Blank Real Estate Purchase Agreement Form for New York

Embarking on the journey of buying or selling property in New York comes with its own set of complexities and necessities, among which the New York Real Estate Purchase Agreement form stands out as a crucial document. This comprehensive form not only outlines the terms and conditions of the real estate transaction but also serves as a legally binding contract between the buyer and seller. It captures essential details such as the purchase price, property description, closing date, and contingencies that might affect the sale, including financing, inspection, and legal compliance issues. By effectively navigating through this form, parties involved can ensure transparency, avoid misunderstandings, and pave the way for a smoother transaction. The importance of this document in the New York real estate landscape cannot be overstated, as it forms the backbone of ensuring that all parties are well-informed and agreed upon the multitude of factors that contribute to the transfer of property ownership.

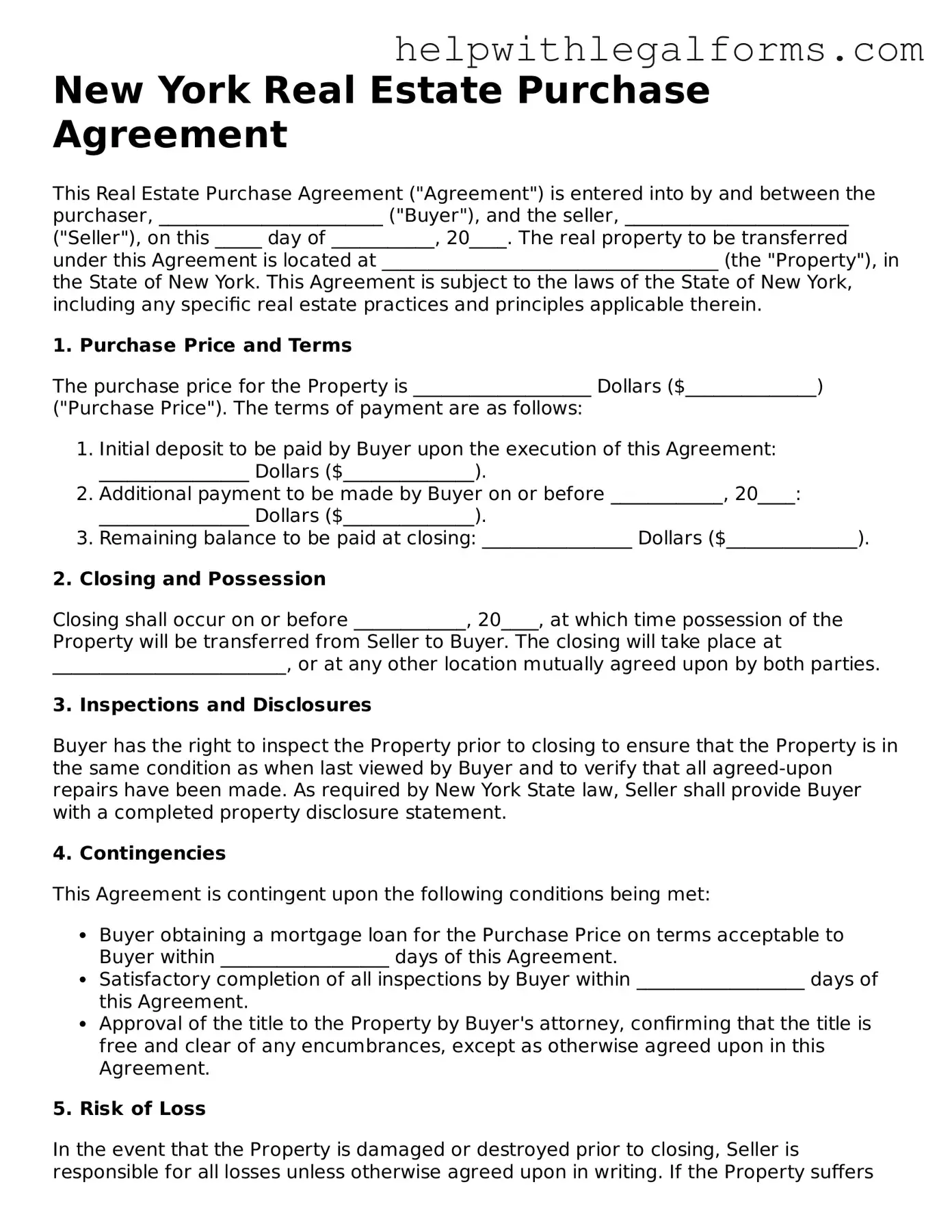

Example - New York Real Estate Purchase Agreement Form

New York Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is entered into by and between the purchaser, ________________________ ("Buyer"), and the seller, ________________________ ("Seller"), on this _____ day of ___________, 20____. The real property to be transferred under this Agreement is located at ____________________________________ (the "Property"), in the State of New York. This Agreement is subject to the laws of the State of New York, including any specific real estate practices and principles applicable therein.

1. Purchase Price and Terms

The purchase price for the Property is ___________________ Dollars ($______________) ("Purchase Price"). The terms of payment are as follows:

- Initial deposit to be paid by Buyer upon the execution of this Agreement: ________________ Dollars ($______________).

- Additional payment to be made by Buyer on or before ____________, 20____: ________________ Dollars ($______________).

- Remaining balance to be paid at closing: ________________ Dollars ($______________).

2. Closing and Possession

Closing shall occur on or before ____________, 20____, at which time possession of the Property will be transferred from Seller to Buyer. The closing will take place at _________________________, or at any other location mutually agreed upon by both parties.

3. Inspections and Disclosures

Buyer has the right to inspect the Property prior to closing to ensure that the Property is in the same condition as when last viewed by Buyer and to verify that all agreed-upon repairs have been made. As required by New York State law, Seller shall provide Buyer with a completed property disclosure statement.

4. Contingencies

This Agreement is contingent upon the following conditions being met:

- Buyer obtaining a mortgage loan for the Purchase Price on terms acceptable to Buyer within __________________ days of this Agreement.

- Satisfactory completion of all inspections by Buyer within __________________ days of this Agreement.

