Blank Real Estate Purchase Agreement Form for Maryland

In the vibrant state of Maryland, engaging in the purchase or sale of real estate is a process that encompasses much more than merely agreeing on a price. At the heart of these transactions is the Maryland Real Estate Purchase Agreement, a critically important document that outlines the terms and conditions of the sale. This comprehensive agreement serves not only as a record of the transaction but also as a legally binding contract that holds both parties accountable to their commitments. It details everything from the agreed-upon purchase price, the deposit amount, contingencies such as financing or the sale of another property, and any specific conditions or provisions that have been negotiated. Often, it will include schedules for inspections, a list of items to be included or excluded from the sale, and the planned closing date. Moreover, it addresses how any potential disputes will be resolved and outlines the responsibilities of both the buyer and the seller leading up to the transfer of ownership. Understanding the components and significance of this agreement is paramount for anyone involved in the buying or selling of property in Maryland, as it lays the foundation for a successful and legally sound real estate transaction.

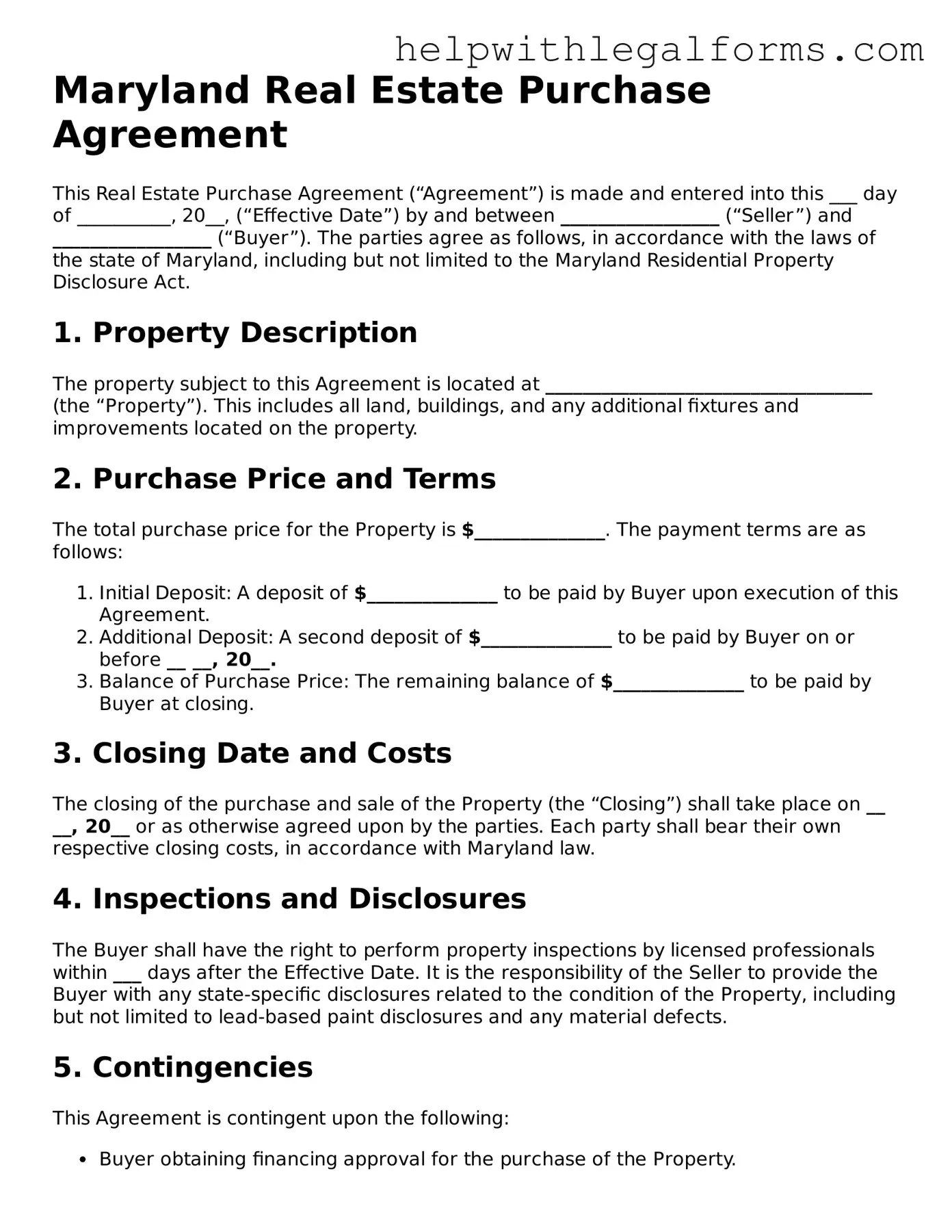

Example - Maryland Real Estate Purchase Agreement Form

Maryland Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is made and entered into this ___ day of __________, 20__, (“Effective Date”) by and between _________________ (“Seller”) and _________________ (“Buyer”). The parties agree as follows, in accordance with the laws of the state of Maryland, including but not limited to the Maryland Residential Property Disclosure Act.

1. Property Description

The property subject to this Agreement is located at ___________________________________ (the “Property”). This includes all land, buildings, and any additional fixtures and improvements located on the property.

2. Purchase Price and Terms

The total purchase price for the Property is $______________. The payment terms are as follows:

- Initial Deposit: A deposit of $______________ to be paid by Buyer upon execution of this Agreement.

- Additional Deposit: A second deposit of $______________ to be paid by Buyer on or before __ __, 20__.

- Balance of Purchase Price: The remaining balance of $______________ to be paid by Buyer at closing.

3. Closing Date and Costs

The closing of the purchase and sale of the Property (the “Closing”) shall take place on __ __, 20__ or as otherwise agreed upon by the parties. Each party shall bear their own respective closing costs, in accordance with Maryland law.

