Blank Real Estate Purchase Agreement Form for Florida

The process of buying or selling property in Florida is underpinned by a crucial document known as the Real Estate Purchase Agreement form. This document serves as a binding contract between the buyer and seller, outlining the terms and conditions of the sale. It addresses a wide array of aspects, including the identification of the property being sold, the purchase price agreed upon by both parties, and any contingencies that must be met before the sale can be finalized. Furthermore, the agreement details the responsibilities of both the buyer and seller, payment arrangements, and the timeline for closing the transaction. Its comprehensive nature ensures that all pertinent details are documented, reducing the potential for misunderstandings and disputes. Consequently, understanding this form and its components is essential for anyone involved in the real estate transaction process in Florida, thereby facilitating a smoother transaction for all parties involved.

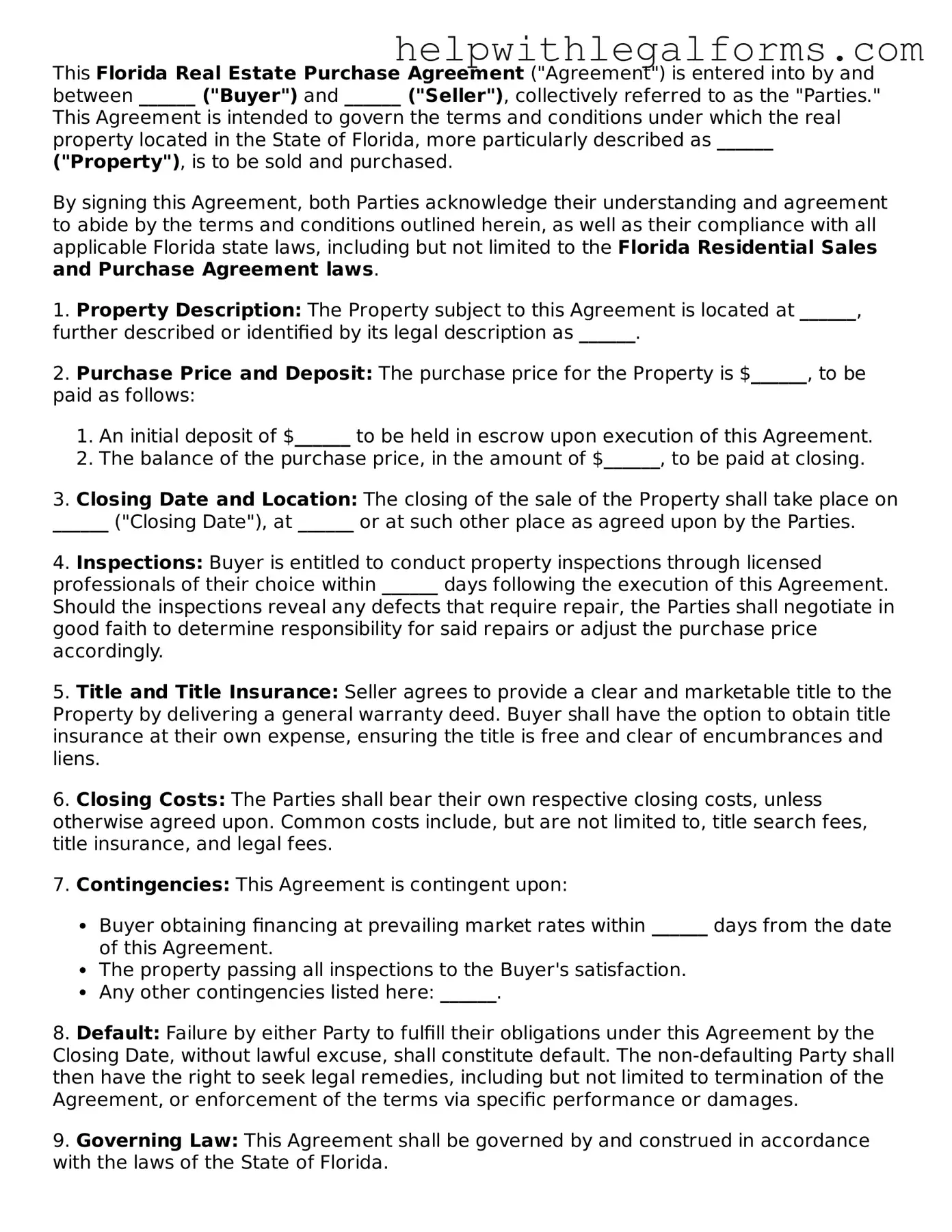

Example - Florida Real Estate Purchase Agreement Form

This Florida Real Estate Purchase Agreement ("Agreement") is entered into by and between ______ ("Buyer") and ______ ("Seller"), collectively referred to as the "Parties." This Agreement is intended to govern the terms and conditions under which the real property located in the State of Florida, more particularly described as ______ ("Property"), is to be sold and purchased.