- Approval of the title to the Property by Buyer's attorney, confirming that the title is free and clear of any encumbrances, except as otherwise agreed upon in this Agreement.

5. Risk of Loss

In the event that the Property is damaged or destroyed prior to closing, Seller is responsible for all losses unless otherwise agreed upon in writing. If the Property suffers significant damage, Buyer has the right to terminate this Agreement and receive a full refund of all deposits made.

6. Legal and Binding Agreement

This Agreement constitutes a legal and binding agreement between Buyer and Seller under the applicable laws of the State of New York. Any disputes arising under this Agreement shall be resolved through mediation, and if necessary, legal action in the courts of New York.

7. Amendments and Addenda

Any modifications or amendments to this Agreement must be made in writing and signed by both Buyer and Seller. Any addenda to this Agreement are considered part of this Agreement and are subject to its terms and conditions.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement on the date first above written.

Seller's Signature: ___________________________ Date: ____________

Buyer's Signature: ___________________________ Date: ____________

PDF Form Attributes

| Fact | Description |

|---|---|

| 1. Purpose | The New York Real Estate Purchase Agreement form is utilized to outline the terms and conditions for the sale and purchase of real estate property between a buyer and a seller. |

| 2. Essential Elements | This form typically includes specific details such as property description, purchase price, terms of payment, closing date, and contingencies like financing or inspection requirements. |

| 3. Governing Law | The agreement is governed by New York State laws, which include regulations related to real estate transactions, property disclosures, and other specific requirements applicable within the state. |

| 4. Signing Requirements | For the Purchase Agreement to be legally binding, it must be signed by both the buyer and the seller. In New York, it is also customary for the signatures to be acknowledged by a notary public. |

| 5. Disclosures | New York law requires sellers to complete a property disclosure statement or offer a credit in lieu of disclosure. This form provides the buyer with detailed information about the property's condition and history. |

Instructions on How to Fill Out New York Real Estate Purchase Agreement

Filling out the New York Real Estate Purchase Agreement becomes necessary when parties decide to transfer property ownership in New York. This document, detailed and comprehensive, ensures all aspects of the sale are understood and agreed upon. To accurately complete this form, it is fundamental to understand not only what information is required but also how it should be accurately provided to bind all parties legally and protect their interests throughout the transaction. Following step-by-step ensures not a single essential detail is missed, clearing the path towards a successful real estate transaction.

