Blank Real Estate Purchase Agreement Form for New Jersey

Embarking on the journey of buying or selling a property in New Jersey introduces individuals to the pivotal document known as the Real Estate Purchase Agreement form. This comprehensive form not only marks the beginning of a significant financial and emotional commitment but also serves as a legal blueprint detailing the terms, conditions, and stipulations under which the property will change hands. It meticulously outlines the purchase price, identification of the parties involved, descriptions of the property, financing details, contingencies (such as inspections and financing), and deadlines by which the transaction must be completed. The form ensures that both buyer and seller are fully aware of their rights and obligations, helping to prevent misunderstandings and disputes during the sale process. This contract is binding once signed, emphasizing the importance of understanding its complexities before proceeding. For individuals navigating the intricacies of real estate transactions in New Jersey, becoming familiar with this agreement is a crucial step towards a successful property transfer.

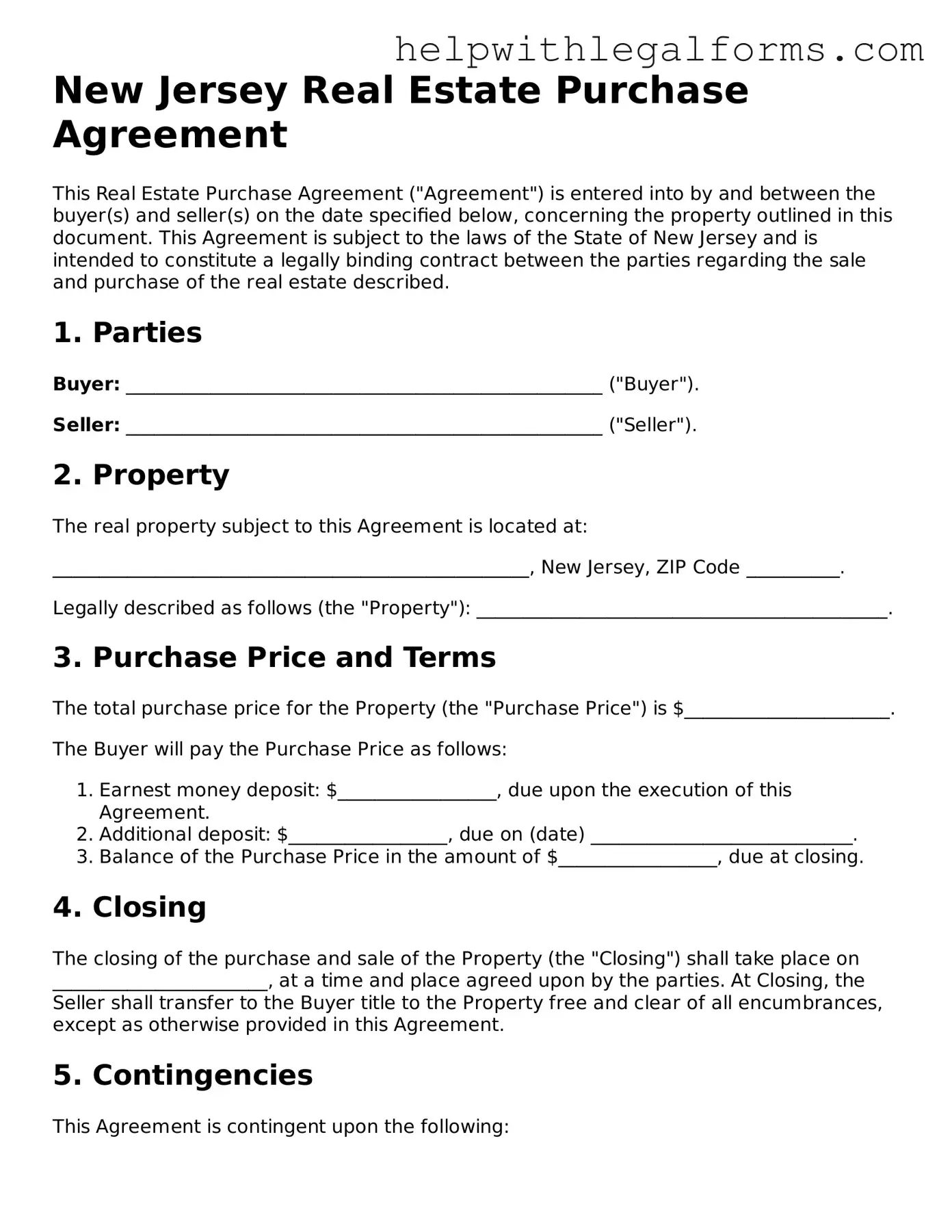

Example - New Jersey Real Estate Purchase Agreement Form

New Jersey Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is entered into by and between the buyer(s) and seller(s) on the date specified below, concerning the property outlined in this document. This Agreement is subject to the laws of the State of New Jersey and is intended to constitute a legally binding contract between the parties regarding the sale and purchase of the real estate described.

1. Parties

Buyer: ___________________________________________________ ("Buyer").

Seller: ___________________________________________________ ("Seller").

2. Property

The real property subject to this Agreement is located at:

___________________________________________________, New Jersey, ZIP Code __________.

Legally described as follows (the "Property"): ____________________________________________.

3. Purchase Price and Terms

The total purchase price for the Property (the "Purchase Price") is $______________________.

The Buyer will pay the Purchase Price as follows:

- Earnest money deposit: $_________________, due upon the execution of this Agreement.

- Additional deposit: $_________________, due on (date) ____________________________.

- Balance of the Purchase Price in the amount of $_________________, due at closing.

4. Closing

The closing of the purchase and sale of the Property (the "Closing") shall take place on _______________________, at a time and place agreed upon by the parties. At Closing, the Seller shall transfer to the Buyer title to the Property free and clear of all encumbrances, except as otherwise provided in this Agreement.

5. Contingencies

This Agreement is contingent upon the following:

