Blank Real Estate Purchase Agreement Form for Connecticut

In Connecticut, the process of buying or selling property is centered around a crucial document, known as the Real Estate Purchase Agreement form. This essential piece of paper serves multiple purposes, acting as a comprehensive record of the sale terms negotiated between buyer and seller, a detailed list of the property being transferred, and a binding legal contract that commits both parties to their agreed-upon obligations. Not only does it specify the sale price, but it also outlines the responsibilities of each party concerning due diligence matters, such as home inspections, financing, and title searches. Furthermore, the form includes sections on closing details and any contingencies that must be satisfied before the transaction can be finalized. Through this document, both buyers and sellers navigate the legal complexities of real estate transactions, safeguarding their interests and ensuring that the property changes hands smoothly and transparently. Understanding the Connecticut Real Estate Purchase Agreement form is pivotal for anyone involved in the property market, as it lays the foundation for successful real estate deals within the state.

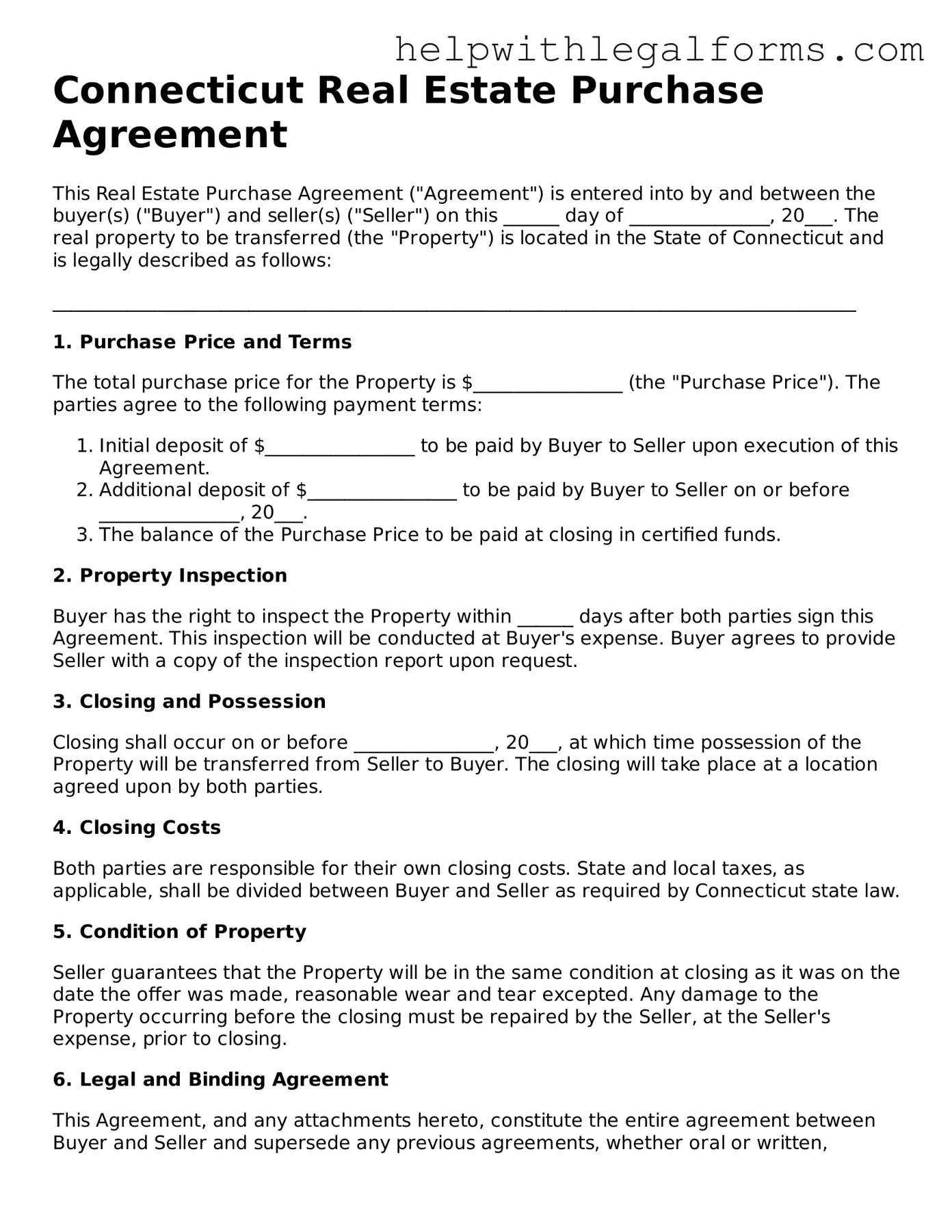

Example - Connecticut Real Estate Purchase Agreement Form

Connecticut Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is entered into by and between the buyer(s) ("Buyer") and seller(s) ("Seller") on this ______ day of _______________, 20___. The real property to be transferred (the "Property") is located in the State of Connecticut and is legally described as follows:

______________________________________________________________________________________

1. Purchase Price and Terms

The total purchase price for the Property is $________________ (the "Purchase Price"). The parties agree to the following payment terms:

- Initial deposit of $________________ to be paid by Buyer to Seller upon execution of this Agreement.

- Additional deposit of $________________ to be paid by Buyer to Seller on or before _______________, 20___.

- The balance of the Purchase Price to be paid at closing in certified funds.

2. Property Inspection

Buyer has the right to inspect the Property within ______ days after both parties sign this Agreement. This inspection will be conducted at Buyer's expense. Buyer agrees to provide Seller with a copy of the inspection report upon request.

3. Closing and Possession

Closing shall occur on or before _______________, 20___, at which time possession of the Property will be transferred from Seller to Buyer. The closing will take place at a location agreed upon by both parties.

4. Closing Costs

Both parties are responsible for their own closing costs. State and local taxes, as applicable, shall be divided between Buyer and Seller as required by Connecticut state law.

5. Condition of Property

Seller guarantees that the Property will be in the same condition at closing as it was on the date the offer was made, reasonable wear and tear excepted. Any damage to the Property occurring before the closing must be repaired by the Seller, at the Seller's expense, prior to closing.

6. Legal and Binding Agreement

This Agreement, and any attachments hereto, constitute the entire agreement between Buyer and Seller and supersede any previous agreements, whether oral or written, concerning the Property. This Agreement is binding upon both parties, their heirs, executors, administrators, successors, and assigns.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Connecticut.

IN WITNESS WHEREOF, the parties have signed this Agreement as of the dates written below:

Buyer's Signature: __________________________________ Date: _______________, 20___

Seller's Signature: _________________________________ Date: _______________, 20___

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Connecticut Real Estate Purchase Agreement form is used to outline the terms and conditions of the sale and purchase of real estate property in Connecticut. |

| Governing Law | This form and the transactions it governs are subject to Connecticut state law, including any specific statutes and regulations related to real estate transactions. |

| Inclusions | The form typically includes details about the buyer, seller, property, purchase price, payment method, contingencies, closing date, and any other terms agreed upon by the parties. |

| Legal Requirement | In Connecticut, the use of a written real estate purchase agreement and proper disclosure forms are required in order for the sale of real estate to be legally binding. |

Instructions on How to Fill Out Connecticut Real Estate Purchase Agreement

The Connecticut Real Estate Purchase Agreement form is a crucial document for anyone looking to buy or sell property in the state. This legally binding contract outlines the terms and conditions of the sale, including the purchase price, property description, closing details, and any contingencies that must be met before the transaction can be completed. Filling out this form accurately is essential for protecting the interests of both parties and ensuring a smooth transaction. The following steps guide you through completing the form correctly.

- Gather all necessary information about the property, including the legal description, address, and any relevant details about the land and buildings on the property.

- Enter the full names and contact information of the buyer(s) and seller(s) involved in the transaction.

- Specify the purchase price of the property in the designated section of the form.

- Detail the terms of the payment, including any deposit paid, financing arrangements, and whether the sale is contingent on the buyer obtaining a mortgage.

- List any personal property that is included in the sale. This may include appliances, furniture, or other items not permanently affixed to the property.

- Include the date by which the offer expires, giving the seller a deadline to accept, counter, or reject the offer.

- Outline any contingencies that must be resolved before the sale can proceed, such as satisfactory home inspections, appraisals, and obtaining homeowner's insurance.

- Designate the closing date and location where the final transaction will take place.

- Ensure both parties understand their obligations regarding closing costs, such as attorney fees, transfer taxes, and any other expenses associated with the transaction.

- Review all entries for accuracy and completeness. Both buyer and seller must sign and date the agreement to make it legally binding.