- Identify the parties involved by providing the full names and contact information of both the buyer(s) and the seller(s). This helps to clearly determine who is committing to the agreement.

- Describe the property in question, including its full address, legal description, and any identifying information that distinguishes it from other properties. This ensures the exact property being sold is documented.

- Detail the purchase price agreed upon by both parties. Include any deposit that has been made and the balance that will be due at closing.

- Outline the terms of the sale. This may include any conditions or contingencies that need to be met before the sale is finalized, such as a successful home inspection or the buyer obtaining financing.

- Specify the closing date and location where the ownership of the property will officially change hands. This sets a clear timetable for both parties to follow.

- Itemize any items that will be included or excluded from the sale. This can range from appliances to light fixtures, ensuring both buyer and seller understand what remains with the property.

- Present any disclosures that are legally required or relevant to the property, such as lead-based paint disclosures or the history of repairs. This ensures transparency and protects the buyer’s interests.

- Include a section where additional terms and conditions can be listed. This could cover a variety of circumstances not previously detailed but agreed upon by both parties.

- Ensure that all parties involved—you, the other party, and, if applicable, the real estate agents—sign and date the agreement. Witness signatures may also be required depending on local statutes.

Once the form is fully completed and signed by all relevant parties, it becomes a legally binding document. It's prudent for both the buyer and seller to retain copies of the agreement for their records. Following these steps carefully will help facilitate a smoother real estate transaction, safeguarding the interests of all involved from any potential oversights.

Crucial Points on This Form

What is a New York Real Estate Purchase Agreement?

A New York Real Estate Purchase Agreement is a legally binding document used in the process of buying or selling real estate in New York. It outlines the terms and conditions agreed upon by both the buyer and the seller, including the purchase price, property description, closing date, and any other conditions that need to be met before the sale is finalized.

Who needs to sign the Real Estate Purchase Agreement?

The Real Estate Purchase Agreement must be signed by all parties involved in the transaction. This includes the buyer(s) and the seller(s). If the property is owned by more than one person, each owner must sign the agreement. In some cases, real estate agents representing the parties may also sign the agreement, acknowledging their role in the transaction.

Is a lawyer required to complete the New York Real Estate Purchase Agreement?

While New York law does not specifically require a lawyer to complete a Real Estate Purchase Agreement, it is highly recommended. Real estate transactions can be complex, and a lawyer can ensure that the agreement complies with all legal requirements and adequately protects the rights and interests of the party they represent.

Can the Purchase Agreement be modified after it is signed?

Yes, the Purchase Agreement can be modified after it is signed, but any changes must be agreed upon by both the buyer and the seller. Changes should be made in writing and duly signed by all parties involved. This helps to prevent any misunderstandings or disputes that may arise later.

What happens if a party breaches the Real Estate Purchase Agreement?

If a party breaches the Real Estate Purchase Agreement, the non-breaching party may have several legal remedies available to them. These remedies can include seeking specific performance, which means asking the court to force the breaching party to comply with the agreement, or seeking damages for financial losses incurred due to the breach.

Are there any contingencies in the New York Real Estate Purchase Agreement?

Yes, there are typically contingencies included in a New York Real Estate Purchase Agreement. These are conditions that must be met for the transaction to proceed. Common contingencies include the buyer securing financing, the sale of the buyer's current home, and the property passing inspection. All contingencies should be clearly stated in the agreement.

What is the closing process in a New York real estate transaction?

The closing process in a New York real estate transaction involves the final transfer of the property title from the seller to the buyer. During the closing, all agreements are finalized, financial transactions are completed, and legal documents are signed and exchanged. The specifics of the closing process can vary, but it typically involves the buyer, the seller, their attorneys, and a closing agent.

Do I need to have a home inspection before signing the Purchase Agreement?

While it's not a legal requirement to have a home inspection before signing the Purchase Agreement, it is strongly advised. A home inspection can reveal potential issues with the property that can affect its value and desirability. Identifying these issues early allows the buyer to negotiate repairs or adjustments to the purchase price before finalizing the agreement.

