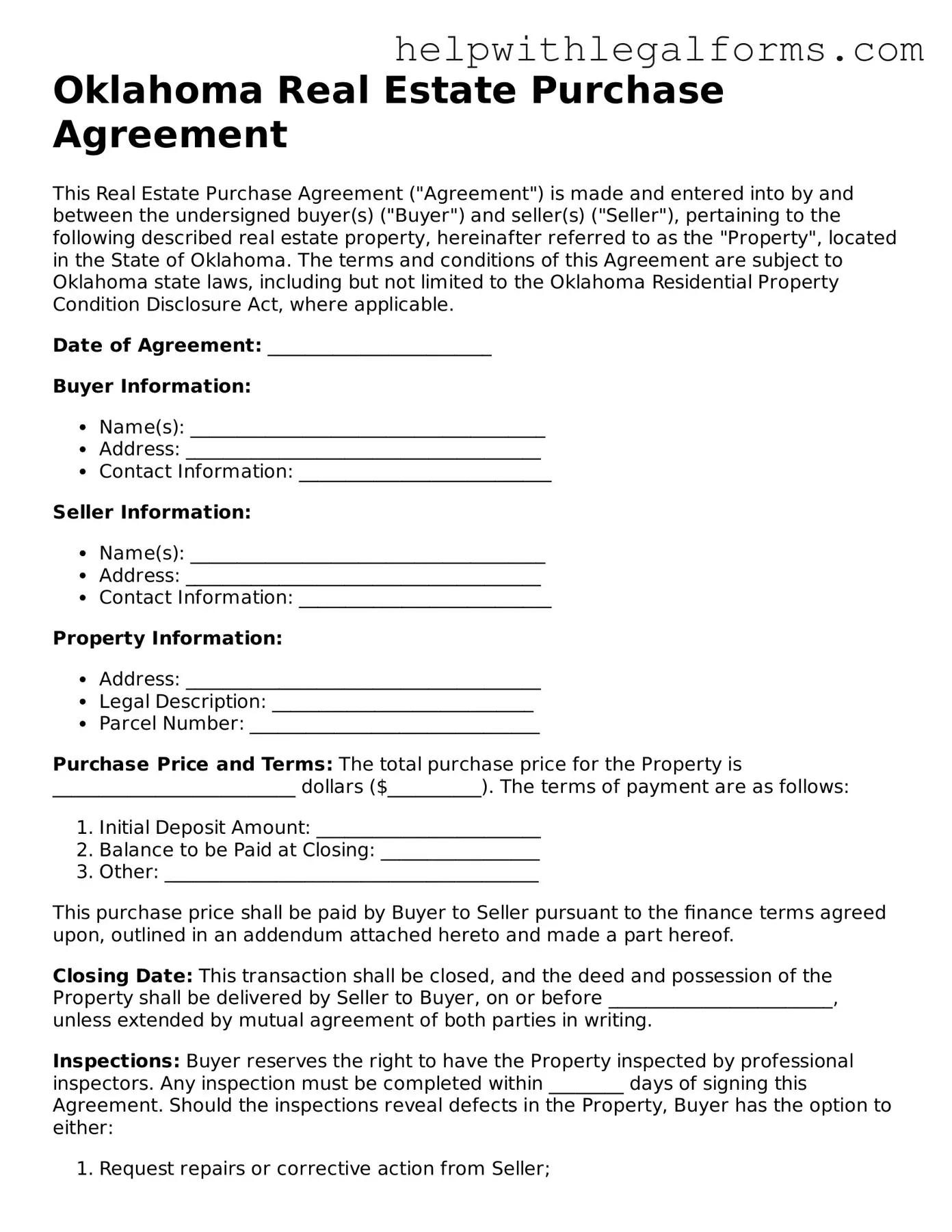

Blank Real Estate Purchase Agreement Form for Oklahoma

Embarking on the journey of buying or selling property in Oklahoma unfolds a complex tapestry of legal and financial considerations, at the heart of which lies the Oklahoma Real Estate Purchase Agreement. This pivotal document does more than just set the sale price; it encapsulates the entirety of the transaction terms, ensuring both buyer and seller are on the same page—literally and figuratively. From earnest money deposits and closing costs to property inspections and the allocation of taxes, this agreement meticulously outlines each party's obligations and rights. It acts as a roadmap, guiding all involved through the intricate landscape of real estate transactions in Oklahoma, mitigating risks and paving the way for a smoother exchange of property ownership. By setting the legal groundwork, it helps prevent misunderstandings and conflicts, making it indispensable for anyone looking to navigate the real estate market. With provisions that cover nearly every aspect of the sale, the Oklahoma Real Estate Purchase Agreement form is a comprehensive tool that protects the interests of both parties while ensuring compliance with state-specific regulations and laws.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Nature of Document | The Oklahoma Real Estate Purchase Agreement is a legally binding document between the buyer and seller regarding the sale and purchase of real estate in Oklahoma. |

| Required Disclosures | The form mandates disclosures such as property defects and lead-based paint warnings (for properties built prior to 1978). |

| Governing Law | Oklahoma Statutes Title 60. Property governs the Oklahoma Real Estate Purchase Agreement. |

| Identification of Parties | A clear identification of both the buyer and seller must be included in the agreement. |

| Description of Property | The agreement must contain a complete and accurate description of the property being sold. |

| Purchase Price and Terms | It outlines the purchase price of the property and the terms of payment agreed upon by both parties. |

| Contingencies | Conditions that may allow the buyer or seller to terminate the agreement are detailed, such as financing terms and property inspections. |

| Closing and Possession Dates | The agreement specifies the dates by which the closing of the sale will occur and when the buyer will take possession of the property. |

| Signature Requirement | Both parties' signatures are required for the document to be legally binding. |

| Filing Requirement | While the purchase agreement itself does not need to be filed with any government body, the final transfer of property (deed) must be recorded with the county clerk's office. |

Instructions on How to Fill Out Oklahoma Real Estate Purchase Agreement