- The Buyer obtaining a mortgage commitment for financing within __________ days after the effective date of this Agreement.

- A satisfactory home inspection report to be received by the Buyer within __________ days after the effective date of this Agreement.

- Other: _________________________________________________________________________.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of New Jersey.

7. Signatures

This Agreement shall be effective upon the signatures of both Buyer and Seller below.

Buyer's Signature: ____________________________________ Date: ________________

Seller's Signature: ____________________________________ Date: ________________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Function | Serves as a legally binding document for the purchase and sale of real estate in New Jersey. |

| Governing Law | Governed by New Jersey real estate laws and regulations. |

| Components | Includes terms such as purchase price, property description, contingency clauses, and closing details. |

| Contingency Clauses | May include financing, inspection, and appraisal contingencies to protect both buyer and seller. |

| Real Estate Commission Approval | Must comply with the New Jersey Real Estate Commission's regulations if involving licensed real estate professionals. |

| Disclosure Requirements | Sellers are required to disclose any known material defects of the property. |

| Signatory Requirements | Must be signed by both the buyer and seller to be enforceable. |

| Amendment Process | Any changes to the agreement must be made in writing and signed by both parties. |

Instructions on How to Fill Out New Jersey Real Estate Purchase Agreement

Filling out a Real Estate Purchase Agreement in New Jersey is an important step in the process of buying or selling property. This document outlines the terms and conditions agreed upon by both parties, including the sale price, property description, and closing details. After completing this form, it serves as a binding contract that guides the transaction to its completion. The following steps are designed to ensure accuracy and completeness when filling out the agreement, safeguarding the interests of both the buyer and the seller throughout the process.

- Begin by identifying the parties involved in the transaction. Write the full legal names of the buyer(s) and seller(s) and their contact information, including addresses and phone numbers.

- Describe the property being sold. This includes the legal description of the property, its address, and any identifying characteristics. It’s crucial to be precise to avoid any confusion about what is being transferred.

- State the purchase price clearly. This is the amount agreed upon by the buyer and the seller. It should be written in both words and figures to prevent misunderstandings.

- Detail the terms of the payment. This section should outline how the payment will be made, including any deposit amount, financing details, and when the full payment is due.

