Blank Real Estate Purchase Agreement Form for Georgia

Buying or selling a home in Georgia is an exciting but complex process, rife with legal requirements and meticulous paperwork. At the heart of this transaction sits the Georgia Real Estate Purchase Agreement form, a crucial document that outlines the terms and conditions of the property transaction. This form spells out the agreed-upon price, deadlines for various stages of the buying process, and the rights and obligations of both the buyer and seller. It serves as a legal blueprint for the sale, ensuring clarity and protecting all parties involved. From earnest money deposits and closing costs to property inspections and repair contingencies, this agreement covers a wide range of details that are essential for a smooth and transparent exchange. Understanding every component of this form is key to a successful real estate transaction, helping both buyers and sellers navigate the intricacies of property law and the specifics of the Georgia real estate market.

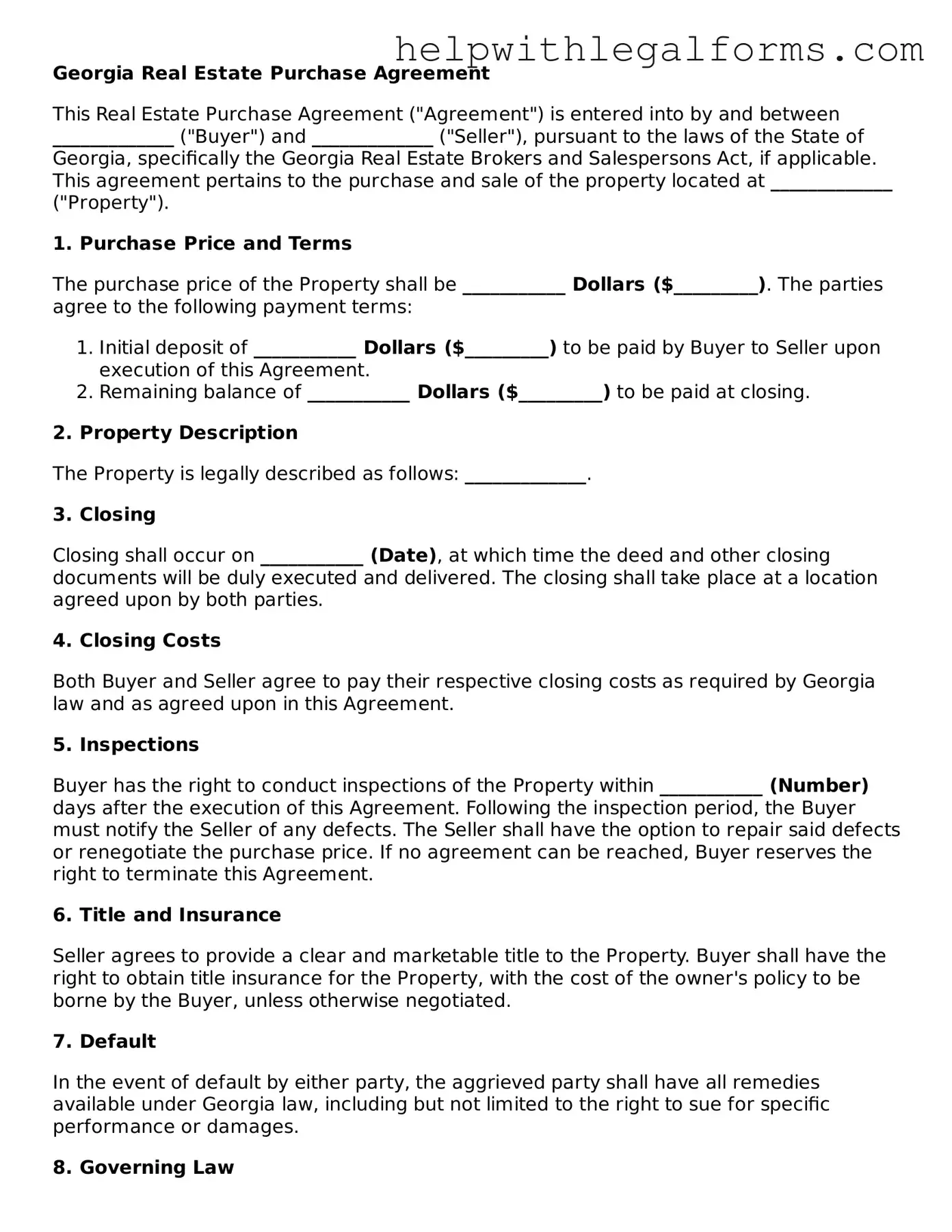

Example - Georgia Real Estate Purchase Agreement Form

Georgia Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is entered into by and between _____________ ("Buyer") and _____________ ("Seller"), pursuant to the laws of the State of Georgia, specifically the Georgia Real Estate Brokers and Salespersons Act, if applicable. This agreement pertains to the purchase and sale of the property located at _____________ ("Property").

1. Purchase Price and Terms

The purchase price of the Property shall be ___________ Dollars ($_________). The parties agree to the following payment terms:

- Initial deposit of ___________ Dollars ($_________) to be paid by Buyer to Seller upon execution of this Agreement.

- Remaining balance of ___________ Dollars ($_________) to be paid at closing.

2. Property Description

The Property is legally described as follows: _____________.

3. Closing

Closing shall occur on ___________ (Date), at which time the deed and other closing documents will be duly executed and delivered. The closing shall take place at a location agreed upon by both parties.

4. Closing Costs

Both Buyer and Seller agree to pay their respective closing costs as required by Georgia law and as agreed upon in this Agreement.

5. Inspections

Buyer has the right to conduct inspections of the Property within ___________ (Number) days after the execution of this Agreement. Following the inspection period, the Buyer must notify the Seller of any defects. The Seller shall have the option to repair said defects or renegotiate the purchase price. If no agreement can be reached, Buyer reserves the right to terminate this Agreement.

6. Title and Insurance