4. Inspections and Disclosures

The Buyer shall have the right to perform property inspections by licensed professionals within ___ days after the Effective Date. It is the responsibility of the Seller to provide the Buyer with any state-specific disclosures related to the condition of the Property, including but not limited to lead-based paint disclosures and any material defects.

5. Contingencies

This Agreement is contingent upon the following:

- Buyer obtaining financing approval for the purchase of the Property.

- The satisfactory completion of all inspections as determined by the Buyer.

- Review and approval of the property’s title and obtaining title insurance.

6. Possession

Possession of the Property will be transferred to the Buyer at Closing, free of any tenants, leases, or occupants unless otherwise agreed in writing between the parties.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Maryland.

8. Signatures

In witness whereof, the parties have executed this Agreement as of the Effective Date first above written.

__________________________

Seller's Signature

Date: _______________

__________________________

Buyer's Signature

Date: _______________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Mandatory Disclosure Requirements | Maryland law requires sellers to disclose specific information about the property's condition, including any material defects. |

| Governing Law | The Maryland Real Estate Purchase Agreement is governed by Maryland state law, including the Maryland Residential Property Disclosure Act. |

| Property Zoning | Sellers are required to provide buyers with zoning information, including any restrictions that apply to the property. |

| Lead-Based Paint Disclosure | For homes built before 1978, sellers must disclose the presence of any known lead-based paint and provide an EPA-approved pamphlet on lead hazards. |

| Property Tax Disclosures | Sellers must inform buyers about the current property tax assessments, including any pending assessments that may affect the property. |

Instructions on How to Fill Out Maryland Real Estate Purchase Agreement

After finding the perfect residential property in Maryland, the next step is to formalize the agreement between the buyer and seller. This is done by completing the Maryland Real Estate Purchase Agreement Form. The form is a legally binding document that outlines the terms and conditions of the real estate transaction, including the sale price, closing date, and any contingencies that must be met before the sale can be finalized. Careful attention must be paid to accurately complete the form to ensure a smooth transaction. Below are the detailed steps required to fill out the form properly.