- Include any contingencies that must be met before the sale can proceed. These might include home inspections, the ability of the buyer to obtain financing, and any repairs that need to be made.

- Specify the closing date and location. This is when and where the transfer of property will officially take place and when the remaining funds will be paid.

- Outline how taxes, utilities, and other fees will be prorated or divided between the buyer and the seller. This ensures a fair distribution of costs associated with the property up to the point of sale.

- List any included or excluded items in the sale. This can cover anything from appliances, furniture, or specific fixtures that will either remain with or be removed from the property.

- Detail any additional terms or conditions that have been agreed upon. This could include obligations for repairs, modifications, or restrictions on the use of the property.

- Signatures. Ensure that all parties involved in the transaction sign and date the agreement. A witness or notary may also be required, depending on state laws.

After the New Jersey Real Estate Purchase Agreement is filled out following these steps, the involved parties should thoroughly review the document to ensure all information is accurate and reflects the terms they’ve agreed upon. It might also be beneficial to have a legal professional review the agreement before it is finalized. Once signed, this document commits both the buyer and seller to the outlined terms, moving them one step closer to completing the property transaction. This is a pivotal moment in the process, as it provides a roadmap for the remainder of the transaction, guiding both parties to a successful conclusion.

Crucial Points on This Form

What is a New Jersey Real Estate Purchase Agreement?

A New Jersey Real Estate Purchase Agreement is a legally binding document used in the buying and selling of real estate within New Jersey. It outlines the terms and conditions agreed upon between the buyer and seller, including the purchase price, property description, and closing details. This contract ensures both parties understand their rights and responsibilities before the transfer of property ownership takes place.

Who needs to sign the New Jersey Real Estate Purchase Agreement?

Both the buyer and the seller must sign the Real Estate Purchase Agreement to make it enforceable. In some instances, representatives such as real estate agents or attorneys who have the authority to act on behalf of the buyer or seller may also need to sign the document.

Are there any contingencies that can be included in the agreement?

Yes, contingencies are common in these agreements. They might include financing contingencies, which allow the buyer to withdraw if they can't secure a mortgage, and inspection contingencies, which give the buyer the right to have the property inspected. Other common contingencies include those related to the sale of the buyer's current home or the requirement for a clear title.

What happens if either party breaches the New Jersey Real Estate Purchase Agreement?

In the event of a breach, the non-breaching party has several remedies. They may seek to enforce the agreement through specific performance, request a return or forfeiture of the earnest money deposit, or pursue damages. The specific remedies available can depend on the terms of the contract and New Jersey law.

Is an attorney required for the real estate transaction in New Jersey?

While New Jersey law does not require an attorney for real estate transactions, it is highly recommended to consult one. An attorney can help navigate the complexities of the agreement, ensure the contract complies with state laws, and provide advice on any legal issues that may arise.

What should be included in the property description?

The property description in the agreement should be detailed and precise. It usually includes the address, legal description, parcel number, and any other identifiers that clearly define the property being sold. This ensures there is no misunderstanding about what is being purchased.

How is the purchase price determined in the agreement?

The purchase price is typically determined through negotiation between the buyer and seller. Once agreed upon, it should be clearly stated in the agreement along with any terms related to the deposit, such as the amount and conditions for its return.

What disclosures are required in New Jersey?

New Jersey requires sellers to disclose known defects and environmental hazards related to the property. This might include issues with the structure, problems with systems (like heating or plumbing), and known contaminants. The specifics should be documented in disclosure forms that are part of or accompany the Purchase Agreement.

Can either party withdraw from the agreement?

Withdrawal from the agreement is typically governed by the contingencies outlined in the document. For example, if a buyer is unable to secure financing and a financing contingency is included, they may withdraw without penalty. Outside of such contingencies, withdrawing could result in the forfeiture of deposits or other penalties as outlined in the contract.

Common mistakes

When filling out the New Jersey Real Estate Purchase Agreement form, people often stumble over several common pitfalls. Paying attention to these mistakes can save a lot of time and prevent potential legal issues down the line. Here is an expanded list of errors to avoid:

Not Checking Zoning Restrictions: Before making any commitments, buyers should verify that the property's zoning laws support their intended use. Overlooking this step can lead to unpleasant surprises, making the property unsuitable for specific plans.

