Blank Real Estate Purchase Agreement Form for Colorado

When it comes to buying or selling property in Colorado, the Real Estate Purchase Agreement form plays a pivotal role in securing the terms of the sale and ensuring that both parties are on the same page. This comprehensive document outlines all the critical aspects of the transaction, including the purchase price, property details, buyer and seller information, contingencies, closing date, and any conditions that need to be met before the sale can be finalized. It serves as a legally binding contract that provides a clear roadmap for the transaction, helping to avoid confusion and disputes. The importance of this form cannot be overstated, as it not only protects the interests of both the buyer and seller but also provides a structured process for the transfer of ownership. Whether you are a first-time homebuyer or an experienced investor, understanding the components and significance of the Colorado Real Estate Purchase Agreement form is essential for a successful real estate transaction.

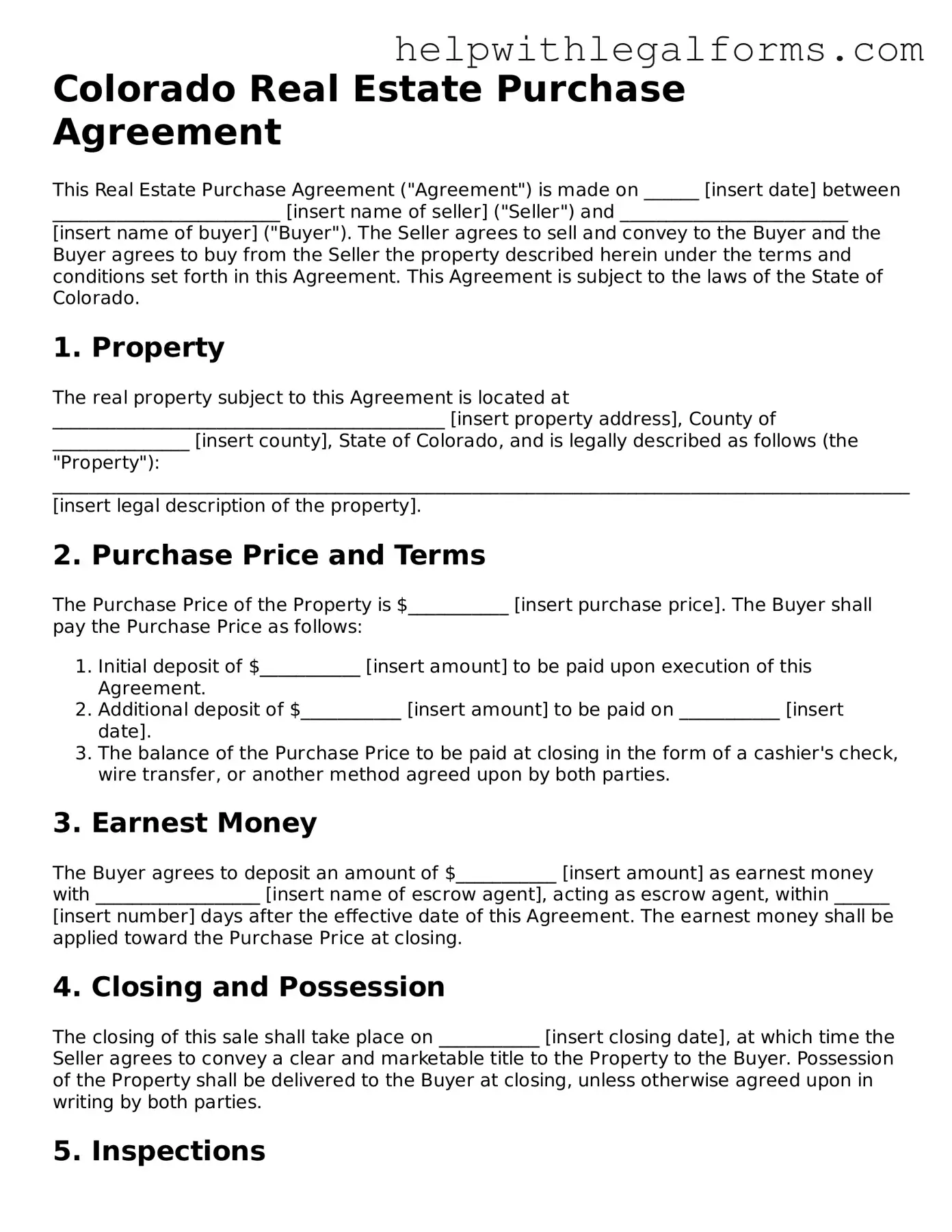

Example - Colorado Real Estate Purchase Agreement Form

Colorado Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made on ______ [insert date] between _________________________ [insert name of seller] ("Seller") and _________________________ [insert name of buyer] ("Buyer"). The Seller agrees to sell and convey to the Buyer and the Buyer agrees to buy from the Seller the property described herein under the terms and conditions set forth in this Agreement. This Agreement is subject to the laws of the State of Colorado.