Filling out the Oklahoma Real Estate Purchase Agreement is a critical step in the process of buying or selling property in Oklahoma. This document outlines the terms and conditions of the sale, including the price, the closing date, and any contingencies that must be met before the sale can go through. With such an important role in the real estate transaction, it's essential to fill out the form carefully and completely. Below are step-by-step instructions to guide you through this process, ensuring accuracy and compliance with Oklahoma laws.

- Start by entering the date of the agreement at the top of the form.

- Fill in the full names and addresses of both the buyer(s) and seller(s) in the designated sections.

- Describe the property being sold, including its legal description and physical address. This information can often be found on a previous deed or mortgage document.

- Specify the purchase price agreed upon by both parties in the space provided.

- Outline the terms of payment, such as down payment amount, financing details, and any conditions related to the payment structure.

- Include any items that will be excluded or included in the sale, such as appliances, lighting fixtures, or furniture.

- Detail the closing date and location where the final transaction will occur.

- Address contingencies that may affect the sale, such as the buyer’s ability to obtain financing, the results of the home inspection, and any required repairs.

- Identify how property-related expenses, like taxes and utilities, will be divided between the buyer and the seller.

- Read through the legal clauses related to default, dispute resolution, and any state-specific requirements. Make sure you understand these provisions as they are legally binding.

- Both the buyer(s) and seller(s) must sign and date the agreement. Witness signatures may also be required, depending on local laws.

After you have completed these steps, it's advised to review the document for accuracy and completeness. Any mistakes could potentially delay the sale or lead to legal issues down the line. Once satisfied, copies of the agreement should be distributed to all parties involved, including any real estate agents or attorneys. This agreement serves as the blueprint for the transaction, guiding both the buyer and seller through to the successful sale of the property.

Crucial Points on This Form

What is an Oklahoma Real Estate Purchase Agreement?

An Oklahoma Real Estate Purchase Agreement is a legal document that outlines the terms and conditions between a buyer and a seller for the purchase of real estate in Oklahoma. This document specifies details such as the purchase price, property description, financing terms, and closing conditions. It's a binding contract once both parties sign it.

Who needs to sign the Oklahoma Real Estate Purchase Agreement?

Both the buyer and the seller need to sign the Oklahoma Real Estate Purchase Agreement for it to be legally binding. In some cases, if either the buyer or the seller is a company, an authorized representative may sign on their behalf.