By signing this Agreement, both Parties acknowledge their understanding and agreement to abide by the terms and conditions outlined herein, as well as their compliance with all applicable Florida state laws, including but not limited to the Florida Residential Sales and Purchase Agreement laws.

1. Property Description: The Property subject to this Agreement is located at ______, further described or identified by its legal description as ______.

2. Purchase Price and Deposit: The purchase price for the Property is $______, to be paid as follows:

- An initial deposit of $______ to be held in escrow upon execution of this Agreement.

- The balance of the purchase price, in the amount of $______, to be paid at closing.

3. Closing Date and Location: The closing of the sale of the Property shall take place on ______ ("Closing Date"), at ______ or at such other place as agreed upon by the Parties.

4. Inspections: Buyer is entitled to conduct property inspections through licensed professionals of their choice within ______ days following the execution of this Agreement. Should the inspections reveal any defects that require repair, the Parties shall negotiate in good faith to determine responsibility for said repairs or adjust the purchase price accordingly.

5. Title and Title Insurance: Seller agrees to provide a clear and marketable title to the Property by delivering a general warranty deed. Buyer shall have the option to obtain title insurance at their own expense, ensuring the title is free and clear of encumbrances and liens.

6. Closing Costs: The Parties shall bear their own respective closing costs, unless otherwise agreed upon. Common costs include, but are not limited to, title search fees, title insurance, and legal fees.

7. Contingencies: This Agreement is contingent upon:

- Buyer obtaining financing at prevailing market rates within ______ days from the date of this Agreement.

- The property passing all inspections to the Buyer's satisfaction.

- Any other contingencies listed here: ______.

8. Default: Failure by either Party to fulfill their obligations under this Agreement by the Closing Date, without lawful excuse, shall constitute default. The non-defaulting Party shall then have the right to seek legal remedies, including but not limited to termination of the Agreement, or enforcement of the terms via specific performance or damages.

9. Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of Florida.

10. Signatures: This Agreement is executed by the Parties as of ______.

Buyer Signature: ___________________________ Date: ______

Seller Signature: ___________________________ Date: ______

PDF Form Attributes

| Fact Number | Description |

|---|---|

| 1 | The Florida Real Estate Purchase Agreement form is specifically designed to facilitate the sale of real estate between a buyer and a seller in the state of Florida. |

| 2 | This form outlines the terms and conditions of the sale, including the purchase price, property description, financing conditions, and closing details. |

| 3 | It is governed by Florida's real estate laws and regulations, ensuring that all transactions comply with state guidelines. |

| 4 | Both parties are required to disclose any known defects or issues with the property as part of the agreement, in accordance with Florida's full disclosure requirements. |

| 5 | Use of the form is mandatory in Florida for all real estate transactions involving a written contract to ensure legal and procedural consistency. |

| 6 | The agreement must be in writing and signed by both the buyer and seller to be considered legally binding in Florida. |

| 7 | Earnest money deposits are typically required as part of the agreement, signifying the buyer's good faith intention to purchase the property. |

| 8 | Closing costs, which can include taxes, agent commissions, and other fees, are detailed in the agreement, with specifics on who is responsible for payment. |

| 9 | The agreement allows for contingencies, such as financing approval or the sale of an existing home, that must be met before the sale can be finalized. |

| 10 | Termination clauses within the agreement outline the conditions under which either party can withdraw from the contract without penalty, subject to certain conditions. |

Instructions on How to Fill Out Florida Real Estate Purchase Agreement

After finding the perfect property and reaching an agreement with the seller, it's crucial to formalize the deal through the Florida Real Estate Purchase Agreement. This document captures the terms, conditions, and specifics of the real estate transaction, ensuring both parties are clear about their responsibilities and the details of the sale. Completing this form accurately lays the groundwork for a smooth transition of property ownership. The steps outlined below will guide through the process of filling out the Florida Real Estate Purchase Agreement form.

- Gather Essential Information: Collect all necessary details including the full names and contact information of both the buyer and seller, property description, purchase price, and any agreed upon contingencies.

- Identify the Property: Include the legal description of the property along with its address. This may require referencing county records to ensure accuracy.

- Determine the Purchase Price: Clearly state the agreed purchase price of the property and document how this amount will be paid.