Seller agrees to provide a clear and marketable title to the Property. Buyer shall have the right to obtain title insurance for the Property, with the cost of the owner's policy to be borne by the Buyer, unless otherwise negotiated.

7. Default

In the event of default by either party, the aggrieved party shall have all remedies available under Georgia law, including but not limited to the right to sue for specific performance or damages.

8. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Georgia.

9. Entire Agreement

This Agreement contains the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior agreements, understandings, negotiations, and discussions, whether oral or written, of the parties.

In Witness Whereof, the parties have executed this Agreement on the ___________ (Date).

Buyer's Signature: _________________ Date: ___________

Seller's Signature: _________________ Date: ___________

PDF Form Attributes

| Fact Number | Fact Detail |

|---|---|

| 1 | The Georgia Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions regarding the sale of a property. |

| 2 | This agreement specifies personal and financial information relating to both the buyer and seller. |

| 3 | It includes detailed descriptions of the property being sold, including legal descriptions and any known defects. |

| 4 | The form must include the sale price agreed upon by both parties and any earnest money deposits. |

| 5 | Closing costs and who is responsible for paying them are outlined in this agreement. |

| 6 | Contingencies such as financing, inspection, and appraisals can be included, which may allow either party to back out under specific conditions. |

| 7 | The agreement is governed by Georgia law, specifically Georgia’s real estate and contract statutes. |

| 8 | Closing dates and possession details are specified, providing a timeline for the transaction’s completion. |

| 9 | Signatures from both the buyer and the seller are required to validate the agreement officially. |

Instructions on How to Fill Out Georgia Real Estate Purchase Agreement

Completing a Real Estate Purchase Agreement in Georgia is a critical step in the process of buying or selling property. This legal document outlines the terms of the sale, including the purchase price, closing date, and any contingencies that must be met before the deal is finalized. It serves as a binding contract between the buyer and seller, ensuring both parties adhere to the agreed terms. Filling out this form accurately is essential to protect the interests of both parties and to facilitate a smooth transaction. The steps below guide you through the essential elements that need to be included in the Georgia Real Estate Purchase Agreement.

