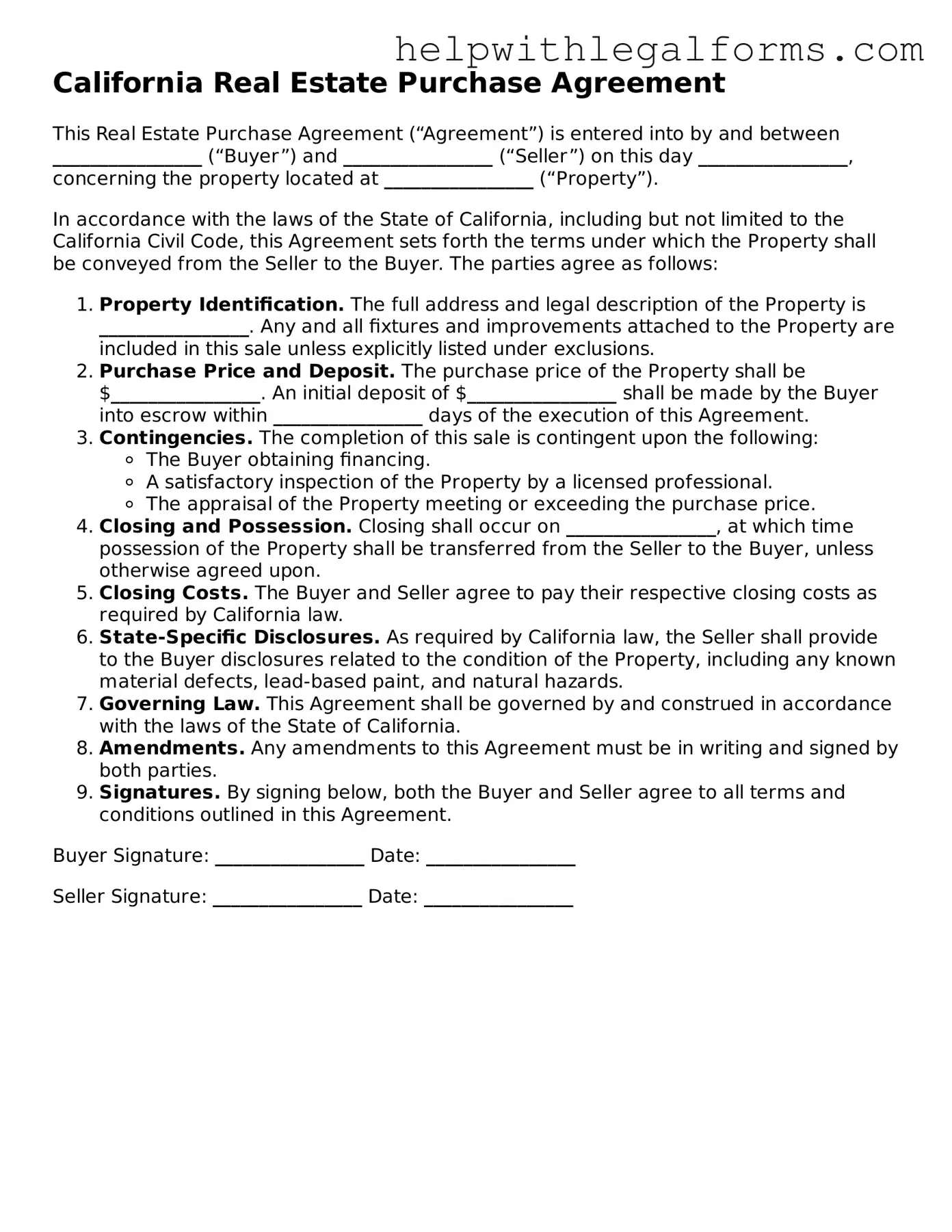

Example - California Real Estate Purchase Agreement Form

California Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is entered into by and between ________________ (“Buyer”) and ________________ (“Seller”) on this day ________________, concerning the property located at ________________ (“Property”).

In accordance with the laws of the State of California, including but not limited to the California Civil Code, this Agreement sets forth the terms under which the Property shall be conveyed from the Seller to the Buyer. The parties agree as follows:

- Property Identification. The full address and legal description of the Property is ________________. Any and all fixtures and improvements attached to the Property are included in this sale unless explicitly listed under exclusions.