Once the Connecticut Real Estate Purchase Agreement form has been completed and signed by both parties, it marks a significant step forward in the property transaction process. It is advisable for both buyers and sellers to retain a copy of the agreement for their records and to proceed with fulfilling any contingencies outlined in the document. Properly executing this form helps safeguard the interests of all involved and paves the way for a successful transfer of property ownership.

Crucial Points on This Form

What is a Connecticut Real Estate Purchase Agreement?

A Connecticut Real Estate Purchase Agreement is a legally binding document between the seller and the buyer of property. This document outlines the terms and conditions of the sale, including the purchase price, property description, inspection rights, closing date, and any contingencies that must be met before the transaction can be completed.

Who needs to sign the Connecticut Real Estate Purchase Agreement?

The agreement must be signed by all parties involved in the transaction. This includes the seller(s) of the property and the buyer(s) who are purchasing it. If the property is owned or being purchased by more than one person, each person must sign the agreement.

Is a lawyer required to prepare or review the Connecticut Real Estate Purchase Agreement?

While it's not legally required to have a lawyer prepare or review the agreement, it is highly recommended. A lawyer can help ensure that the agreement complies with state laws, address any legal issues, and protect the rights and interests of the parties involved.

Can the purchase price be negotiated after the Connecticut Real Estate Purchase Agreement is signed?

Typically, the purchase price is agreed upon before the agreement is signed. However, the agreement may include contingencies that allow for renegotiation or termination of the contract under certain conditions, such as issues discovered during a home inspection.

What happens if either party wants to back out of the Connecticut Real Estate Purchase Agreement?

If either party wishes to back out of the agreement, they can do so only if they meet the conditions for termination outlined in the agreement itself. This could include failing to meet contingencies or mutual agreement to terminate. Backing out without a contractual basis may result in legal consequences, including the forfeiture of the earnest money deposit or facing a lawsuit for breach of contract.

Are there contingencies in the Connecticut Real Estate Purchase Agreement?

Yes, contingencies are common in real estate purchase agreements. They are conditions that must be satisfied before the sale can proceed. Common contingencies include financing approval, satisfactory home inspection, and the ability of the buyer to sell their current home.

What is an earnest money deposit, and is it required in Connecticut?

An earnest money deposit is a deposit made by the buyer to show their good faith and intention to complete the transaction. While not specifically required by Connecticut law, it is a common practice and acts as security for the seller. The amount and conditions for its return should be clearly outlined in the purchase agreement.

How is the closing date determined?

The closing date, when the transaction is completed and the property officially changes hands, is agreed upon by the seller and buyer during the negotiation of the purchase agreement. Factors affecting the closing date include the completion of inspections, mortgage approval timelines, and any contingencies that need to be resolved.

What happens if there are disagreements during the closing process?

If disagreements arise during the closing process, it's essential for both parties to refer back to the purchase agreement, as it outlines how disputes should be resolved. Negotiation or mediation may be required to overcome disagreements. In some cases, legal intervention might be necessary if an agreement cannot be reached.

Common mistakes

Filling out the Connecticut Real Estate Purchase Agreement form properly is crucial for a smooth property transaction. However, people often make mistakes during this process, which can lead to delays or more serious legal issues. Below are eight common errors to avoid:

- Incorrect Information: Entering incorrect details such as names, addresses, or the legal description of the property can cause significant problems. Double-check all entries for accuracy.

- Overlooking Contingencies: Failing to include important contingencies related to financing, inspections, or the sale of a current home can leave parties without crucial protections.

- Skip Reading the Fine Print: Not thoroughly reading every part of the agreement can lead to misunderstandings about the terms and obligations.

- Forgetting to Specify Fixtures and Personal Property: Not clearly specifying what will stay with the property and what will be removed by the seller can lead to disputes at closing.

- Miscalculating Financial Details: Incorrectly calculating the purchase price, earnest money, or closing costs can disrupt the financial arrangement between the buyer and seller.

- Lack of Signatures or Initials: Every party involved must sign or initial the agreement where required. Missing signatures can invalidate the contract.

- Omitting Dates: Failure to include pertinent dates, such as the offer expiration or closing date, can lead to confusion and potential disagreements.

- Ignoring Legal Requirements: Not adhering to Connecticut's specific legal requirements for real estate transactions can delay the process or void the agreement.