Skipping Over Disclosures: New Jersey law requires sellers to complete certain disclosures about the property's condition. Buyers sometimes fail to review these disclosures thoroughly, which could lead to missed information on potential defects or hazards.

Incorrectly Listing Parties: All parties involved in the transaction must be accurately listed. Mistakes here can include misspellings, omitting middle names or initials, or not using legal names, leading to confusion or issues with enforceability.

Leaving Blanks Unfilled: Every field in the agreement should be filled out or marked as not applicable (N/A). Leaving sections blank might cause disputes about the agreed terms or suggest that parts of the agreement were overlooked.

Failing to Specify Fixtures vs. Personal Property: The agreement should clearly state which items are included in the sale as fixtures (permanently attached to the property) and which are considered removable personal property. Ambiguities here can result in disagreements at closing.

Overlooking Contingencies: Buyers sometimes forget to include important contingencies in the agreement, such as financing, inspection, or the sale of their current home. These safeguards are crucial for protecting the buyer’s deposit and ensuring the right to withdraw under certain circumstances without penalty.

Avoiding these mistakes requires careful attention to detail and an understanding of real estate transactions. When in doubt, consulting with a legal professional experienced in New Jersey real estate law can provide clarity and help navigate this complex process.

Documents used along the form

When buying or selling real estate in New Jersey, parties often use the Real Estate Purchase Agreement form to outline the terms of the sale. However, this form doesn't stand alone in the transaction process. Several other forms and documents play crucial roles, ensuring that every detail is legally documented and agreed upon by all parties involved. Understanding these additional forms can provide clarity and streamline the real estate transaction process.

- Disclosure Statements: These documents inform buyers about the condition of the property, including any known defects or hazards.

- Title Insurance Policy: This policy protects the buyer from future claims against the property's title, ensuring it is free and clear.

- Mortgage Pre-Approval Letter: Often required at the offer stage, this letter indicates the buyer's ability to secure financing.

- Home Inspection Report: A detailed report that provides the buyer with comprehensive information about the condition of the property.

- Pest Inspection Report: Identifies any current or potential pest problems the property may have.

- Appraisal Report: A professional appraiser's assessment of the property's market value, usually required by the lender.

- Lead-Based Paint Disclosure: A mandatory disclosure for homes built before 1978, informing about the presence of lead-based paint.

- Homeowners' Association (HOA) Documents: For properties in an HOA, these documents outline the association’s rules, fees, and regulations.

- Home Warranty Policy: Offers the buyer protection against defects or failures in the home’s major systems and appliances.

- Final Walk-Through Checklist: Used by the buyer to verify the condition of the property before the closing date.

Together with the Real Estate Purchase Agreement, these documents form the backbone of a real estate transaction in New Jersey. They ensure that the rights and responsibilities of all parties are clearly defined and protected, contributing to a smoother and more transparent transaction. For anyone involved in buying or selling property, being familiar with these documents and their purposes is invaluable.

Similar forms

Bill of Sale: This document, similar to the Real Estate Purchase Agreement, serves as a formal record that an item's ownership has been transferred from the seller to the buyer. While a Bill of Sale typically pertains to personal property (like a car or a computer), and a Real Estate Purchase Agreement pertains to real property (land or buildings), both documents play a pivotal role in anchoring the transaction's legitimacy and setting forth the terms and conditions of the sale.

Lease Agreement: A Lease Agreement, much like a Real Estate Purchase Agreement, outlines the terms under which one party agrees to rent property owned by another party. However, instead of leading to a change of ownership like a Real Estate Purchase Agreement does, a Lease Agreement confirms the tenant's right to use the property for a specified term in exchange for rent, thereby establishing the responsibilities of each party during the lease term.

Mortgage Agreement: This document bears resemblance to a Real Estate Purchase Agreement in that it is instrumental in real estate transactions, securing a loan that enables the buyer to acquire the property. A Mortgage Agreement delineates the terms of the loan and the property that serves as collateral for the loan, ensuring the lender's interest in the property until the mortgage is fully repaid.