- Purchase Price and Deposit. The purchase price of the Property shall be $________________. An initial deposit of $________________ shall be made by the Buyer into escrow within ________________ days of the execution of this Agreement.

- Contingencies. The completion of this sale is contingent upon the following:

- The Buyer obtaining financing.

- A satisfactory inspection of the Property by a licensed professional.

- The appraisal of the Property meeting or exceeding the purchase price.

- Closing and Possession. Closing shall occur on ________________, at which time possession of the Property shall be transferred from the Seller to the Buyer, unless otherwise agreed upon.

- Closing Costs. The Buyer and Seller agree to pay their respective closing costs as required by California law.

- State-Specific Disclosures. As required by California law, the Seller shall provide to the Buyer disclosures related to the condition of the Property, including any known material defects, lead-based paint, and natural hazards.

- Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of California.

- Amendments. Any amendments to this Agreement must be in writing and signed by both parties.

- Signatures. By signing below, both the Buyer and Seller agree to all terms and conditions outlined in this Agreement.

Buyer Signature: ________________ Date: ________________

Seller Signature: ________________ Date: ________________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The California Real Estate Purchase Agreement is governed by the real estate laws of California, including specifics about property sales and transactions. |

| Use of Form | This form is used to outline the terms and conditions under which a property will be sold and purchased in California. |

| Disclosures | California law requires sellers to disclose specific information about the property's condition, including any known material defects. |

| Binding Agreement | Once signed by both the buyer and the seller, the agreement becomes a legally binding contract. |

| Contingencies | The agreement often includes contingencies that must be fulfilled before the sale can be completed, such as financing approval and home inspections. |

Instructions on How to Fill Out California Real Estate Purchase Agreement

Filling out the California Real Estate Purchase Agreement form is a significant step in the process of buying or selling a property in California. This document will formalize the terms and conditions of the sale, ensuring both parties are clear about their obligations and the details of the transaction. It is important to complete this document carefully and accurately to protect your interests and facilitate a smooth property transfer. The instructions below will guide you through each section of the form to ensure all necessary information is correctly provided.

- Begin by entering the date of the agreement in the top right corner of the first page.

- Fill in the full legal names of the buyer(s) and seller(s) in the respective fields provided.

- Specify the address and a detailed description of the property being sold, including its legal description and parcel number.

- Enter the total purchase price agreed upon by the buyer and seller in the space provided.

- Detail the terms of the deposit, including the amount, the holder of the deposit, and the account where it will be kept.

- Outline the financing arrangements, if any, including loan type, amount, terms, and contingency periods.

- Include any additional terms and conditions related to the sale, such as items to be included or excluded in the sale, any necessary repairs, or other conditions.

- List any inspection, disclosure, and report requirements, specifying who is responsible for each task.

- Specify the closing date and the possession date for the property.

- Review all filled sections carefully to ensure accuracy and completeness.

- Have both the buyer(s) and seller(s) sign and date the form in the designated areas at the end of the document.

- Make sure to provide a copy to all parties involved for their records once the form is fully executed.

After the California Real Estate Purchase Agreement form is completed and signed by all parties, the next step involves ensuring compliance with any additional legal or regulatory requirements specific to California real estate transactions. This may include completing further disclosures, conducting inspections, or securing financing, among other tasks. Successfully navigating these steps will bring you closer to finalizing the property transaction.

Crucial Points on This Form

What is a California Real Estate Purchase Agreement?

A California Real Estate Purchase Agreement is a legal document used to outline the terms and conditions of a transaction where someone is buying real estate in California. This comprehensive document includes details like the purchase price, escrow arrangements, disclosure requirements, and any contingencies that must be met before the sale can be finalized. It is legally binding once signed by both the buyer and the seller.

Who should use a California Real Estate Purchase Agreement?

This agreement should be used by anyone looking to buy or sell a piece of property in California. It could be residential, commercial, or any type of real estate. Both parties, the buyer and the seller, need to agree to and sign the document for the sale process to move forward. Real estate agents involved in the transaction will also use this agreement as part of the sale negotiation and completion process.

What key information is included in the agreement?

The agreement covers vital information necessary for the real estate transaction, such as the identities of the buyer and seller, a legal description of the property being sold, the purchase price, the deposit amount, financing details, closing date, conditions or contingencies that need resolving before closing, and specific disclosures related to the property. It also outlines who pays for what costs, like inspections and title insurance, and how any disputes will be resolved.