- Identify the parties involved in the transaction: Clearly write the full names of the buyer(s) and seller(s) to establish who is entering into the agreement.

- Describe the property: Include a legal description of the property being sold. This may involve the property's address, legal description as per the county records, and any other identifying details.

- State the purchase price: Detail the total amount agreed upon for the sale of the property.

- Outline the terms of payment: Indicate whether the purchase will be made with cash, financed through a mortgage, or a combination of both. Include information about any earnest money deposit to be made.

- List any included and excluded items: Clearly specify any personal property that will remain with or be removed from the home before the sale, such as appliances or light fixtures.

- Detail the closing and possession dates: Specify the anticipated closing date when the final sale will be completed, and the date when the buyer will take possession of the property.

- Address contingencies: Include any conditions that must be met before the sale can proceed, such as the buyer obtaining suitable financing, the results of a home inspection, or the sale of another property.

- Signature and dates: Ensure that all parties involved in the transaction sign and date the agreement to validate its terms.

Once the Georgia Real Estate Purchase Agreement is fully completed and signed by all parties, it becomes a legally binding document. It's advisable for both the buyer and seller to review the agreement carefully before signing, to ensure all terms are clearly understood and agreeable. Legal counsel can also provide valuable guidance and review to protect the interests of both parties entering into the real estate transaction.

Crucial Points on This Form

What is a Georgia Real Estate Purchase Agreement?

A Georgia Real Estate Purchase Agreement is a legally binding document used in the buying and selling of real estate within the state of Georgia. This form outlines the terms and conditions agreed upon by both the buyer and the seller regarding the sale of a specific property. It includes details such as the purchase price, property description, and any contingencies that must be met before the sale is finalized.

Who needs to sign the Georgia Real Estate Purchase Agreement?

Both the buyer and the seller must sign the Georgia Real Estate Purchase Agreement for it to be legally valid. In some cases, if either the buyer or seller is a company or an entity rather than an individual, a duly authorized representative must sign the agreement. Additionally, witnesses or a notary public may be required to sign, validating the identity of the parties and their agreement.

What contingencies are typically included in this agreement?

Common contingencies within a Georgia Real Estate Purchase Agreement might include a satisfactory home inspection, the buyer's ability to obtain financing, the sale being contingent on the buyer selling their current home, and clear title contingencies. Such contingencies protect both parties, allowing them to back out of the agreement under specific circumstances without facing legal consequences.

How is the purchase price determined in the agreement?

The purchase price in the agreement is determined through negotiations between the buyer and the seller prior to drafting the document. The agreed-upon amount should reflect the current market value of the property and any other considerations such as the condition of the property, included furnishings or appliances, and any modifications or repairs agreed to be completed before the sale.

Is a real estate agent required to complete a Georgia Real Estate Purchase Agreement?

While a real estate agent can provide valuable assistance and expertise in drafting a Georgia Real Estate Purchase Agreement, their involvement is not legally required. Buyers and sellers can negotiate the terms of the agreement themselves or with the help of a legal professional. However, employing a real estate agent can ensure that the agreement complies with all Georgia real estate laws and regulations and can help streamline the process.

How long does the buyer have to complete the purchase after signing the agreement?

The timeframe for the buyer to complete the purchase after signing the agreement is detailed within the document itself. This period, often referred to as the "closing date," is agreed upon by both the buyer and the seller during negotiations and can vary significantly depending on factors such as the buyer's financing arrangements and any agreed-upon repairs or modifications to the property. It is crucial this date is clearly specified to avoid any misunderstandings.

Can either party withdraw from the agreement after it has been signed?

Either party can withdraw from a Georgia Real Estate Purchase Agreement after it has been signed, but only under conditions specified within the contingencies of the agreement. For example, if the buyer is unable to secure financing or if a home inspection reveals significant issues not previously disclosed, they may have the legal right to terminate the agreement without penalty. Withdrawal outside of these contingencies may result in legal ramifications or the forfeiture of the earnest money deposit.