- Gather necessary information: Before starting, collect all relevant property details, including the legal description of the property, the names of the buyer(s) and seller(s), and the agreed-upon purchase price.

- Enter the date: At the top of the form, write the current date. This marks when the agreement is being made.

- Fill in buyer and seller information: Provide the legal names of the buyer(s) and seller(s) as well as their contact information.

- Describe the property: Include the full address of the property and its legal description. If the property has a specific identifier like a parcel number, include that as well.

- Outline the purchase price and terms: Clearly state the purchase price agreed upon by the buyer and seller. If there are specific terms related to the payment, such as a down payment or financing arrangements, detail these in the designated section.

- Detail earnest money: Specify the amount of earnest money being deposited by the buyer and how it will be handled throughout the transaction.

- Identify included and excluded personal property: List any personal property items that are included or excluded from the sale.

- State the closing date: Indicate the agreed-upon closing date when the final sale will be completed and ownership will be transferred to the buyer.

- Include contingencies: If the sale is contingent upon certain conditions, such as a satisfactory home inspection or the buyer securing financing, list these contingencies clearly.

- Review and sign: Both the buyer(s) and seller(s) should thoroughly review the form to ensure all information is accurate and complete. Once confirmed, all parties involved must sign and date the form to validate the agreement.

Completing the Maryland Real Estate Purchase Agreement Form is a crucial step in the process of buying or selling a property. By following the steps outlined above, parties can ensure their interests are protected and the transaction proceeds smoothly. It's recommended to consult with a real estate professional or legal expert to review the form before submission, guaranteeing that all legal requirements are met and the documents accurately reflect the terms of the deal.

Crucial Points on This Form

What is a Maryland Real Estate Purchase Agreement?

A Maryland Real Estate Purchase Agreement is a legally binding document between a seller and a buyer for the purchase and sale of real estate in Maryland. This document outlines the terms and conditions of the sale, including the purchase price, property description, financing conditions, and closing details, ensuring that both parties are clear on their obligations.

Who needs to sign the Maryland Real Estate Purchase Agreement?

The Maryland Real Estate Purchase Agreement must be signed by both the buyer and the seller to be legally binding. In some cases, real estate agents representing either party may also sign, but the essential signatures are those of the actual buyer(s) and seller(s).

Are there any specific disclosures required in Maryland?

Yes, Maryland law requires certain disclosures to be made. These include, but are not limited to, the disclosure of material defects, lead-based paint disclosures for properties built before 1978, and other conditions that could affect the property's value or safety. These disclosures must be provided to the buyer before the real estate purchase agreement is finalized.

Can I back out of a Maryland Real Estate Purchase Agreement?

Backing out of a Maryland Real Estate Purchase Agreement is possible under certain conditions, such as during the agreed-upon inspection period or if contingencies outlined in the agreement, like financing or the sale of a current home, are not met. It's important to understand these contingencies and the potential consequences, which may include forfeiture of the earnest money deposit, before attempting to withdraw from the agreement.

What happens if either party breaches the agreement?

If either the buyer or the seller breaches the Maryland Real Estate Purchase Agreement, the non-breaching party has several options. They can seek enforcement of the agreement, ask for financial damages, or, in some cases, terminate the agreement and potentially recover any earnest money paid. The specific remedies available will depend on the terms of the agreement and the nature of the breach.

Is an attorney required for real estate transactions in Maryland?

While Maryland law does not require an attorney to be present at real estate closings, it is highly recommended to consult with one when entering into a real estate purchase agreement. An attorney can provide valuable advice, ensure that the agreement is legally sound, and help navigate any potential legal issues that may arise during the transaction.

What should be included in a Maryland Real Estate Purchase Agreement?

A Maryland Real Estate Purchase Agreement should include the names and contact information of the buyer and seller, a legal description of the property, the purchase price, terms of payment, contingencies, closing and possession dates, disclosure information, and any other conditions or terms relevant to the sale. It is crucial to ensure that all necessary information is accurately included to avoid future disputes.