Are disclosures required in the California Real Estate Purchase Agreement?

Yes, California law requires the seller to provide specific disclosures in the real estate purchase agreement, including any known material defects that could affect the property's value or desirability. Examples include natural hazards, lead-based paint if the property was built before 1978, and any deaths on the property in the last three years. Meeting these disclosure requirements is essential for the legal transfer of property.

What are contingencies in a Real Estate Purchase Agreement?

Contingencies are conditions specified in the purchase agreement that must be met before the sale can be completed. Common contingencies include the buyer securing financing, the successful completion of a home inspection, and the property appraising at a value that supports the agreed purchase price. Both buyers and sellers must agree on how these contingencies will be resolved within specified timelines.

Can either party back out of a California Real Estate Purchase Agreement?

Yes, but conditions apply. If contingencies outlined in the agreement are not met, the buyer can usually cancel the contract without penalty. Similarly, if the buyer defaults or fails to follow through with the purchase without a valid reason, the seller might retain the deposit as a breach of contract. Therefore, understanding and adhering to the agreement's contingencies and terms is crucial for both parties.

How does the escrow process work in California?

In California, the escrow process is a critical component of the real estate transaction. An escrow company or agent acts as a neutral third party that holds the deposit and manages the exchange of documents and funds between the buyer and seller. This process ensures that the terms of the purchase agreement are met before any money and property ownership are exchanged. The escrow process begins once the buyer and seller sign the purchase agreement and ends at the close of escrow, when the sale is complete and the property officially changes hands.

Common mistakes

Not fully identifying the parties: Both the buyer(s) and seller(s) need to be clearly identified with full legal names to avoid any confusion.

Omitting important dates: Specific dates such as the offer expiration, closing, and possession date must be accurately filled in to ensure all parties are on the same timeline.

Skipping legal descriptions of the property: Apart from the address, the legal description as recorded in the public record is vital for precisely identifying the property.

Incorrectly stating the purchase price: This is the key figure in the agreement and must be accurate, including the allocation of costs like closing fees.

Leaving out contingencies: These are crucial for protecting the buyer's interests, covering finance, inspection, and sale of current home contingency clauses.

Failing to detail included and excluded personal property: Clarity about what remains and what goes with the seller can prevent disputes later.

Neglecting to outline the condition of the property: A clear statement regarding the property's current state and any agreed-upon repairs is necessary.

Forgetting to specify earnest money details: Amount, holding party, and conditions for refundability should be clearly documented.

Overlooking the dispute resolution: This section, specifying mediation, arbitration, or court action, guides how disputes will be resolved.

Not obtaining all necessary signatures: Every party involved, including co-buyers or co-sellers, must sign the agreement for it to be legally binding.

Double-check all entered information for accuracy.

Understand every clause and its implications.

Consult with a real estate professional or lawyer if any part of the agreement is unclear.

Documents used along the form

When it comes to buying or selling property in California, the Real Estate Purchase Agreement (REPA) is just the tip of the iceberg. This critical document outlines the terms and conditions of the sale, but several other forms and documents are often required to navigate the process smoothly. Each plays a pivotal role in ensuring a transparent, lawful, and hassle-free transaction. Let's explore some of these essential documents that commonly accompany a California REPA.

- Disclosure Statements: Sellers are typically required to complete various disclosure statements. These include revealing any known defects or issues with the property, such as lead-based paint disclosures for older homes, natural hazards, or other material facts that could affect the property's value or desirability.

- Title Report: This document gives a detailed history of the property, including ownership, any liens or encumbrances, and detailed information about the property's boundaries. It's crucial for ensuring the seller has a clear title to transfer to the buyer.

- Loan Documents: If the buyer is financing the purchase, the lender will require several documents, including a loan application and, eventually, a mortgage or deed of trust on the property, to secure the loan.

- Home Inspection Report: Although not always mandatory, a home inspection report is highly recommended. It provides an in-depth look at the property's condition, highlighting any repairs that may be needed prior to closing.

- Preliminary Title Report: This is provided by a title company before closing, offering a preview of what will be included in the final title report. It allows the buyer to see any potential issues that could delay or prevent the transfer of the title.