Common mistakes

Filling out a New York Real Estate Purchase Agreement form is a critical step in the process of buying or selling property. It lays out the terms and conditions of the sale, binding both parties to the agreement. However, errors can occur during this process, potentially leading to misunderstandings, legal disputes, or the nullification of the agreement. Here are five common mistakes people make when filling out these forms:

Omitting Important Details: One of the most common mistakes is leaving important fields blank or entering incomplete information. Every detail, from the legal description of the property to the specifics of the purchase price and contingencies, needs to be meticulously recorded to avoid ambiguity and ensure the agreement's enforceability.

Ignoring Contingencies: Failing to correctly outline the contingencies can lead to significant issues. Contingencies such as financing, home inspections, and the sale of the buyer's current home safeguard both the buyer and seller, allowing either party to back out of the sale under certain conditions without penalty.

Miscalculating Financials: Errors in calculating the purchase price, down payment, closing costs, or other financial terms can lead to disputes and delays. It's crucial that both parties review these numbers closely to ensure they reflect the agreed upon terms.

Not Specifying Closing and Possession Dates: It's essential to explicitly state the closing date and the date of possession in the agreement. These dates set clear expectations for both parties and help avoid conflicts about when the property will officially change hands.

Neglecting to Disclose Known Property Issues: Sellers must disclose any known issues with the property. Failure to do so can result in legal action for nondisclosure. Disclosing these issues upfront can prevent future disputes and ensure a fair deal for both parties.

Carefully filling out the New York Real Estate Purchase Agreement can help streamline the property sale process, prevent legal complications, and protect the interests of all parties involved.

Documents used along the form

When engaging in a real estate transaction in New York, the Real Estate Purchase Agreement is a critical document. However, it often requires additional forms and documents to ensure a seamless process. These documents can provide further legal protection, clarification, and details needed to fulfill the requirements of both parties involved in the transaction. Understanding these accompanying documents can be crucial for both buyers and sellers to navigate the complexities of real estate transactions successfully.

- Residential Property Disclosure Form: This document requires sellers to disclose known defects in the property, including structural, environmental, or other issues that might influence a buyer's decision.

- Title Insurance Policy: A title insurance policy protects against losses due to defects in the title that were not uncovered in the initial title search. It provides peace of mind and financial protection from possible legal issues related to the property’s title.

- Mortgage Pre-approval Letter: Often submitted with an offer to purchase, this document from a lender indicates the amount a buyer is pre-approved to borrow. It adds credibility to the buyer's offer by showing financial readiness.

- Home Inspection Report: This report, conducted by a professional home inspector, outlines the condition of the home's major systems and structures. It can affect negotiations and is typically a contingency within the purchase agreement.

- Pest Inspection Report: In some cases, especially with older homes, a pest inspection is required or highly recommended to uncover any infestations or damage caused by insects or rodents.

- Lead-Based Paint Disclosure: For homes built before 1978, federal law requires sellers to disclose information about lead-based paint and lead-based paint hazards before selling a house.

- Septic System Inspection Report: For properties with a septic system, this report from a certified inspector assesses the system’s condition and functionality, important for ensuring environmental and personal health safety.

- Appraisal Report: An appraisal report provides a professional assessment of the property's market value. Required by lenders, it ensures the property's sale price is in line with its appraised market value.

Together with the Real Estate Purchase Agreement, these documents form a comprehensive package that addresses the legal, financial, and physical aspects of real estate transactions. Each serves a unique purpose, helping to inform, protect, and facilitate the interests and rights of both buyers and sellers in the complex process of transferring property ownership. Navigating these documents effectively requires an understanding of their roles and implications in the context of New York real estate transactions.

Similar forms

Bill of Sale: This document is quite similar to a Real Estate Purchase Agreement in that it serves as a formal agreement between two parties concerning the sale and purchase of personal property. While a Real Estate Purchase Agreement covers real property (land and buildings), a Bill of Sale applies to personal property like vehicles, equipment, or other tangible goods. Both documents outline the terms of the exchange, including the purchase price and the transfer of ownership.

Lease Agreement: Similar to Real Estate Purchase Agreements, Lease Agreements establish terms under which a property is rented. Though one involves purchasing and the other renting, both documents specify conditions regarding the use of real estate, delineate responsibilities between the parties involved (e.g., maintenance, utilities), and set forth duration terms, whether it's ownership in perpetuity or tenancy for a specified period.