Deed: A Deed, akin to a Real Estate Purchase Agreement, is fundamental in the transfer of property ownership. However, while the Real Estate Purchase Agreement specifies the terms under which the property is to be sold and confirms the intent to sell and buy, the Deed is the actual legal document that transfers ownership of the property from the seller to the buyer.

Title Insurance Policy: Similar to a Real Estate Purchase Agreement in its role in purchases, a Title Insurance Policy safeguards against future claims or unforeseen discrepancies related to property ownership. While the Real Estate Purchase Agreement initiates the transfer process, the Title Insurance Policy provides protection against losses due to title defects that were not known at the time of the sale.

Property Disclosure Statement: This document, along with a Real Estate Purchase Agreement, is integral in real estate transactions. The Property Disclosure Statement requires the seller to reveal any known issues with the property, ensuring that the buyer is fully informed about the property's condition before finalizing the purchase, much like how a Real Estate Purchase Agreement lays out the terms of the sale.

Home Inspection Report: While not a contract like a Real Estate Purchase Agreement, a Home Inspection Report is crucial in the buying process, giving a detailed account of the property's current condition. It informs both the buyer and seller about necessary repairs or potential issues, thereby influencing the terms and decisions within the Real Estate Purchase Agreement.

Financing Addendum: This document, often used in conjunction with a Real Estate Purchase Agreement, modifies the original agreement to include specific terms and conditions regarding the buyer's financing. It details the type of financing being used, deadlines for securing financing, and the consequences of failing to secure financing, ensuring that both the buyer and seller understand how the purchase depends on the approval of a loan.

Dos and Don'ts

When preparing to fill out a New Jersey Real Estate Purchase Agreement, paying attention to detail is crucial. This document seals the deal on your property transaction, thus ensuring accuracy and completeness is essential. Below are guidelines that serve as do's and don'ts to help navigate through this process effectively.

- Do review the entire form before beginning. It’s important to understand every section of the form to ensure that all relevant information is accurately provided.

- Do verify all parties’ legal names. The names of the buyer(s) and seller(s) need to be accurate and should match identification documents exactly.

- Do provide complete property details. This includes the legal description of the property, which may be different from the street address. Consult a recent property tax statement or the deed for accurate information.

- Do include all necessary financial terms. Clearly state the purchase price, earnest money deposit, and terms regarding the down payment and financing. Precise details will help avoid misunderstandings later on.

- Do specify contingencies clearly. If the purchase depends on the buyer obtaining financing or the sale of their current home, these contingencies must be explicitly mentioned.

- Don't skip over any sections. Even if a section seems not to apply, review it carefully. If it truly is not applicable, indicate this clearly to avoid the appearance of an oversight.

- Don’t use informal language or abbreviations. The agreement is a formal, legal document. Use clear, professional language throughout.

- Don’t sign without reviewing. All parties should carefully review the entire document for accuracy, completeness, and understanding of terms before signing.

- Don’t neglect to consult a professional. If there is any confusion or a need for advice on legal or financial terms within the agreement, consulting with a real estate attorney or professional is advised.

Adhering to these guidelines can significantly smooth the transaction process, protecting all parties involved and ensuring that the agreement accurately reflects their intentions and legal requirements. Real estate transactions can be complex, but with careful attention to detail, many common issues can be avoided.

Misconceptions

Understanding the New Jersey Real Estate Purchase Agreement form is pivotal for anyone involved in buying or selling property within the state. There are numerous misconceptions surrounding this legal document, which can lead to confusion, delays, and at times, unnecessary legal complications. Highlighted below are nine common misconceptions about the New Jersey Real Estate Purchase Agreement form, clarified for better comprehension.

- One Size Fits All: Many individuals mistakenly believe that there is a universal form that applies to all real estate transactions in New Jersey. In reality, the form should be tailored to fit the specific details and agreements between the buyer and the seller.

- Attorney Review is Optional: It's a common misconception that the attorney review clause is an optional part of the agreement. However, in New Jersey, this review period is mandatory, providing both parties with the opportunity to have the contract examined by legal counsel.