How is the purchase price determined?

The purchase price in a Maryland Real Estate Purchase Agreement is determined through negotiation between the buyer and the seller. Often, the buyer will make an offer based on the listing price, and the seller can accept, reject, or counter the offer. The final purchase price is agreed upon when both parties sign the real estate purchase agreement.

Common mistakes

In the process of completing the Maryland Real Estate Purchase Agreement form, individuals often encounter complexities and subtleties that may lead to errors. These mistakes can have significant implications, affecting the validity of the agreement or even causing delays in the transaction. Below is a detailed look at six common errors to be mindful of during this important process.

Not Checking for Completeness: A frequent oversight is failing to ensure that all required fields in the form have been filled. This form is a legally binding document, and every section demands careful attention. Omitting information can lead to misunderstandings or legal complications down the line.

Incorrect Information: Another common error is the inclusion of incorrect details, such as misspelling names, incorrect property addresses, or inaccurate financial figures. These mistakes can not only cause confusion but may also necessitate the drafting of a new agreement, thereby delaying the transaction.

Overlooking Contingencies: Often, individuals fail to adequately consider or include necessary contingencies within the agreement. Such contingencies might cover home inspections, financing, or the sale of an existing home. These are critical safeguards that protect both the buyer and seller, ensuring that certain conditions are met before the transaction proceeds.

Unclear Terms: Sometimes, the terms of the sale are not clearly defined or articulated within the agreement. Ambiguities regarding the closing date, possession date, or specific items included in the sale can lead to disputes or complications. Clear, precise language is essential to avoid these issues.

Failure to Verify Signatory Authority: In cases where the property is owned by a corporation, trust, or partnership, a common error is not verifying whether the individual signing the agreement has the legal authority to do so on behalf of the entity. This oversight can invalidate the agreement or lead to legal challenges.

Not Consulting Legal Counsel: Perhaps the most significant error is the failure to seek the advice of an attorney. Given the legal nuances and potential ramifications of what is agreed to in a real estate purchase agreement, professional guidance is crucial. An attorney can ensure that the rights and interests of the party they represent are adequately protected and that the agreement complies with Maryland law.

When individuals are aware of these common mistakes and take steps to avoid them, the process of completing the Maryland Real Estate Purchase Agreement form can be smoother and more efficient, paving the way for a successful real estate transaction.

Documents used along the form

Purchasing real estate is a significant milestone that involves several legal steps and documentation to ensure a smooth and legally sound transaction. In Maryland, the Real Estate Purchase Agreement form is a crucial document that outlines the terms and conditions of the sale. However, this form is just one piece of the puzzle. To provide a comprehensive overview and facilitate a hassle-free transaction, several other forms and documents are often used in conjunction with the Real Estate Purchase Agreement.

- Residential Disclosure and Disclaimer Statement: This document is essential for the seller to inform the buyer about the condition of the property. It includes any known defects or malfunctions in the property's systems and structures.

- Title Insurance Commitment: Before closing, a title insurance company will issue this document after conducting a title search. It ensures that the property title is clear of liens or claims and outlines the terms under which the title insurance policy will be issued.

- Home Inspection Report: A crucial report that provides the buyer with detailed information on the property's condition, including any potential issues or necessary repairs, as identified by a professional inspector.

- Lead-Based Paint Disclosure: For homes built before 1978, this document is required by federal law. Sellers must disclose the presence of lead-based paint or hazards and provide any related records or reports.

- Financing Contingency Document: This document outlines the buyer's condition to obtain financing from a lender to purchase the home. It details the terms of the loan, including the amount, interest rate, and deadlines.

- Appraisal Report: An appraisal report is often required by the lender to determine the property's fair market value. It serves as a validation that the property is worth the agreed-upon sale price.

- Property Survey: This document outlines the property's boundaries, structures, and any encroachments or easements. It is crucial for identifying any potential issues with property lines or compliance with local zoning laws.