- Decide on a Closing Date: Agree upon and document a closing date, which is when the transaction will be completed and the property officially changes hands.

- Detail Payment Methods: Specify the payment terms including if it's cash, financing, or another arrangement. Include any deposit amount and terms related to it.

- Outline Contingencies: List any contingencies that must be met before the sale is finalized. This often includes property inspections, financing, and sale of the buyer's current home.

- Disclosure of Material Facts: If applicable, include any disclosures such as the existence of lead paint or known property defects.

- Review and Signatures: Both the buyer and seller should carefully review the agreement to ensure all the details are correct and complete. Once satisfied, both parties need to sign and date the document in the presence of a notary or witnesses if required by state law.

Following these steps will help ensure the Florida Real Estate Purchase Agreement is accurately filled out, providing a solid foundation for the upcoming property transfer. This agreement is a crucial step in the home buying process, legally binding both parties to the terms laid out within the document. It's advisable to consult with a real estate attorney or professional to confirm that all legal requirements are met and to provide guidance through this significant transaction.

Crucial Points on This Form

What is a Florida Real Estate Purchase Agreement?

A Florida Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions of the sale of real estate between a seller and a buyer. This comprehensive agreement includes essential details such as the purchase price, property description, financing terms, closing date, and any contingencies that must be met before the sale can be finalized. In Florida, this document is crucial for the transfer of property ownership to occur legally and smoothly.

Who needs to sign the Florida Real Estate Purchase Agreement?

The signing of the Florida Real Estate Purchase Agreement must be carried out by all parties involved in the transaction. This typically includes the buyer(s) and the seller(s) of the property. In some cases, if either party has designated a legal or real estate representative, these representatives may also need to sign the agreement. It is important that all signatures are obtained to ensure the enforceability of the agreement.

Are there any specific disclosures required in a Florida Real Estate Purchase Agreement?

In Florida, sellers are required to make certain disclosures within the Real Estate Purchase Agreement or through separate documents. One key disclosure is the property’s condition, including any known defects that could affect the property's value or desirability. Additionally, Florida law requires sellers to disclose any evidence of termites or other wood-destroying organisms, radon gas, and lead-based paint if the property was built before 1978. These disclosures are made to ensure buyers are fully informed about the property they intend to purchase.

What happens if either the buyer or seller backs out of the Florida Real Estate Purchase Agreement?

If either party decides to back out of the Florida Real Estate Purchase Agreement without legal justification, they may face significant consequences. For a buyer, this often means forfeiting any earnest money deposit made to secure the property under the terms of the agreement. For a seller, backing out could lead to legal action from the buyer, including potential lawsuits for breach of contract. However, most agreements include contingencies that allow either party to legally withdraw under specific circumstances, such as failure to secure financing or unsatisfactory inspection results. It's crucial to understand these conditions fully before entering or exiting an agreement.

Common mistakes

Filling out a Florida Real Estate Purchase Agreement is a critical step in the process of buying or selling property. This document outlines the terms and conditions of the sale, binding both parties to the agreement. While it may seem straightforward, certain mistakes can occur, potentially leading to misunderstandings or legal issues down the line. Here are nine common errors to avoid:

-

Not verifying the accuracy of personal details. It's essential to double-check the names, addresses, and other personal information of both the buyer and seller. Mistakes here can lead to complications in property records or legal documents.

-

Overlooking property descriptions. The agreement should include a detailed description of the property being sold. This includes not just the address, but also the legal description found in public records. Incorrect or vague descriptions can cause disputes.

-

Ignoring contingencies. Contingencies protect both parties if certain conditions aren’t met, such as the buyer obtaining financing or the results of a home inspection. Failing to clearly spell out these conditions can lead to conflicts.

-

Forgetting to specify fixtures and exclusions. Clearly state which fixtures and personal property are included or excluded from the sale. This can include appliances, lighting fixtures, and even plants.

-

Misunderstanding the closing costs and who pays for what. The agreement should outline all closing costs and specify who is responsible for each cost. Misunderstandings about these costs can lead to delays or disputes at closing.

-

Underestimating the importance of the closing date. The closing date is when the sale is finalized, and ownership transfers from the seller to the buyer. A realistic timeframe should be agreed upon, considering any contingencies that must be met.

-

Not specifying the earnest money deposit. The earnest money deposit shows the buyer's good faith in proceeding with the purchase. The amount, due date, and terms for forfeiture or return should be clear.

-

Overlooking property condition disclosures. Sellers are required to disclose known defects or issues with the property. Failing to provide or accurately complete these disclosures can lead to legal problems after the sale.