These common mistakes highlight the importance of carefully completing the Connecticut Real Estate Purchase Agreement form. Attention to detail and consulting with a legal professional when necessary can help ensure a successful and legally sound real estate transaction.

Documents used along the form

In the process of buying or selling real estate in Connecticut, parties often utilize a Real Estate Purchase Agreement to outline the terms of the transaction. This legally binding document records the agreed-upon conditions, including price and closing details, between the buyer and seller. Yet, this agreement doesn't stand alone. Various other forms and documents are frequently required to ensure the transaction adheres to legal standards and fully captures the intentions of all parties involved. Here is an overview of some of these essential documents.

- Addendum or Amendment to Purchase Agreement: This document is used if the parties need to make changes or add details to the original Purchase Agreement. It could adjust the sale price, closing date, or other significant terms initially agreed upon.

- Residential Property Disclosure Form: Sellers are required to provide this form to disclose the condition of the property, including any known defects. This requirement helps buyers make informed decisions before finalizing their purchase.

- Title Search Documentation: This consists of a series of documents that verify the seller has a clear title to the property, ensuring no disputes or liens exist that could complicate the transfer of ownership.

- Home Inspection Report: Conducted by a professional inspector, this report provides an in-depth look at the property's physical condition, noting any issues or potential repairs needed. It's a crucial document for a buyer's decision-making process.

- Lead-Based Paint Disclosure: For homes built before 1978, sellers must comply with federal law by disclosing the presence of lead-based paint, which poses health risks, especially to children and pregnant women.

- Financing Documents: If the buyer is securing a mortgage to purchase the property, several documents related to the financing must be provided. These include the loan application, pre-approval letter, and, eventually, the mortgage agreement.

- Closing Disclosure: This document outlines the final costs associated with the transaction and must be provided to the buyer at least three days before closing. It details the loan terms, projected monthly payments, and all closing costs.

Together, these documents play a vital role in the real estate transaction process in Connecticut, providing transparency, setting expectations, and protecting the interests of both the buyer and seller. Ensuring that each of these forms is carefully reviewed and properly executed helps to facilitate a smooth and legally compliant transfer of property.

Similar forms

A Lease Agreement shares similarities with a Real Estate Purchase Agreement in that both define the terms between two parties over the use of a property. However, while a lease agreement is concerned with the rental of property, a Real Estate Purchase Agreement pertains to the transfer of property ownership. Both documents outline the rights and obligations of each party, payment details, and the duration of the agreement, albeit for different purposes.

A Bill of Sale is akin to a Real Estate Purchase Agreement as both serve as written records that a sale has occurred, detailing the transaction between buyer and seller. They ensure that the parties' understandings are clear and legally documented. However, a Bill of Sale is typically used for personal property (like vehicles and equipment), while a Real Estate Purchase Agreement is used specifically for real property transactions.

A Loan Agreement can be similar to a Real Estate Purchase Agreement in its function of documenting the terms and conditions of a financial arrangement. Both agreements specify payment terms, obligations, and the consequences of breach of agreement. In real estate, a Loan Agreement often accompanies the Purchase Agreement when the purchase involves financing, underlining how the buyer intends to fulfill the financial commitment.

The Title Deed is directly related to the Real Estate Purchase Agreement in real estate transactions. While the Purchase Agreement stipulates the agreement to transfer ownership of real estate from seller to buyer, the Title Deed is the actual document that proves ownership has been transferred. The Purchase Agreement facilitates the process leading to the issuance of a Title Deed, making these documents complementary in nature.

Dos and Don'ts

When filling out the Connecticut Real Estate Purchase Agreement form, it's essential to approach the document with care and attention to detail. This legal document marks a crucial step in the process of buying or selling property. To ensure everything goes smoothly, here are some do's and don'ts to keep in mind:

- Do thoroughly review all sections of the form to ensure understanding of every provision. This form defines the terms and conditions of the sale, so clarity is key.

- Do ensure that all the information is accurate and complete. Mistakes or omissions can lead to delays or legal complications later on.

- Do use clear, legible handwriting if filling out the form by hand. Alternatively, if an electronic fillable form is available, it's wise to use it to avoid legibility issues.

- Do consult with a real estate attorney if there are any terms or phrases that are not clear. An attorney can provide clarity and advise on any potential legal implications.

- Do include any agreed-upon contingencies in the agreement. These might cover financing, inspections, or other conditions that must be met before the sale is finalized.