Common mistakes

The Georgia Real Estate Purchase Agreement form is a vital document in the process of buying and selling property within the state. It outlines the terms and conditions of the sale, ensuring both parties are clear about their obligations. However, when filling out this form, individuals often make mistakes that can lead to complications or delays in the transaction. Below are ten common errors to be mindful of.

Not providing complete information: All fields in the agreement should be filled out with accurate and comprehensive details. Missing information can lead to misunderstandings or legal issues down the line.

Failing to specify the closing date: The agreement must include a clear closing date, which is when the transaction is to be completed and the property officially changes hands.

Overlooking contingency clauses: These are conditions that must be met for the transaction to proceed. Common contingencies include home inspections, financing, and the sale of a current home. Without these, buyers and sellers have less protection.

Misunderstanding earnest money requirements: Earnest money is a deposit made to demonstrate the buyer's good faith. The agreement should clearly state the amount, who holds it, and under what conditions it is refundable.

Ignoring legal descriptions of the property: A legal description is more precise than an address and is necessary for accurately identifying the property being sold.

Incorrectly identifying parties: Make sure all buyers and sellers are correctly named and identified in the agreement. Mistakes here can invalidate the contract.

Leaving out fixtures and personal property: The agreement should specify which fixtures and personal property are included in the sale. Without this clarity, disputes can arise over items like appliances or chandeliers.

Not using clear financial terms: The purchase price, down payment, and financing details need to be explicitly stated to avoid confusion. Misunderstandings about financial arrangements can derail the sale.

Forgetting to document the condition of the property: The agreement should include terms relating to the condition of the property and any required repairs before closing. This can prevent disputes after the sale.

Failing to include signatures and dates: A real estate purchase agreement isn't valid unless it's signed and dated by all parties. This simple oversight can nullify the entire document.

Avoiding these common mistakes can help ensure a smoother real estate transaction. It's often beneficial to consult with a real estate attorney or professional when completing this important document, to ensure all legal requirements are met and the agreement accurately reflects the terms of the sale.

Documents used along the form

When entering into a real estate transaction in Georgia, the Real Estate Purchase Agreement is a critical document, but it often works in conjunction with several other forms and documents to ensure a comprehensive understanding and legally binding arrangement between the parties involved. These documents can vary depending on the specific needs of the transaction, regulatory requirements, and the properties in question. Descriptions of some of the most commonly used documents accompanying a Real Estate Purchase Agreement in Georgia are outlined below.

- Amendment to Purchase Agreement: Used to make changes or add specific details to the original purchase agreement after it has been executed.

- Disclosure Statements: Sellers use these forms to inform buyers about the condition of the property, including any known defects or environmental hazards.

- Lead-Based Paint Disclosure: Federal law requires sellers of properties built before 1978 to disclose the presence of lead-based paint, which could pose health risks.

- Closing Disclosure: A document that outlines the final transaction details, including the closing costs, loan terms, and other financial information, provided to the buyer before closing.

- Title Search and Title Insurance Documents: These documents provide details on the property's legal ownership, revealing any outstanding liens or encumbrances, and offer insurance to protect the buyer from legal claims against the title.

- Home Inspection Report: A comprehensive examination of the property's condition conducted by a professional inspector, detailing any defects or issues that could affect the home's value or safety.

- Appraisal Report: This document assesses the property's market value, typically required by lenders to ensure the property is worth the loan amount.

- Loan Agreement: If the purchase involves financing, this document outlines the terms of the loan, including interest rates, repayment schedule, and other conditions.

- Property Insurance Documents: Proof of insurance is often required by lenders before closing, ensuring the property is protected against damage or loss.

- Warranty Deeds or Quitclaim Deeds: These documents are used to transfer legal ownership of the property from the seller to the buyer, with varying levels of guarantee regarding the clearness of title.

Each of these documents plays a vital role in the real estate transaction process, providing clarity, legal protection, and a smooth transition of property ownership. Given the complexity and legal significance of these documents, both buyers and sellers are encouraged to consult with legal professionals to ensure their interests are fully protected and all regulatory requirements are met. The careful coordination and execution of these documents alongside the Real Estate Purchase Agreement form the foundation of a legally binding and successful property transaction in Georgia.