Land Contract: Also known as a contract for deed, a Land Contract is closely related to a Real Estate Purchase Agreement as it outlines the sale of a property directly from the seller to the buyer. However, the key distinction lies in the payment structure and transfer of ownership. In a Land Contract, the buyer pays the seller in installments, and the transfer of the title occurs only after the full purchase price is paid, unlike in a Real Estate Purchase Agreement where the transfer is immediate upon closing.

Mortgage Agreement: This document establishes a security interest in the property being purchased, similar to how a Real Estate Purchase Agreement facilitates the transfer of that property. A Mortgage Agreement involves a borrower (who is acquiring the property) and a lender (usually a bank), stipulating that the property's title will serve as collateral for the loan. It's the financial side of purchasing real estate, detailing the loan terms, repayment schedule, and actions in case of default.

Title Insurance Policy: Although differing in nature—a policy versus an agreement—a Title Insurance Policy complements a Real Estate Purchase Agreement through its protective measures. It insures against financial loss from defects in title to real property and from the invalidity or unenforceability of mortgage loans. Essentially, it backs up the property transfer process covered in the purchase agreement by ensuring the buyer’s legal ownership and rights to the property are clear and safeguarded.

Home Inspection Report: Before finalizing a real estate transaction outlined in a Real Estate Purchase Agreement, a Home Inspection Report is often utilized. It provides a detailed analysis of the property's condition, including structural elements, systems, and any need for repairs. Though more informational than contractual, this report directly influences the continuation, adjustment, or termination of the agreement based on the findings related to the property’s actual condition.

Property Deed: A Property Deed is a legal document that officially transfers ownership of real estate from the seller to the buyer, serving as the culmination of the transaction process initiated by a Real Estate Purchase Agreement. While the purchase agreement sets the terms and conditions of the sale, the deed completes the transaction by legally documenting the change in ownership. Both documents are integral to the buying and selling of property, marking the agreement and then the final transfer.

Dos and Don'ts

When you're preparing to fill out the New York Real Estate Purchase Agreement form, the goal is to ensure that all information is accurate and legally sound. This document is crucial for both the buyer and the seller, as it lays down the terms of the sale, including the sale price, the property description, and any conditions or contingencies that need to be met before the sale can be finalized. Below are important dos and don'ts to consider:

Do:- Double-check property details: Make sure the property address, legal description, and any identifying details match those on the property's official records. Errors here can cause significant legal issues.

- Review financial terms carefully: Ensure that the sale price, deposit amounts, and any financial adjustments are clearly stated and agreed upon by both parties. Misunderstandings or inaccuracies in this section can derail the entire agreement.

- Specify contingency clauses: If the purchase is subject to conditions such as financing approval, home inspections, or the sale of the buyer's current home, these should be clearly outlined in the agreement.

- Keep records: Once the agreement is finalized and signed, make sure both parties receive a copy and keep it for their records. This document will be essential for both the closing process and any potential disputes.

- Skim over the fine print: Every clause and condition can have significant legal implications. Take the time to read and understand the entire document before signing.

- Leave blanks: Avoid leaving any fields blank. If a section does not apply, mark it as “N/A” (not applicable) instead of leaving it empty to prevent future alterations.

- Sign under pressure: Don’t feel pressured to sign the agreement until you fully understand and agree with all its terms. Consulting with a real estate attorney can provide clarity and assurance.

- Forget to include all parties: Make sure that anyone who holds an interest in the property is included in the agreement and signs it. This includes all owners or legal representatives.

Misconceptions

When it comes to buying real estate, the process can feel overwhelming, filled with legal documents that seem inscrutable at first glance. The New York Real Estate Purchase Agreement form is one such document that often misunderstands those not well-versed in real estate law. Let's demystify some common misconceptions about this crucial document.

The agreement is standardized and non-negotiable. Many people mistakenly believe that the New York Real Estate Purchase Agreement form is a one-size-fits-all document that cannot be changed. In reality, while there are standard forms, the terms within those forms can often be negotiated and customized to fit the needs of both the buyer and the seller.