Each of these documents plays a vital role in informing the buyer and seller, safeguarding their interests, and ensuring compliance with legal requirements. Their use, alongside the Maryland Real Estate Purchase Agreement, enables a transparent, legally sound, and efficient transaction process. It's essential for both parties to understand and properly manage these documents to ensure a successful real estate transaction.

Similar forms

Lease Agreement: Both a Real Estate Purchase Agreement and a Lease Agreement outline terms between two parties regarding property, but while a Lease Agreement relates to renting property, a Real Estate Purchase Agreement is concerned with the sale and transfer of property ownership. Both documents detail legal descriptions of the property, payment terms, and the responsibilities of each party.

Bill of Sale: This document is similar to a Real Estate Purchase Agreement in that it specifies the details of transferring ownership of an item (or items) from one party to another. However, a Bill of Sale usually covers personal property like cars or furniture, whereas a Real Estate Purchase Agreement deals with real property. Both include descriptions of the property being transferred and the terms of the sale.

Mortgage Agreement: Like a Real Estate Purchase Agreement, a Mortgage Agreement involves real estate transactions. However, it specifically relates to financing the purchase of a property. It outlines the borrower's obligations to the lender and includes the property as collateral. Both documents are critical in real estate transactions involving financed purchases.

Deed: The deed is another document similar to a Real Estate Purchase Agreement, as it is vital in the transfer of property ownership. However, while the Real Estate Purchase Agreement outlines the terms of sale, including the agreement between buyer and seller, the deed actually transfers the property title from the seller to the buyer. Both are required for the legal transfer of property.

Title Insurance Policy: This document is related to a Real Estate Purchase Agreement through the focus on property transactions. Title insurance protects the buyer (and lender) from loss due to defects in the property title not discovered during the sale process. The Real Estate Purchase Agreement initiates this process by detailing the terms of the sale, which then leads to the examination of the title before insurance is issued.

Dos and Don'ts

When filling out a Maryland Real Estate Purchase Agreement form, it is important to approach the document with careful consideration and attention to detail. The process involves legal documentation that establishes the terms and conditions of the sale of real estate. Considering the importance of this agreement, there are specific do's and don'ts one should follow to ensure the process goes smoothly.

Do's:

- Read thoroughly: Before anything else, make a point to read every section of the agreement carefully. Understanding each clause fully is crucial to ensuring that the terms align with your expectations and requirements.

- Provide accurate information: When filling out the form, ensure all the information you provide is accurate and complete. This includes personal information, property details, and terms of the sale.

- Consult a professional: Given the legal nature of the agreement, consulting a real estate lawyer or a professional realtor can provide valuable insight and guidance. They can help identify any potential issues or areas that may require negotiation.

- Review contingency clauses: Pay special attention to any contingency clauses within the agreement. These conditions must be met for the sale to proceed, covering aspects like financing, inspections, and appraisals.

Don'ts:

- Skip sections: Avoid the temptation to skip over sections or assume all standard forms are the same. Every aspect of the form can have significant implications for the sale and purchase.

- Ignore deadlines: Deadlines are critical in real estate agreements. Missing deadlines for inspections, mortgage applications, or other contingencies can result in the loss of the sale or legal complications.

- Forget to initial changes: If any changes are made to the agreement after initial discussions, make sure they are initialed by both the buyer and the seller. This ensures that all modifications are acknowledged and agreed upon.

- Underestimate the importance of the closing date: The closing date is when the sale is officially completed, and the property changes hands. It is important not to overlook this date, as it involves significant coordination and completion of legal documents.

By following these guidelines, participants in a real estate transaction can navigate the process more effectively, ensuring that their interests are protected and that the sale proceeds as smoothly as possible.

Misconceptions

When it comes to buying a house in Maryland, the Real Estate Purchase Agreement form is a critical document. It outlines the terms and conditions of the sale between the buyer and the seller. However, there are several misconceptions about this form that can confuse both parties involved in the transaction. Let's address some of these misunderstandings to help ensure that buyers and sellers have a clear picture of what to expect.