1. Property

The real property subject to this Agreement is located at ___________________________________________ [insert property address], County of _______________ [insert county], State of Colorado, and is legally described as follows (the "Property"): ______________________________________________________________________________________________ [insert legal description of the property].

2. Purchase Price and Terms

The Purchase Price of the Property is $___________ [insert purchase price]. The Buyer shall pay the Purchase Price as follows:

- Initial deposit of $___________ [insert amount] to be paid upon execution of this Agreement.

- Additional deposit of $___________ [insert amount] to be paid on ___________ [insert date].

- The balance of the Purchase Price to be paid at closing in the form of a cashier's check, wire transfer, or another method agreed upon by both parties.

3. Earnest Money

The Buyer agrees to deposit an amount of $___________ [insert amount] as earnest money with __________________ [insert name of escrow agent], acting as escrow agent, within ______ [insert number] days after the effective date of this Agreement. The earnest money shall be applied toward the Purchase Price at closing.

4. Closing and Possession

The closing of this sale shall take place on ___________ [insert closing date], at which time the Seller agrees to convey a clear and marketable title to the Property to the Buyer. Possession of the Property shall be delivered to the Buyer at closing, unless otherwise agreed upon in writing by both parties.

5. Inspections

Within ______ [insert number] days after the effective date of this Agreement, the Buyer has the right to have the Property inspected by a licensed property inspector. Should the inspection reveal defects that are unacceptable to the Buyer, the Buyer may terminate this Agreement by providing written notice to the Seller within ______ [insert number] days after the inspection.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Colorado.

7. Signatures

This Agreement shall be deemed effective when signed by both the Seller and the Buyer below:

Seller's Signature: _______________________________ Date: ______ [insert date]

Buyer's Signature: _______________________________ Date: ______ [insert date]

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | The Colorado Real Estate Purchase Agreement is a legal document used for the purchase of real estate in Colorado. |

| Mandatory Disclosures | Under Colorado law, sellers must provide specific disclosures about the property’s condition, including any known material defects. |

| Governing Laws | The agreement is governed by Colorado real estate laws and regulations. |

| Binding Effect | Once signed by all parties, the agreement becomes legally binding and enforceable in Colorado courts. |

Instructions on How to Fill Out Colorado Real Estate Purchase Agreement

When entering the real estate market in Colorado, completing a Real Estate Purchase Agreement form is a crucial step. This document serves as a binding contract between the buyer and seller, detailing the terms of the property sale. It includes information such as the purchase price, property description, and contingencies that need to be met before the deal can close. Properly filling out this form ensures that both parties clearly understand their rights and responsibilities, reducing the potential for disputes down the line. To complete the Colorado Real Estate Purchase Agreement, follow these steps:

- Gather all necessary information: Before filling out the form, make sure you have all the relevant details about the property, including its legal description, the sale price, and any personal property included in the sale.

- Identify the parties: Clearly write the full names and contact information of both the buyer and the seller at the beginning of the form.

- Describe the property: Provide a detailed description of the property being sold, including its address, legal description, and any unique features or fixtures included in the sale.

- State the purchase price: Clearly indicate the agreed-upon purchase price for the property, including how it will be paid (e.g., cash, financing).

- List any contingencies: Specify any conditions that must be met before the sale can proceed. Common contingencies include the buyer obtaining financing, the sale of another property, and satisfactory inspection results.

- Include additional agreements: Detail any additional agreements between the buyer and the seller, such as who will pay for inspections, repairs, or closing costs.

- Signatures: Ensure both the buyer and the seller sign and date the agreement, making it legally binding. Include witness signatures if required by state law.

After completing these steps, it's essential to retain a copy of the signed agreement for your records. This document will serve as the foundation for the entire real estate transaction, guiding both parties through the closing process. Whether you're a first-time homebuyer or a seasoned investor, understanding and accurately completing the Real Estate Purchase Agreement is key to a successful property transfer in Colorado.