Similar forms

Bill of Sale: This document, often used in the sale of personal property, is similar to a Real Estate Purchase Agreement in that it outlines the terms of a sale, including the parties involved, a description of the item being sold, and the price. However, it's typically for personal property, not real estate.

Lease Agreement: Lease Agreements share common ground with Real Estate Purchase Agreements, as they both deal with real estate transactions. A Lease Agreement outlines the terms under which one party agrees to rent property from another party, including the duration and payment terms, much like how a purchase agreement outlines the terms of a sale.

Land Contract: A Land Contract is another document closely related to a Real Estate Purchase Agreement. It facilitates the sale of a property by allowing the buyer to pay the seller in installments. The main distinction is that the seller retains legal title until the full purchase price is paid, unlike in a standard real estate transaction.

Deed: Often the next step after a Real Estate Purchase Agreement, a Deed is the document that actually transfers ownership of real estate from one person to another. It serves to execute the agreement made in the purchase agreement, including a description of the property and the parties involved.

Mortgage Agreement: Similar in its relation to real estate transactions, a Mortgage Agreement outlines the terms under which a lender loans money to a borrower to purchase real estate. The property itself serves as collateral for the loan, a context where the purchase agreement lays the groundwork for the sale that the mortgage finances.

Promissory Note: While it's more broadly applicable, a Promissory Note is often involved in real estate transactions to outline the terms of a loan. Similar to a purchase agreement, it details payment obligations but is focused on the borrower's promise to pay back a sum to the lender, often tied to the property being purchased.

Property Disclosure Statement: This document complements a Real Estate Purchase Agreement by providing potential buyers with important information about the property's condition. Similarities lie in the context of real estate transactions, aiming to inform and protect the parties involved in the sale.

Escrow Agreement: An Escrow Agreement is involved in real estate transactions to ensure that financial transactions and property transfers happen smoothly and according to previously agreed terms. It holds an asset or funds before they are transferred from one party to another, providing a layer of security to the transaction outlined in a purchase agreement.

Option Agreement: Related to real estate transactions, an Option Agreement gives one party the opportunity to purchase or sell real estate at a predetermined price within a specific period. It's similar to a Real Estate Purchase Agreement but focuses more on securing the possibility of a future transaction rather than executing it immediately.

Home Inspection Report: While not a contract, a Home Inspection Report is closely tied to the process surrounding Real Estate Purchase Agreements. It provides a detailed account of the condition of a property, which can influence the terms of the purchase agreement, such as adjustments in price or conditions that need to be met before the sale.

Dos and Don'ts

When filling out the Georgia Real Estate Purchase Agreement form, individuals are advised to proceed with meticulous care to ensure the integrity of the agreement and to avoid common pitfalls. The following is a list of do's and don'ts to consider during this important process:

- Do thoroughly review the entire form before starting to fill it out. Understanding each section is crucial for accurately completing the form.

- Do use clear and precise language when filling out the form to avoid any ambiguity or misunderstandings between the parties involved.

- Do verify all the information, such as property details, names of the parties, and financial figures, for accuracy to prevent potential disputes.

- Do include all necessary attachments that are required as part of the agreement, such as legal descriptions of the property, disclosure forms, and any addenda.

- Do have all parties involved review the completed form before signing, to ensure that they fully understand and agree to the terms set forth.

- Don't leave any fields blank. If a section does not apply, it is better to indicate this with "N/A" (not applicable) rather than leaving it empty, which can lead to confusion.

- Don't use ambiguous terms or phrases that could be misinterpreted. Clarity is key in legal documents to mitigate risks of disputes.

- Don't hesitate to seek the advice of a professional, such as a real estate attorney, especially if there are complex issues or large sums of money involved.

- Don't sign the form until all parties are confident that the information is complete and accurate. Once signed, the agreement becomes legally binding.