- Contingency Removal Forms: Depending on the terms of the REPA, there may be contingencies that must be met before the sale can proceed. These forms are used to document the removal of such contingencies, signalling that the transaction is moving forward.

- Final Walk-Through Checklist: Just before closing, buyers often perform a final walk-through of the property. This checklist helps ensure that the property's condition has not changed since the sale agreement and that any agreed-upon repairs have been completed.

Navigating a real estate transaction can seem daunting, especially with the multitude of documents and forms involved. However, each document serves to protect all parties involved, ensuring that the transaction is conducted fairly and lawfully. Understanding the purpose and importance of each document that accompanies a California Real Estate Purchase Agreement can provide peace of mind and contribute to a smoother transaction for everyone involved.

Similar forms

Bill of Sale: This document, like a Real Estate Purchase Agreement, is used during the process of selling property. However, it is typically used for personal property, such as vehicles or office equipment, rather than real estate. Both documents include detailed descriptions of the property being sold, the purchase price, and the terms of the sale.

Lease Agreement: Used for renting or leasing property, a Lease Agreement shares similarities with a Real Estate Purchase Agreement in that it outlines conditions like payment terms, duration, and obligations of each party. However, it differs in that it pertains to the rental of property, not its sale.

Mortgage Agreement: This document outlines the terms of a loan used to purchase real estate, similarly involving a detailed description of the property and the financial terms. Both a Mortgage Agreement and a Real Estate Purchase Agreement are essential for the purchasing process of property but serve different roles, with the Mortgage Agreement specifically focusing on the loan aspects.

Quitclaim Deed: A Quitclaim Deed transfers property ownership without making any warranties about the property’s title, similar to how a Real Estate Purchase Agreement transfers ownership. However, a Quitclaim Deed is generally used between known parties and doesn’t entail financial transactions or guarantees about the property's encumbrances.

Warranty Deed: Like a Real Estate Purchase Agreement, a Warranty Deed is used in the sale of property and provides guarantees about the clear title of the property being transferred. It ensures that the seller holds the title to the property and has the right to sell it, offering more protections compared to a Quitclaim Deed.

Option Agreement: This is a contract giving a party the right, but not the obligation, to buy or sell property at a determined price within a specified period. Both an Option Agreement and a Real Estate Purchase Agreement deal with the conditions under which property might be sold, but an Option Agreement allows a buyer the choice to proceed with the purchase.

Promissory Note: A Promissory Note is a financial instrument outlining a promise to pay back a specified sum of money to a lender at a certain time frame. It is often used in conjunction with a Real Estate Purchase Agreement when the purchase involves seller financing. The agreement outlines the sale, and the Promissory Note details the repayment of funds.

Deed of Trust: In some regions, a Deed of Trust is used instead of a traditional Mortgage Agreement. It involves a trustee, holding the property's legal title until the borrower pays off the loan. Both documents are integral to real estate transactions involving financing but differ in their legal structure and the parties involved.

Land Contract: A Land Contract allows a buyer to pay the seller for a property in installments, with the legal title transferring once all payments have been made. It is similar to a Real Estate Purchase Agreement in that it facilitates the sale of property, differing primarily by the payment and transfer terms.

Assignment Agreement: This type of agreement transfers rights or interests in a property from one party to another but does not transfer the actual property. It is similar to a Real Estate Purchase Agreement in terms of altering parties' rights concerning a property, but it does not concern the direct sale of real estate.

Dos and Don'ts

When preparing to fill out a California Real Estate Purchase Agreement, it is essential to approach the task with care. This document is crucial in the process of buying or selling property, serving as a binding contract between the parties involved. To navigate this process smoothly, here are nine do's and don'ts to keep in mind:

- Do thoroughly review the entire form before beginning to ensure you understand all the requirements and sections.

- Do provide complete and accurate information for every field to prevent any misunderstandings or legal issues down the line.

- Do consult with a real estate professional or legal advisor if you have any questions or concerns about the form or the process.

- Do use clear and concise language to avoid any ambiguity.

- Do double-check the dates and deadlines specified in the agreement, as timing can be critical in real estate transactions.

- Don't leave any sections blank. If a section does not apply, consider filling it in with “N/A” (not applicable) rather than leaving it empty.

- Don't sign the agreement until both the buyer and the seller fully understand and agree to all its terms.