Crucial Points on This Form

What is a Colorado Real Estate Purchase Agreement?

A Colorado Real Estate Purchase Agreement is a legal document used to outline the terms and conditions under which a property in Colorado will be sold and purchased. It covers essential details such as the price, property description, financing terms, and any contingencies that must be met before the sale can finalize.

Who needs to sign the Colorado Real Estate Purchase Agreement?

The agreement must be signed by both the buyer(s) and seller(s) involved in the transaction. If the property is owned by more than one person or is being bought by multiple individuals, all parties should sign the agreement to ensure that it is legally binding and that all parties are held to the terms outlined within it.

Are there any contingencies that should be included in the agreement?

Yes, including contingencies in a Colorado Real Estate Purchase Agreement is common practice. Contingencies can include financing approval, the sale of the buyer's current home, satisfactory inspection and appraisal of the property, and the ability to obtain insurance. These conditions provide a means for either party to legally withdraw from the agreement under specific circumstances without penalty.

What happens if either party wants to back out of the agreement after it is signed?

If either party wishes to back out of the agreement after it has been signed, they may face legal and financial consequences unless the withdrawal is covered by one of the contingencies outlined in the agreement. If a party breaches the contract without legal justification, they may be required to forfeit their earnest money deposit or potentially face further legal action by the other party seeking fulfillment of the contract or damages.

Common mistakes

When filling out the Colorado Real Estate Purchase Agreement, people often make a range of mistakes. These errors can lead to delays, misunderstandings, or even legal issues down the line. It's crucial to approach this document with attention to detail and thorough understanding. Below are seven common mistakes to watch out for.

Not double-checking for accuracy: People frequently fill in details hurriedly and fail to go back to ensure all information is correct. This encompasses everything from names and addresses to the specifics of the property in question.

Overlooking deadlines: Specific dates like the closing date, inspection periods, and deadlines for obtaining financing are pivotal. Misunderstanding or missing these can create complications or cause the deal to fall through.

Ignoring contingencies: The agreement allows for contingencies, such as the sale being subject to a satisfactory home inspection or the buyer securing financing. Failure to clearly specify these can lead to disputes.

Leaving blanks: Sometimes, sections that are currently not applicable are left blank. It is better to fill these sections with "N/A" or "none" to confirm they were reviewed but deemed not relevant, rather than overlooked.

Omitting the inclusion or exclusion of items: Failing to expressly mention which fixtures or personal property items are included or excluded in the sale can lead to confusion or conflict after the sale is completed.

Not specifying dispute resolution methods: The agreement should outline how disputes will be resolved should they arise. Leaving this blank or vague can invite lengthy and costly legal disputes.

Forgetting to initial changes: When modifications are made to any part of the agreement after initial signatures, all parties must initial these changes to validate them. This step is often forgotten or overlooked.

Understanding and avoiding these mistakes can smooth the path to a successful real estate transaction. It ensures a clear agreement between all parties involved and minimizes the risk of future disputes or legal challenges.

Documents used along the form

When navigating the complexities of real estate transactions in Colorado, the Real Estate Purchase Agreement is just the initial step in a series of necessary documents. Each document plays a critical role, ensuring the transaction proceeds transparently, legally, and in the best interest of all parties involved. Here is a closer look at up to seven other essential forms and documents often used alongside the Colorado Real Estate Purchase Agreement, designed to make the purchase process smoother and more understandable.

- Counterproposal Form: This document is used if the buyer or seller wants to make changes to the initial offer. It allows negotiation on terms such as price, closing dates, and contingencies, ensuring both parties are in agreement before proceeding.

- Disclosures Statement: Sellers are required to provide this form, which reveals any known defects or issues with the property. It's a critical document for transparency and helps buyers make informed decisions.

- Title Insurance Commitment: This document provides details about the title's status and outlines any existing easements, liens, or other encumbrances that could affect the buyer's ownership rights.

- Home Inspection Report: Typically obtained by the buyer, this report from a professional inspector details the condition of the property, including any repairs or maintenance issues that may need to be addressed.

- Loan Estimate and Closing Disclosure: For transactions involving a mortgage, the lender will provide these documents. The Loan Estimate gives an overview of the loan terms, projected payments, and closing costs, while the Closing Disclosure offers detailed information on transaction costs and finalizes the loan terms.

- Appraisal Report: This report assesses the value of the property to ensure it meets or exceeds the amount being financed. It is crucial for mortgage lenders to ensure the loan amount is appropriate for the property's value.