Verbal agreements are as good as the written contract. This couldn't be further from the truth in real estate transactions. In New York, as in many other places, a verbal agreement concerning real estate purchases holds no legal weight. All agreements must be in writing and signed by both parties to be enforceable.

It's just a formality that doesn't need much attention. Each clause in the purchase agreement can significantly impact the buyer's and seller's rights and obligations. Overlooking the details can lead to unforeseen problems down the line. It's crucial to understand every aspect of the agreement before signing.

The purchase price is the only important figure. While the purchase price is indeed a critical component of the real estate transaction, other financial aspects detailed in the agreement, such as earnest money requirements, closing costs, and any concessions, are equally important and can affect the overall financial commitment.

Buyers are always required to put down earnest money. Although earnest money deposits are common to show the buyer's good faith, there are instances where a deal can proceed without them. The terms surrounding earnest money are negotiable and should be detailed in the purchase agreement.

Only the buyer needs a lawyer to review the agreement. Given the legal and financial complexities of real estate transactions, both buyers and sellers benefit from having legal representation. Lawyers can help negotiate terms, understand rights and obligations, and spot potential issues before they become problems.

Inspections are optional. While the New York Real Estate Purchase Agreement might not always explicitly require an inspection, conducting one is in the buyer's best interest. Inspections can reveal crucial information about the property's condition, influencing the buyer's decision and potentially renegotiating the purchase terms.

Closing dates are set in stone. Closing dates are often thought of as final deadlines. However, they can be adjusted if both the buyer and seller agree. Circumstances such as inspection findings or financing issues might necessitate moving the closing date, which can be accommodated through amendments to the agreement.

Once the agreement is signed, it's too late for any changes. While it's true that a signed agreement represents a legal commitment, amendments can be made if both parties agree. Changes to closing dates, purchase terms, or other conditions can be negotiated and documented through an amendment to the original agreement.

Understanding the intricacies of the New York Real Estate Purchase Agreement is essential for anyone involved in a real estate transaction. By dispelling these common misconceptions, buyers and sellers can approach the process with confidence and clarity, ensuring a smoother journey to closing.

Key takeaways

Navigating the complexities of real estate transactions in New York requires a clear understanding of the Real Estate Purchase Agreement form. This document is not just a formal requirement; it's the foundational blueprint of the purchasing process, ensuring all parties are aligned with the sale's terms and conditions. Here are five key takeaways to bear in mind when filling out and using this crucial form:

- Accuracy is paramount: Every detail in the Real Estate Purchase Agreement must be accurate. This includes the names of the buyer and seller, the property address, the purchase price, and any contingencies (like financial or inspection requirements). Errors or omissions can lead to disputes or a voided agreement.

- Understand the contingencies: Contingencies are conditions that must be met for the transaction to proceed. These may include obtaining financing, satisfactory home inspection results, or the sale of the buyer's current home. Buyers and sellers need to clearly understand these conditions, as they offer protection and escape clauses if the agreed terms aren't met.

- Be clear about inclusions and exclusions: The agreement should specify what is included in the sale (such as appliances, lighting fixtures, or window treatments) and what is not. This clarity prevents future disagreements about what was supposed to remain with the property versus what the seller could take.

- Legal review is recommended: Before signing, it's advisable for both buyers and sellers to have the agreement reviewed by their respective legal representatives. Lawyers can highlight potential issues, suggest amendments, and ensure that the agreement serves the best interest of their clients.

- Signatures are binding: Once the agreement is signed by both parties, it becomes a legally binding contract. Both the buyer and seller are then obligated to fulfill their parts of the bargain, provided all contingencies are met. This underscores the importance of not rushing into signing without fully understanding every element of the agreement.

Deftly handling the New York Real Estate Purchase Agreement is crucial for a smooth transaction. Remembering these key points helps protect the interests of all involved parties and paves the way for a successful property transfer.

Create Other Real Estate Purchase Agreement Forms for US States

Real Estate Contract Template - Documentation that serves as the evidence of a sale agreement between two parties over real estate.

Contract for Purchase - Information on any existing liens or encumbrances on the property is disclosed.

Property Purchase Agreement Format - Essential paperwork that captures the agreement between a buyer and seller regarding the transfer of property ownership.