- Don't leave any fields blank. If a section does not apply, it's advisable to write “N/A” (not applicable) instead of leaving it empty.

- Don't sign the form without ensuring that all parties understand and agree to its terms. This agreement is legally binding once signed.

- Don't rush through the process. Take the time needed to carefully go through the form and double-check everything before signing.

- Don't forget to keep a copy of the signed agreement for personal records. It's important to have your own copy for future reference.

By following these guidelines, parties involved can help ensure a smoother transaction and avoid common pitfalls associated with the Connecticut Real Estate Purchase Agreement process. Ensuring due diligence now can save a great deal of time and potential legal trouble down the road.

Misconceptions

When it comes to buying or selling property in Connecticut, the Real Estate Purchase Agreement form is a crucial document. However, there are several misconceptions about this form that can lead to confusion. Understanding the facts can help parties navigate the process more smoothly.

It's just a formality: Some people think that the Connecticut Real Estate Purchase Agreement is merely procedural, but it's a legally binding contract that outlines the terms and conditions of the sale, including price, closing date, and contingencies.

One size fits all: Contrary to the belief that there is a standard, one-size-fits-all document, the agreement can vary significantly based on the property type and sale conditions. It needs to be tailored to the specific transaction.

No need to read it thoroughly: Given its legal importance, skipping a close read is risky. Every provision, from contingencies to closing dates, needs to be understood by both buyer and seller.

It’s non-negotiable: Many people mistakenly believe that the terms in the agreement are set in stone. In reality, almost everything in the agreement can be negotiated before it is signed.

Only real estate agents can fill it out: While real estate agents commonly prepare these agreements, parties can draft their agreements, provided they include all the required legal elements. Legal advice, however, is highly recommended.

Electronic signatures aren’t legal: This is not true. Connecticut law, aligning with federal law, recognizes electronic signatures as valid and binding, as long as they meet certain criteria.

It’s the final step in the buying process: Actually, signing the agreement is just one part of the process. Following the agreement, inspections, appraisals, and possibly further negotiations happen before the closing.

Attaching a check is mandatory: While earnest money is commonly attached to the agreement as a sign of good faith, the requirement and amount are subject to negotiation. There are instances where an agreement can proceed without an earnest money deposit.

Key takeaways

When navigating the complexities of real estate transactions in Connecticut, the Real Estate Purchase Agreement form is pivotal. Here are eight key takeaways for those looking to fill out and use this document effectively:

- Accuracy is crucial: Make sure all the information provided in the form is accurate and complete. This includes the names of the buyer and seller, the description of the property, and the purchase price.

- Legal descriptions are important: The property should be described in legal terms, not just its street address. This often includes the lot number, subdivision, and other details found in the property's deed.

- Understand the terms: Both parties should thoroughly understand every term and condition outlined in the agreement, including payment terms, contingencies, and closing conditions.

- Contingencies are protective: Contingencies, such as those for financing, inspections, and appraisals, protect both the buyer and seller. They should be clearly stated and agreed upon by both parties.

- Signatures matter: The agreement must be signed by all parties involved to be legally binding. Ensure that everyone who needs to sign does so and that signatures are witnessed if required by state law.

- Disclosure requirements: Connecticut law requires sellers to disclose certain information about the property, such as its physical condition and any known defects. These disclosures must be made before the agreement is signed.

- Seek professional advice: Given the legal and financial implications of a Real Estate Purchase Agreement, consulting with professionals such as real estate attorneys or agents is advisable to ensure that your rights are protected and that the document complies with Connecticut law.

- Amendments and addenda: If any changes need to be made to the agreement after it has been signed, these should be done through written amendments or addenda, signed by all parties. This ensures that the entire agreement remains enforceable and reflects the latest understanding between the buyer and seller.

Create Other Real Estate Purchase Agreement Forms for US States

Contract for Purchase - It can be amended with mutual consent if both parties agree to changes after the initial signing.

Colorado Real Estate Commission - Outlines the procedures for handling any adjustments, such as for property taxes or utilities, before closing.

Property Purchase Agreement Format - A legally enforceable document that sets the terms for purchasing real estate, detailing obligations of the buying and selling parties.

Real Estate Contract for Sale by Owner Free Georgia - The agreement protects the buyer by allowing for inspections and appraisals to ensure the property's condition and value.