- Lead-Based Paint Disclosure: For homes built before 1978, this federally required document informs buyers about the presence of lead-based paint, which could pose health risks.

Each of these documents complements the Colorado Real Estate Purchase Agreement by providing additional layers of protection and assurance to both buyers and sellers. Understanding the purpose and contents of these documents can significantly enhance the transparency and ease of real estate transactions, ensuring all parties are well-informed and their interests are safeguarded throughout the process.

Similar forms

Lease Agreement: Like a Real Estate Purchase Agreement, a Lease Agreement outlines the terms between two parties, but instead of detailing a purchase, it specifies the terms under which one party agrees to rent property from another. Both documents include details such as the identification of parties, property description, payment terms, and the duration for which the agreement is valid. The critical difference is the Lease Agreement focuses on the renting of property rather than its sale.

Bill of Sale: This document is similar to a Real Estate Purchase Agreement in that it transfers ownership of an asset (like a car or boat, as opposed to real estate) from a seller to a buyer. It serves as evidence of the transaction and contains detailed information about the asset sold, the sale price, and the parties involved, mirroring the structure and purpose of the Real Estate Purchase Agreement.

Loan Agreement: A Loan Agreement shares common ground with a Real Estate Purchase Agreement by setting forth the terms under which money or property is lent, potentially for purchasing property. It details the obligations of the borrower and the lender, interest rates, payment schedules, and the consequences of default, paralleling how a purchase agreement outlines the terms between buyer and seller regarding a property transaction.

Contract for Deed: A Contract for Deed, also known as a land contract, closely resembles a Real Estate Purchase Agreement since it is a form of seller financing for property sales. It outlines the sale of a property under the condition that the buyer will make installment payments, and the transfer of property title is deferred until these payments are completed. Both documents formalize the terms under which property ownership will change hands, though the payment and transfer process differs.

Home Improvement Contract: While focused on the renovation or construction aspects related to a property rather than the sale, a Home Improvement Contract is similar to a Real Estate Purchase Agreement in structure and legal function. It details the scope of work, materials to be used, timelines, and payments between the homeowner and a contractor, ensuring all terms of the agreement are clearly understood and agreed upon, akin to how a purchase agreement secures the terms between buyer and seller in a real estate transaction.

Dos and Don'ts

Filling out a Colorado Real Estate Purchase Agreement form is a significant step in buying or selling property. It legally outlines the terms and conditions of the sale, making it imperative to approach this document with the utmost care. Here’s a list of dos and don’ts to consider when handling this important paperwork.

Do:

- Review the entire document carefully before filling it out. Ensure you understand every section and its implications. This understanding is crucial in ensuring that all the terms and conditions meet your expectations and protect your interests.

- Include all relevant details. This means specifying the legal description of the property, the purchase price, the earnest money deposit amount, and any contingencies that the sale depends upon, such as financing or the sale of another property.

- Utilize professional advice. Having a real estate agent, attorney, or both review the document can provide valuable insights. They can help ensure that the agreement is complete, accurate, and in your best interest.

- Clarify terms and conditions. If there are any unique arrangements or details about the sale that are agreed upon, ensure they are clearly outlined in the document. Ambiguity can lead to disputes later on.

- Ensure all parties understand and agree to the contract. Before finalizing the agreement, discuss its contents with the other party to make sure everyone is on the same page. Misunderstandings or discrepancies can complicate the process down the line.

Don't:

- Rush through the process. Take your time to fill out each section accurately. Overlooking details or rushing can result in errors that might compromise the agreement or lead to legal issues later.

- Leave blanks on the form. If a section is not applicable, make sure to write “N/A” (Not Applicable) or “0” if it refers to a numerical value. Blank spaces can lead to misunderstandings or manipulation of the document after signing.

- Forget to specify who pays for what. The agreement should clearly outline who is responsible for paying fees for inspections, closing costs, and other expenses related to the sale. Omitting this information can lead to conflicts.

- Sign without verifying all information. Before affixing your signature, check that all the information is complete, accurate, and reflects the agreed-upon terms. Once signed, changing the agreement becomes significantly harder.

- Ignore state-specific requirements. Colorado may have unique stipulations that need to be included in the agreement. Ensure that all state-specific legal requirements are met to avoid potential legal issues.

Adhering to these dos and don’ts when filling out the Colorado Real Estate Purchase Agreement form will help make the selling or buying process smoother and more secure for all parties involved. Being thorough and seeking professional advice when necessary can save you from future headaches and ensure that the transaction proceeds as planned.