-

Not getting professional advice. It’s wise to consult real estate professionals or legal advisors when filling out this agreement. They can help avoid mistakes and ensure the agreement meets all legal requirements.

Make sure to approach the Florida Real Estate Purchase Agreement with the seriousness it deserves. Avoiding these common mistakes can help ensure a smoother, more secure transaction for everyone involved.

Documents used along the form

When it comes to purchasing real estate in Florida, the Real Estate Purchase Agreement form is crucial as it outlines the terms and conditions of the sale. However, this document rarely stands alone. Several other forms and documents often accompany it, each serving a specific function to ensure the transaction is comprehensive, legal, and transparent. Understanding these additional documents can help both buyers and sellers navigate the complexities of real estate transactions more effectively.

- Title Insurance Commitment: This document is pivotal as it offers a preliminary report, revealing any existing easements, liens, or other encumbrances on the property. It assures the buyer that the seller has a legitimate title to the property, free of any legal binds that could affect ownership.

- Loan Estimate and Closing Disclosure: For buyers obtaining a mortgage, these documents are supplied by the lender. The Loan Estimate outlines the terms of the loan, including the interest rate and closing costs, providing an initial financial overview. The Closing Disclosure confirms these details and must be reviewed before finalizing the transaction.

- Home Inspection Report: This report, generated after a professional inspection, highlights any defects or issues within the property. It's essential for identifying potential problems that may require negotiated repairs or alterations to the purchase agreement.

- Flood Zone Statement: In Florida, where certain areas are susceptible to flooding, this statement determines whether the property resides in a flood zone. It is crucial for insurance purposes and for the buyer's awareness of potential flood risks.

- Homeowners' Association (HOA) Documents: These are required if the property is within an HOA-managed community. They outline the rules, regulations, and fees associated with the HOA, providing the buyer with an understanding of the community standards and obligations.

- Seller's Disclosure: This form is a statement from the seller disclosing any known issues or defects with the property. It's a critical component for transparency and helps protect the buyer from potential undiscovered issues.

While the Real Estate Purchase Agreement forms the foundation of the real estate transaction in Florida, the cumulative information from these additional documents ensures that both parties are well-informed and protected throughout the process. Prospective buyers and sellers should familiarize themselves with these forms and seek professional guidance to navigate the complexities of real estate transactions effectively.

Similar forms

Lease Agreement: Both the Real Estate Purchase Agreement and a Lease Agreement involve the occupation or use of real property, setting terms for the duration of occupancy, payments, and responsibilities of both parties. However, while a purchase agreement results in ownership transfer, a lease agreement grants usage rights for a specific period without transferring ownership.

Bill of Sale: This document, like a Real Estate Purchase Agreement, is used to transfer ownership of personal property from seller to buyer and details the terms of sale, including payment. The primary difference is that a Bill of Sale is typically used for personal property (e.g., furniture, cars), whereas a Real Estate Purchase Agreement is used for real property transactions.

Loan Agreement: Similar to a Real Estate Purchase Agreement, a Loan Agreement outlines the terms between two parties, the borrower and the lender, including payment schedule, interest rate, and collateral, often necessary for financing real estate purchases. Both forms establish legally binding obligations and detail the consequences of non-compliance.

Construction Contract: This contract involves an agreement to do specific construction work, detailing the work to be done, materials, timeline, and payment agreements, much like a Real Estate Purchase Agreement details terms of a property sale. Both documents are legally binding and specify how disputes will be handled.

Dos and Don'ts

When you're filling out the Florida Real Estate Purchase Agreement form, it's crucial to ensure every step is handled correctly to avoid any legal mishaps or delays in your property transaction. Here are several key dos and don’ts to keep in mind:

Do:- Review the entire form before you start filling it out. This gives you a clear understanding of all the information required and ensures you have all the necessary details on hand.

- Use clear and precise language. Avoid any ambiguity in your terms, as this could lead to misunderstandings or legal challenges down the line.

- Double-check all figures. This includes the purchase price, deposit amounts, and any other financial terms. Make sure they are accurate to prevent costly errors.

- Include all relevant parties in the agreement. Ensure that the names and contact information of each party involved are correctly listed.

- Specify dates clearly. This includes the offer date, acceptance deadline, and closing date. Clear timelines are crucial for a smooth transaction.

- Outline all contingencies. These clauses protect both the buyer and the seller, covering aspects such as financing, inspections, and appraisals.

- Sign and date the form. The agreement isn't legally binding until all parties have signed and dated it. Don't overlook this crucial step.