Do I need a lawyer to create an Oklahoma Real Estate Purchase Agreement?

While it's not mandatory to have a lawyer create an Oklahoma Real Estate Purchase Agreement, it is highly recommended. A lawyer can help ensure that the agreement complies with local laws, fulfills all legal requirements, and protects your interests. They can also assist in negotiations and address any legal issues that may arise.

What happens if someone breaks the Oklahoma Real Estate Purchase Agreement?

If either the buyer or the seller breaks the Oklahoma Real Estate Purchase Agreement, it can lead to legal consequences. The aggrieved party may sue for breach of contract, seeking damages or specific performance, which is a court order for the breaching party to fulfill their obligations under the contract. The actual outcome depends on the specific terms of the agreement and the situation.

Can I back out of an Oklahoma Real Estate Purchase Agreement?

Backing out of an Oklahoma Real Estate Purchase Agreement is possible but may have financial and legal repercussions, depending on the stage of the transaction and the conditions outlined in the agreement. Many agreements include contingencies, such as inspection or financing clauses, that allow parties to cancel under specific conditions. However, withdrawing without a contractual basis may result in the forfeiture of the earnest money deposit or other penalties.

How long does it take to close on a house after signing an Oklahoma Real Estate Purchase Agreement?

The closing time after signing an Oklahoma Real Estate Purchase Agreement can vary widely, typically ranging from 30 to 45 days. This timeframe allows for the completion of inspections, appraisals, and financing arrangements. The exact timeline can be faster or slower, depending on the agreed-upon closing date and any contingencies in the agreement.

Are there any specific disclosures required in an Oklahoma Real Estate Purchase Agreement?

Yes, Oklahoma law requires sellers to provide specific disclosures in a real estate transaction. These include disclosing any known material defects about the property's condition, such as problems with the foundation, roof, plumbing, or electrical systems. Sellers must fill out a Residential Property Condition Disclosure Statement and give it to buyers before the Real Estate Purchase Agreement is signed. This ensures that buyers are fully informed about the property's condition before finalizing the purchase.

Common mistakes

When filling out the Oklahoma Real Estate Purchase Agreement form, individuals often make errors that can lead to misunderstandings, delays, or legal complications in the property transfer process. Paying close attention to detail and avoiding common mistakes can ensure a smoother transaction. Here are nine common errors to avoid:

-

Not verifying the legal description of the property: It's crucial to ensure that the legal description matches the property being sold. Mismatches can cause significant issues in the title transfer process.

-

Omitting important addenda: Often, parties fail to attach necessary addenda that cover inspections, seller disclosures, or specific contingencies, which can affect rights and obligations.

-

Incorrectly filling in financial details: Mistakes in entering the purchase price, earnest money amount, or other financial terms can create disputes or misunderstandings between the parties.

-

Leaving blanks: Not completing every required field can lead to ambiguity or the impression of incomplete agreement, potentially voiding the contract or necessitating additional negotiation.

-

Not specifying closing and possession dates: Failing to clearly define when closing will occur and when possession of the property will be transferred can lead to conflicts and logistical problems.

-

Forgetting to address fixtures and personal property: The agreement should specify what items remain with the property and which the seller will remove to prevent disputes over personal property and fixtures.

-

Misunderstanding contingency clauses: Buyers and sellers sometimes fail to clearly understand or correctly specify the conditions that must be met for the transaction to proceed, such as financing or sale of another property.

-

Failing to obtain required signatures: The agreement must be signed by all parties who hold an interest in the property. Missing signatures can invalidate the entire agreement.

-

Not consulting a professional: Individuals often complete the form without seeking legal or real estate advice. Professional guidance can help avoid errors and ensure that the agreement reflects the parties' intentions.

Avoiding these mistakes can help parties involved in a real estate transaction in Oklahoma ensure that their purchase agreement accurately and effectively reflects the terms of their deal, minimizing the risk of future disputes or legal challenges.

Documents used along the form

When completing a real estate transaction in Oklahoma, the Real Estate Purchase Agreement form is a crucial document. However, this agreement often requires additional forms and documents to ensure a comprehensive and legally sound transaction. These supplementary documents vary in purpose, ranging from disclosures about the property's condition to financial documents proving the buyer's ability to purchase the home. The following list outlines forms and documents commonly used alongside the Oklahoma Real Estate Purchase Agreement form, providing a brief description of each.