Misconceptions

When it comes to buying or selling property in Colorado, the Real Estate Purchase Agreement (REPA) is a vital document that outlines the terms and conditions of the sale. However, there are several misconceptions regarding this agreement. Let’s clarify some of these common misunderstandings:

- It’s just a formality. Many believe the REPA is merely procedural, but it legally binds both the buyer and seller to the terms outlined within it, making it a crucial part of the real estate transaction.

- They’re all the same. While Colorado REPA forms may share common elements, each agreement is unique and tailored to the specific terms negotiated between the buyer and seller.

- It's only about the sale price. Beyond setting the price, the REPA covers a wide range of details, including timelines, contingencies, and specific obligations for both parties.

- You can back out anytime. Once the REPA is signed by both parties, withdrawing without a stipulated reason outlined in the agreement can have legal consequences.

- Verbal agreements are binding. In Colorado, for a real estate transaction to be legally binding, it must be in writing and signed by both parties involved.

- It’s only beneficial for the seller. The REPA protects both the seller and the buyer by setting clear expectations and obligations, ensuring a fair and transparent transaction for both sides.

- Any attorney can review it. While any attorney could technically review the document, it’s best to have it evaluated by someone with experience in Colorado real estate law to navigate the specifics effectively.

- Modifications cannot be made once it’s signed. Changes can be made after signing, but they must be agreed upon by both the buyer and seller and documented in writing.

- It determines the closing date. The REPA proposes a closing date, but this can be adjusted if both parties agree, often depending on factors like loan approval and inspection results.

- The earnest money is always forfeited if the buyer backs out. The forfeiture of earnest money depends on the contingencies outlined in the REPA. For instance, if a buyer legally withdraws based on an inspection contingency not being met, they may be entitled to their earnest money back.

Understanding these misconceptions can help buyers and sellers navigate the complexities of the Colorado Real Estate Purchase Agreement with more clarity and confidence, ensuring a smoother transaction process for everyone involved.

Key takeaways

When delving into the world of buying or selling property in Colorado, understanding how to properly fill out and utilize the Colorado Real Estate Purchase Agreement form is crucial. Here are ten pivotal takeaways to guide you through this process:

- Accuracy is Key: Ensure every detail you provide on the form is accurate. This includes names of the parties, property address, purchase price, and dates. Mistakes can lead to confusion or legal issues down the line.

- Understand the Terms: Familiarize yourself with the terms and conditions laid out in the agreement. It's not just about the price; terms regarding property inspection, earnest money, and closing dates are equally vital.

- Legal Description of the Property: The form requires a legal description of the property being sold, not just the address. This often includes the lot number, block number, subdivision name, and county.

- Financing: Clearly outline the financing details. Whether the purchase will be made with cash, a loan, or any other financing arrangement, these details need to be transparent in the agreement.

- Disclosures: Colorado law requires sellers to disclose certain information about the property, such as any known defects. Make sure these disclosures are included in the agreement to avoid future legal problems.

- Contingencies: Understand and use contingencies wisely. These conditions must be met for the transaction to proceed, covering aspects like home inspections, financing, and appraisal. Each party should know what contingencies are included.

- Close of Escrow: Pay attention to the closing date. This is when the transaction is set to be finalized, and the property officially changes hands. Both parties need to agree on a realistic timeline for closing.

- Real Estate Agent Roles: If real estate agents are involved in the transaction, their roles and commissions should be clearly stated in the agreement.

- Signatures: For the agreement to be legally binding, it must be signed by both the buyer and the seller. Make sure all parties sign the document and that these signatures are witnessed if required.

- Professional Advice: Considering the complexity and legal significance of the Real Estate Purchase Agreement, seeking advice from a real estate lawyer or a certified real estate professional is strongly advised. They can provide valuable insights and help avoid common pitfalls.

Armed with these key takeaways, navigating through the Colorado Real Estate Purchase Agreement should be a smoother and more informed process. Remember, each transaction is unique, so tailor your agreement to fit the specific circumstances of your deal. And always, prioritize clear communication and legal guidance to safeguard your property transaction.

Create Other Real Estate Purchase Agreement Forms for US States

Purchasing Agreement - The agreement can outline the procedures for handling earnest money, including refund conditions and how it will be credited at closing.

Real Estate Contract Nj - Disclosures relevant to the property's condition, such as lead paint or asbestos, are required by law to be included in the agreement.