- Don't forget to make and distribute copies to all parties involved after the form is completed and signed, ensuring that everyone has a record of the agreement.

Adherence to these guidelines can promote a smoother transaction process, reduce the likelihood of disputes, and help protect the interests of all parties involved in the real estate transaction.

Misconceptions

It's just a formality: Many believe the Georgia Real Estate Purchase Agreement is merely a formality without much legal weight. However, it's a legally binding contract that outlines the terms of the property sale, including price, closing date, and contingencies. Its contents have significant implications for both buyers and sellers.

One size fits all: Another common misconception is that this agreement is a one-size-fits-all document that can't be altered. In reality, parties can negotiate terms and include specific provisions that suit their unique needs, as long as both parties agree to these terms in writing.

No need for a lawyer: Some people believe they don't need a lawyer to understand or complete the Georgia Real Estate Purchase Agreement. While the agreement might seem straightforward, it's advisable to consult with a legal professional. They can provide valuable insights, ensuring that the agreement protects one's interests.

Verbal agreements are sufficient: A common mistake is thinking verbal agreements regarding the property sale are enough. According to Georgia law, real estate purchase agreements must be in writing to be legally enforceable. Any verbal agreements made outside of this written contract are generally not binding.

It dictates the closing process: Some assume that the Purchase Agreement dictates every detail of the closing process. While it does set the stage for closing by specifying terms, dates, and responsibilities, many aspects of the closing process are guided by Georgia real estate law and practices, as well as by the chosen closing agent.

It's binding once signed: People often think the agreement is binding the moment it's signed. While signing is a critical step, the agreement typically includes contingencies—such as securing financing or satisfactory home inspections—that must be met for the transaction to proceed. If these are not met, the agreement may be voided.

Any changes require a new agreement: Finally, there's a belief that any modifications to the agreement after it's been signed necessitate drafting a new agreement. In fact, parties can often make amendments or addenda to the existing contract as long as both parties consent in writing to the changes.

Key takeaways

The Georgia Real Estate Purchase Agreement form is a crucial document for conveyancing transactions in the state of Georgia, outlining the terms and conditions of the sale of real estate. Here are key takeaways for filling out and using this form properly:

Ensure all parties involved have a clear understanding of the property in question, including its precise location and any physical or legal attributes that affect its value or use.

Accurately list the purchase price agreed upon by the buyer and seller, and detail the method of payment. This can include any deposits, financing terms, or other payment arrangements.

Include a comprehensive list of all items that will be included or excluded in the sale, such as appliances, fixtures, or any personal property.

Clearly define the responsibilities of both buyer and seller regarding the property's condition and any inspections to be carried out prior to closing.

Detail any contingencies that the agreement is subject to. These can include financing approval, sale of the buyer’s current home, or satisfactory property inspections.

Specify the closing date and location where the final transfer of property will occur, along with any penalties for delayed closings.

Document any special terms or conditions that have been agreed upon, such as the seller agreeing to make certain repairs before closing.

Both parties should disclose any known information regarding environmental hazards or zoning laws that could affect the future use of the property.

Ensure both the buyer and seller are identified by their full legal names to prevent any confusion about the parties involved.

Before signing, both parties should review the agreement thoroughly to ensure accuracy and completeness of all the information. Consider consultation with a real estate attorney to clarify any unfamiliar terms or conditions.

Filling out the Georgia Real Estate Purchase Agreement with attention to detail and clear terms can help safeguard the interests of all parties involved, leading to a smoother transaction process.

Create Other Real Estate Purchase Agreement Forms for US States

Maryland Real Estate Purchase Agreement - It’s an essential step in the home buying process, providing a clear path forward for transferring the property title.

Connecticut Real Estate Contract - The form includes details about the payment schedule, including any deposit amount, financing arrangements, and the closing date.

Colorado Real Estate Commission - This form specifies the agreed-upon price, property condition, and closing details for a real estate transaction.

Real Estate Contract Nj - For commercial property transactions, it can include terms related to zoning, leasing, and the use of the property.