- Leave any fields blank. If a section doesn’t apply, mark it as “N/A” instead of leaving it empty to prevent unauthorized alterations.

- Forget to include any addenda or attachments. If there are additional documents that form part of the agreement, ensure they are referenced and included.

- Assume verbal agreements will be upheld. All agreements should be in writing to be enforceable. Don’t rely on verbal promises or understandings.

- Use jargon or complex legal terminology unless necessary. Keep the language simple to ensure it is understandable to all parties involved.

- Overlook the need for a witness or notary, if required. Some jurisdictions might need the signing to be witnessed or notarized, so don’t forget to comply with this requirement.

- Ignore local laws and requirements. Real estate transactions are subject to state and sometimes local laws, so make sure your agreement complies with these.

- Rush through the process. Take your time to review everything thoroughly before finalizing the agreement to avoid any mistakes or oversights.

Misconceptions

Understanding the intricacies of real estate transactions is crucial, especially when it comes to legal documents like the Florida Real Estate Purchase Agreement. However, misconceptions about this document can lead to confusion and misguided decisions. Here are four common misunderstandings:

One Size Fits All: A prevalent misconception is that the Florida Real Estate Purchase Agreement is a standardized form that fits every transaction. In reality, though certain elements are consistent across agreements due to state laws, clauses and conditions often need to be tailored to the specific details of each transaction. Factors such as financing terms, inspection requirements, and closing conditions can vary significantly and should be addressed individually.

Verbal Agreements Suffice: Some believe that verbal agreements or handshake deals are binding. However, in Florida, real estate transactions must be in writing to be legally enforceable. The purchase agreement serves as the documented consensus between buyer and seller, detailing the terms of the sale and protecting both parties’ interests. Verbal agreements may lead to misunderstandings and are not recognized by the court in disputes involving real estate transactions.

Attorney Review isn’t Necessary: There's a common belief that attorney review of the purchase agreement is optional or unnecessary. While Florida law does not mandate attorney involvement in every real estate transaction, consulting with a legal professional can safeguard your rights and interests. Given the complexity of real estate laws and the significant financial implications of these transactions, having the purchase agreement reviewed or drafted by an attorney can prevent costly oversights.

Doesn’t Impact the Closing Process: Another misconception is that the purchase agreement is merely a formal step in the buying process without real impact on the closing. Contrary to this belief, the agreement lays the groundwork for the closing by setting forth the conditions under which the sale will proceed, timelines, and responsibilities of each party. Discrepancies or unmet conditions in the agreement can delay or even derail the closing, emphasizing its critical role in the transaction's success.

Key takeaways

Filling out the Florida Real Estate Purchase Agreement form is a crucial step in the process of buying or selling property in Florida. This document outlines the terms and conditions of the sale, ensuring both parties are clear on the agreement. Below are five key takeaways to remember when dealing with this important document.

- Accuracy is key: Every detail on the Florida Real Estate Purchase Agreement must be accurate. This includes personal information, property details, and financial terms. Mistakes can lead to delays or legal issues down the line.

- Legal requirements: The form must comply with Florida state laws. It covers essential elements such as the offer, acceptance, and consideration, including terms about deposits, financing, and inspections. Ensuring legal compliance avoids potential voiding of the agreement.

- Contingencies: Including contingencies, like financing approval or home inspections, provides protection for both buyer and seller. These clauses allow parties to back out under specific conditions without penalty.

- Closing details: The agreement outlines the expected closing date and responsibilities of both parties in preparing for the closure. Understanding these details helps prevent last-minute surprises.

- Professional advice: While it's possible to complete the form without legal help, consulting a real estate professional or lawyer can provide valuable insights. They can ensure the agreement meets all legal requirements and protects your rights.

Being thorough and cautious when filling out the Florida Real Estate Purchase Agreement form can greatly influence the smoothness of the property transaction. Paying attention to the details and understanding the legal implications can help avoid complications, making the process as efficient as possible for everyone involved.

Create Other Real Estate Purchase Agreement Forms for US States

Colorado Real Estate Commission - It is often accompanied by disclosures mandated by state law, regarding the condition of the property.

Real Estate Contract Nj - This agreement is a prerequisite for most real estate transactions, ensuring all legal bases are covered before proceeding.

Purchasing Agreement - It also dictates the method of conveyance, such as a warranty deed or quitclaim deed, specifying how title to the property will be transferred.

For Sale by Owner Oklahoma Contract - A Real Estate Purchase Agreement outlines the terms of a property sale between a buyer and a seller.