- Don't hesitate to negotiate terms that do not meet your needs or expectations. Remember, the purchase agreement is subject to negotiation between the buyer and seller.

- Don't rely solely on verbal agreements. Make sure all agreements, amendments, or special requests are documented in writing and included in the final agreement.

Adhering to these guidelines can help you navigate the process of completing a California Real Estate Purchase Agreement more effectively, leading to a smoother transaction for all parties involved. Always keep the lines of communication open and ensure that any changes or adjustments are mutually agreed upon and properly documented.

Misconceptions

The California Real Estate Purchase Agreement is a crucial document in the property buying process. However, there are misconceptions surrounding this form that need clarification:

It's just a standard form: Many believe the Real Estate Purchase Agreement is a one-size-fits-all document. However, this agreement is customizable and can be tailored to the specific terms and conditions agreed upon by the buyer and seller.

Verbal agreements are enforceable: People often think verbal agreements made during negotiations are binding. In California, agreements related to real estate transactions must be in writing and signed by both parties to be enforceable.

It only covers the sale price: A common misconception is that the agreement only details the sale price. It actually covers a wide range of terms including financing conditions, inspection rights, timelines, and responsibilities of each party.

No attorney review needed: Some parties assume that because the agreement seems straightforward, they don't need legal review. It's crucial to have an attorney review the agreement before signing to ensure your interests are protected.

Deposits are non-refundable: Many believe that all deposits made when an offer is accepted are automatically forfeited if the buyer backs out. However, the return of deposits depends on the contingencies outlined in the agreement and whether they have been met or waived.

It's final once signed: There's a misconception that once the agreement is signed, no changes can be made. In reality, any changes or amendments can be made if both parties agree and those changes are put in writing and signed by both parties.

Understanding the complexities and the flexibility of the California Real Estate Purchase Agreement can provide a smoother transaction for both buyers and sellers. Accurate knowledge ensures that all parties are adequately protected throughout the process.

Key takeaways

The California Real Estate Purchase Agreement is a crucial document used in the transaction of purchasing property within the state of California. Understanding the key elements and how to properly fill it out can significantly impact the buying process. Here are nine important takeaways:

- Details of the Parties Involved: The full legal names of both the buyer(s) and the seller(s) should be accurately filled out. This ensures that the agreement is legally binding and enforceable.

- Description of the Property: The agreement must include a complete and accurate description of the property being purchased, including its physical address and legal description.

- Purchase Price and Terms: The document should clearly state the purchase price of the property and the terms of payment. This section outlines whether the purchase is contingent on financing and the specifics of any deposit made.

- Contingencies: Common contingencies include financing, home inspections, appraisals, and the sale of another property. Each contingency should be clearly specified, including the time frames for meeting these conditions.

- Closing and Possession Dates: The agreement must specify the closing date and the date when the buyer will take possession of the property. These dates are important for both planning and legal purposes.

- Disclosures: Sellers are required to provide certain disclosures about the property's condition and history. The agreement should mention which disclosures will be provided and acknowledge their receipt by the buyer.

- Legal Compliance: The agreement must comply with all federal, state, and local laws, including those related to real estate transactions, zoning, and environmental regulations.

- Signature Requirements: For the agreement to be legally binding, it must be signed by all parties involved in the transaction. The date of signing should also be recorded.

- Dispute Resolution: The document should outline the process for resolving disputes that may arise between the buyer and seller during the transaction process. This could include mediation, arbitration, or legal action.

Filling out the California Real Estate Purchase Agreement form carefully and completely is essential for the protection of all parties involved in the transaction. Both buyers and sellers are advised to review the agreement thoroughly, including all standard and additional terms, to ensure that it accurately reflects the terms of the deal.

Create Other Real Estate Purchase Agreement Forms for US States

Connecticut Real Estate Contract - It requires the seller to guarantee that the property has a clear title, free of any liens or disputes, ensuring a smooth transfer of ownership.

Purchasing Agreement - Seller financing terms can be included in the agreement, outlining the interest rate, payment schedule, and other details of the loan provided by the seller.

For Sale by Owner Oklahoma Contract - Prevents misunderstandings by thoroughly documenting the sale terms, ensuring clarity for both parties.

Real Estate Contract Template - An executed contract that records the agreed-upon terms for a property transaction.