- It's Just Standard Paperwork: Many people think the Maryland Real Estate Purchase Agreement is simply a formality—standard paperwork that doesn't need much attention. This notion couldn't be further from the truth. Each clause in the agreement can significantly impact both the buyer's and the seller's obligations and rights. It's essential to read and understand every part of the document before signing.

- It's Identical Throughout Maryland: Another common misunderstanding is that the Real Estate Purchase Agreement is the same no matter where you buy a property in Maryland. In reality, local jurisdictions might have specific requirements or disclosures, so the agreement can vary significantly from one area to another. Always ensure the document complies with local regulations.

- Verbal Agreements are Just as Binding: Sometimes, buyers and sellers believe that a verbal agreement on certain terms of the sale is enough to hold both parties accountable. However, for the contract to be legally binding in Maryland, it must be in writing and signed by both parties. Verbal agreements related to the purchase are not enforceable in a court of law.

- It Can't Be Changed Once Signed: It's a common belief that once the Real Estate Purchase Agreement is signed, the terms are set in stone. This is not necessarily true. Both parties can agree to amend the contract if the need arises. However, any changes must be made in writing and signed by both the buyer and the seller to be valid.

- The Deposit Is Always Forfeited If the Buyer Backs Out: Many assume that if a buyer decides not to proceed with the purchase, they automatically lose their deposit. While it's true that the deposit can be forfeited under certain conditions, there are contingencies—such as financing or inspection issues—that can allow a buyer to legally withdraw from the agreement and still recover their deposit. It's crucial to understand the conditions under which the deposit is refundable or not.

Understanding the Real Estate Purchase Agreement is vital for anyone looking to buy or sell property in Maryland. Misconceptions can lead to costly mistakes or legal challenges. Buyers and sellers should consider consulting with a real estate professional or an attorney to navigate the complexities of this important document.

Key takeaways

The Maryland Real Estate Purchase Agreement is a legally binding document used during the purchase of real estate in Maryland. This agreement outlines the terms and conditions of the sale between the buyer and seller. Here are key takeaways about filling out and using this form:

- Accuracy is crucial: When completing the form, every piece of information must be accurate and true. Incorrect details can lead to legal issues or the nullification of the agreement.

- Legal Description of the Property: The agreement must include a complete legal description of the property being sold. This is more detailed than the address and may require a professional to provide.

- Offer and Acceptance: The agreement serves as proof of the offer made by the buyer and the acceptance by the seller. This is binding once both parties sign the document.

- Price and Terms: The purchase price and the terms of the payment must be clearly stated. This includes any deposits, financing arrangements, and the closing date.

- Disclosures: Maryland law requires sellers to make certain disclosures about the condition of the property. Failing to provide these disclosures can lead to legal consequences.

- Contingencies: Contingencies are conditions that must be met for the sale to proceed. Common contingencies include financing approval, home inspections, and the selling of a current home.

- Inspection and Repairs: The agreement should specify who is responsible for home inspections and any necessary repairs identified during the inspection process.

- Closing and Possession Dates: Clearly outline the closing date when the sale is officially completed and the date when the buyer will take possession of the property.

- Signature Requirements: All parties involved in the transaction must sign the agreement for it to be legally binding. This includes the buyers, sellers, and their legal representatives.

- Professional Assistance: Due to the legal and financial implications of the Real Estate Purchase Agreement, consulting with a real estate attorney or professional is highly recommended for guidance through the process.

Create Other Real Estate Purchase Agreement Forms for US States

For Sale by Owner Oklahoma Contract - Empowers buyers and sellers with a detailed account of the transaction, promoting transparency.

Real Estate Contract Template - An enforceable contract that sets forth the terms under which property will be exchanged.

Real Estate Contract Nj - This document also states what happens if either party fails to meet their obligations or chooses to back out of the deal.