- No Need for Disclosure: Some think that sellers are not required to disclose issues or defects with the property. Yet, New Jersey law mandates that sellers disclose known material defects of the property before the sale is concluded.

- Verbal Agreements are Binding: A misunderstanding exists that verbal agreements related to the real estate transaction are enforceable. While verbal negotiations can take place, only the written and signed purchase agreement holds legal weight.

- It Only Outlines the Sale Price: The belief that the purchase agreement solely specifies the sale price underestimates its complexity. Besides the sale price, it includes terms regarding the deposit, contingencies, closing dates, and more.

- Home Inspections are Unnecessary: Some parties on either end of the transaction may assume that home inspections are not needed if the property appears to be in good condition. Nevertheless, an inspection clause is typically included to protect the buyer, ensuring they are informed of the property's condition beyond its outward appearance.

- It's Just an Informal Document: Treating the purchase agreement as an informal document can be a grave mistake. This document is a legally binding contract that outlines the rights and responsibilities of each party, providing legal recourse in situations where the terms are not met.

- All Deposits are Refundable: Another misconception is that all deposits made as per the agreement are automatically refundable. The truth is, the refundability of deposits depends on the terms outlined within the contract and the fulfillment of certain conditions by both parties.

- Quick Closing Times are Guaranteed: Some believe that once the purchase agreement is signed, the closing will occur swiftly. In contrast, various factors, such as financing approval, inspections, and appraisals, can affect the closing timeline, potentially leading to delays beyond the anticipated closing date.

For buyers and sellers in New Jersey, dispelling these misconceptions and obtaining accurate information about the Real Estate Purchase Agreement is crucial. It ensures that all parties enter into transactions with a clear understanding of their commitments and rights, safeguarding their interests throughout the process. Engaging with knowledgeable professionals, including real estate agents and attorneys, can provide valuable guidance and peace of mind.

Key takeaways

The New Jersey Real Estate Purchase Agreement form is an essential document used in the process of buying or selling property in New Jersey. Its careful completion ensures clarity and legality in the transaction for all parties involved. Here are key takeaways to consider when filling out and using this form.

- Accuracy is paramount: All information provided in the agreement should be accurate and truthful, including the names of the parties, the description of the property, and the purchase price. Errors can lead to misunderstandings or legal issues.

- Legal descriptions are necessary: In addition to the address, a legal description of the property must be included to precisely identify the real estate being transferred.

- Contingencies should be clearly stated: Any conditions that must be met for the transaction to proceed, such as obtaining a mortgage, inspecting the property, or selling a current home, should be clearly outlined in the agreement.

- Deposit details matter: The agreement must specify the amount and conditions of the deposit, including how it will be held and the circumstances under which it may be refunded.

- Closing costs and who will bear them: The agreement should detail which party is responsible for specific costs associated with closing the transaction.

- Signatures are necessary: For the agreement to be legally binding, it must be signed by all parties involved in the transaction. These signatures must be obtained before proceeding.

- Legal advice can be beneficial: Considering the complexity of real estate transactions, consulting with a lawyer to review the agreement before signing is advisable. Legal counsel can provide clarity and ensure the protection of one's rights.

- Amendments must be in writing: Any changes to the agreement after it has been signed should be made in writing and signed by all parties. Oral agreements are difficult to enforce and can lead to disputes.

Understanding and adhering to these key points can significantly enhance the smoothness and legality of real estate transactions in New Jersey. It's important for all parties involved to read the agreement carefully and ensure it reflects their understanding and intentions before signing.

Create Other Real Estate Purchase Agreement Forms for US States

Contract for Purchase - It provides a timeline for each stage of the buying process, ensuring a clear path to ownership.

Real Estate Contract for Sale by Owner Free Georgia - It clarifies the roles of real estate agents or brokers involved in the transaction.

Purchasing Agreement - The Real Estate Purchase Agreement marks the transition from negotiation to a formal commitment, setting the stage for the transfer of property ownership.

Property Purchase Agreement Format - A formal written agreement that acts as the cornerstone for a real estate transaction, detailing the commitments of involved parties.