- Lead-Based Paint Disclosure – This is a mandatory document for any residential property built before 1978, detailing the presence of lead-based paint used in the home.

- Residential Property Condition Disclosure – Sellers use this form to provide buyers with detailed information about the property's current condition and history of repairs or issues.

- Title Insurance Policy – A document that protects the buyer and the lender from future claims against the property’s title, ensuring it is free of liens or disputes.

- Flood Zone Statement – A statement indicating whether the property is located in a flood zone, which affects insurance requirements and costs.

- Home Inspection Report – A detailed report produced by a professional inspector, outlining the condition of the home's structure, systems, and any repairs needed.

- Proof of Homeowners’ Insurance – A document showing the property will be insured, as required by mortgage lenders prior to closing.

- Mortgage Pre-Approval Letter – A letter from a lender stating the amount of money a buyer is approved to borrow, based on their creditworthiness and financial history.

- Appraisal Report – An evaluation by a licensed appraiser to determine the property's fair market value, usually required by lenders to finalize a loan.

- Closing Disclosure – A form that outlines the final terms, costs, and transactions for both buyer and seller, required by law to be provided at least three days before closing.

- Property Survey – A document that outlines the property’s boundaries, structures, and any encroachments, ensuring that all parties are aware of the property's exact dimensions and layout.

Accompanying the Oklahoma Real Estate Purchase Agreement with these documents can significantly streamline the buying and selling process. Each plays a vital role in providing transparency, fulfilling legal requirements, and protecting the interests of both buyers and sellers. Properly understanding and utilizing these documents ensures a smoother, more reliable real estate transaction.

Similar forms

A Bill of Sale is similar to a Real Estate Purchase Agreement in the sense that both legalize the transfer of ownership from one party to another. While a Real Estate Purchase Agreement specifies the transfer of property from seller to buyer, a Bill of Sale covers personal property, like vehicles or business assets, providing a detailed list of items being sold along with the terms of sale.

A Lease Agreement shares common ground with a Real Estate Purchase Agreement by delineating the terms under which one party agrees to rent property from another party. Both agreements specify terms about the property involved, albeit with different end goals: one concludes with ownership changing hands, while the other involves temporary occupancy rights.

Loan Agreement documents, notably mortgages, mirror Real Estate Purchase Agreements through their role in facilitating major transactions. These agreements dictate the terms under which money is borrowed and must be repaid, including a lien on real estate as collateral for the loan, akin to how Real Estate Purchase Agreements set out the terms for transferring the property itself.

Finally, a Property Deed is akin to a Real Estate Purchase Agreement because it is an essential document for the legal transfer of property. However, while the Purchase Agreement outlines the transaction’s terms and conditions, the Property Deed is the actual legal document that transfers ownership of the property from the seller to the buyer upon the completion of the agreement.

Dos and Don'ts

Filling out the Oklahoma Real Estate Purchase Agreement requires attention to detail and an understanding of what is legally required for a successful and binding contract. To ensure the process goes smoothly, here are essential dos and don'ts to keep in mind:

Do:

- Review all sections of the form thoroughly before filling it out to ensure you understand each requirement.

- Include detailed information about the property, such as its legal description, address, and any applicable parcel ID numbers.

- Clarify terms of the sale, including the purchase price, deposit amounts, and specific conditions or contingencies that must be met.

- Use clear, concise language to avoid any ambiguity that could lead to disputes or misunderstandings.

- Have all parties involved sign and date the agreement, as this formalizes the commitment and makes the document legally binding.

Don't:

- Leave any sections blank. If a section doesn't apply, write "N/A" to indicate this rather than leaving it empty.

- Sign the agreement without ensuring that all information is accurate and complete. Mistakes could lead to legal complications down the line.

- Overlook the importance of obtaining professional advice. Consulting with a real estate attorney can provide valuable insights and help avoid common pitfalls.

- Forget to specify who is responsible for paying certain fees, such as closing costs, inspections, and taxes. This clarification can prevent disputes.

- Ignore the need for a contingency plan. Conditions such as financing approval, home inspections, and appraisals should be clearly outlined to protect all parties involved.

Misconceptions

When engaging with the Oklahoma Real Estate Purchase Agreement form, various misconceptions can arise, often due to misinformation or a lack of experience in the real estate domain. Understanding these misconceptions is crucial for both buyers and sellers to navigate the complexities of real estate transactions smoothly. Below, some common misconceptions are cleared up, providing clarity and reassurance.

All real estate purchase agreements are the same. This is a widespread misconception. While many forms follow a standard format, the Oklahoma Real Estate Purchase Agreement is tailored to meet state-specific regulations and requirements. Each state has unique laws pertaining to real estate transactions, making it important to use the state-specific form.

Legal representation is not necessary when completing the form. Although it's possible to complete the form without a lawyer, it's highly advisable to seek legal advice. Real estate transactions involve significant legal and financial implications, and professional guidance can ensure that your interests are adequately protected.

The form is final and cannot be modified. In reality, the Oklahoma Real Estate Purchase Agreement is negotiable until both parties sign it. Buyers and sellers can negotiate terms, conditions, and contingencies to be included in the contract. Modifications should be clearly written and mutually agreed upon.

A verbal agreement is as binding as the written contract. In Oklahoma, as in most states, real estate transactions must be in writing to be legally enforceable. While verbal agreements can be a good starting point for negotiations, they are not binding for the purchase of real estate.

Once signed, the buyer is obliged to buy, and the seller is obliged to sell. While the signing of the agreement does indicate a serious commitment, various contingencies often included in these agreements can allow either party to withdraw under specific circumstances, such as the failure to secure financing or unsatisfactory inspection results.

The purchase price is the only negotiable aspect of the agreement. This misconception overlooks the negotiability of numerous other aspects of the purchase agreement, including closing costs, closing date, inspections, repairs, and included personal property, among others. All terms of the agreement can be subject to negotiation.

You can back out of the agreement anytime before closing without consequences. Backing out of a signed real estate purchase agreement without a legally valid reason or outside of agreed-upon contingencies can lead to serious consequences, including the forfeiture of the earnest money deposit or even legal action for specific performance or damages.

Understanding these misconceptions can equip parties involved in a real estate transaction with the knowledge needed to make informed decisions. Always consider consulting with professionals to guide you through the intricacies of the Oklahoma Real Estate Purchase Agreement.

Key takeaways

Filling out the Oklahoma Real Estate Purchase Agreement form is a critical step in the process of buying or selling property in Oklahoma. This document serves as a binding contract between the buyer and seller, outlining the terms and conditions of the sale. Here are five key takeaways to help you navigate the complexities of this important document.

- First and foremost, accuracy is paramount. Every detail entered into the agreement, from the names of the parties involved to the specifics of the property and terms of sale, should be double-checked for accuracy. Errors or omissions can lead to disputes or legal complications down the line.

- Understanding the terms is crucial. Before signing, all parties should fully understand every condition, clause, and provision within the agreement. This includes the sale price, closing costs, inspection rights, and any contingencies that may affect the progression of the sale.

- The agreement should clearly specify the timeline for the transaction. Key dates such as the closing date, deadlines for inspections, and any other milestones should be explicitly stated to avoid confusion and ensure a smooth transaction process.

- Disclosure requirements must be met. In Oklahoma, sellers are required to disclose certain information about the property's condition and history. Ensure that all necessary disclosures are completed and included with the agreement to comply with state laws.

- Lastly, professional guidance is invaluable. Given the legal and financial implications of the Real Estate Purchase Agreement, consulting with a real estate professional or attorney can provide clarity and assurance. They can help review the document, explain complex terms, and suggest amendments to protect your interests.

By keeping these key takeaways in mind, participants in a real estate transaction can navigate the process with greater confidence and security, ensuring that the sale progresses smoothly and efficiently.

Create Other Real Estate Purchase Agreement Forms for US States

Contract for Purchase - Including a section for additional terms and conditions, the form allows for customization to the specific deal.

Real Estate Contract for Sale by Owner Free Georgia - The form ensures compliance with state and local laws regarding property transfers and disclosures.