Legal Owner Financing Contract Form

Exploring the Owner Financing Contract form unveils a unique avenue for buying and selling property, where traditional lending institutions like banks are bypassed, and the seller becomes the lender. This method not only facilitates a more direct financial agreement between the parties involved but also provides an alternative for buyers who might not qualify for conventional loans. Its major components cover the interest rate, repayment schedule, and consequences of default, ensuring both parties understand their obligations and rights. For sellers, it's a way to potentially sell their property faster, and for buyers, it can represent an opportunity to purchase a home when other doors are closed due to credit issues or other barriers. The form also details the legal repercussions for non-compliance, embedding a layer of security and trust into the transaction. With owner financing, each agreement can be tailored to fit the specific needs and situations of the parties involved, making it a flexible and attractive option for many. However, it is crucial for both parties to comprehend the legal implications and financial details outlined in the Owner Financing Contract form to ensure a smooth and successful property transfer.

Example - Owner Financing Contract Form

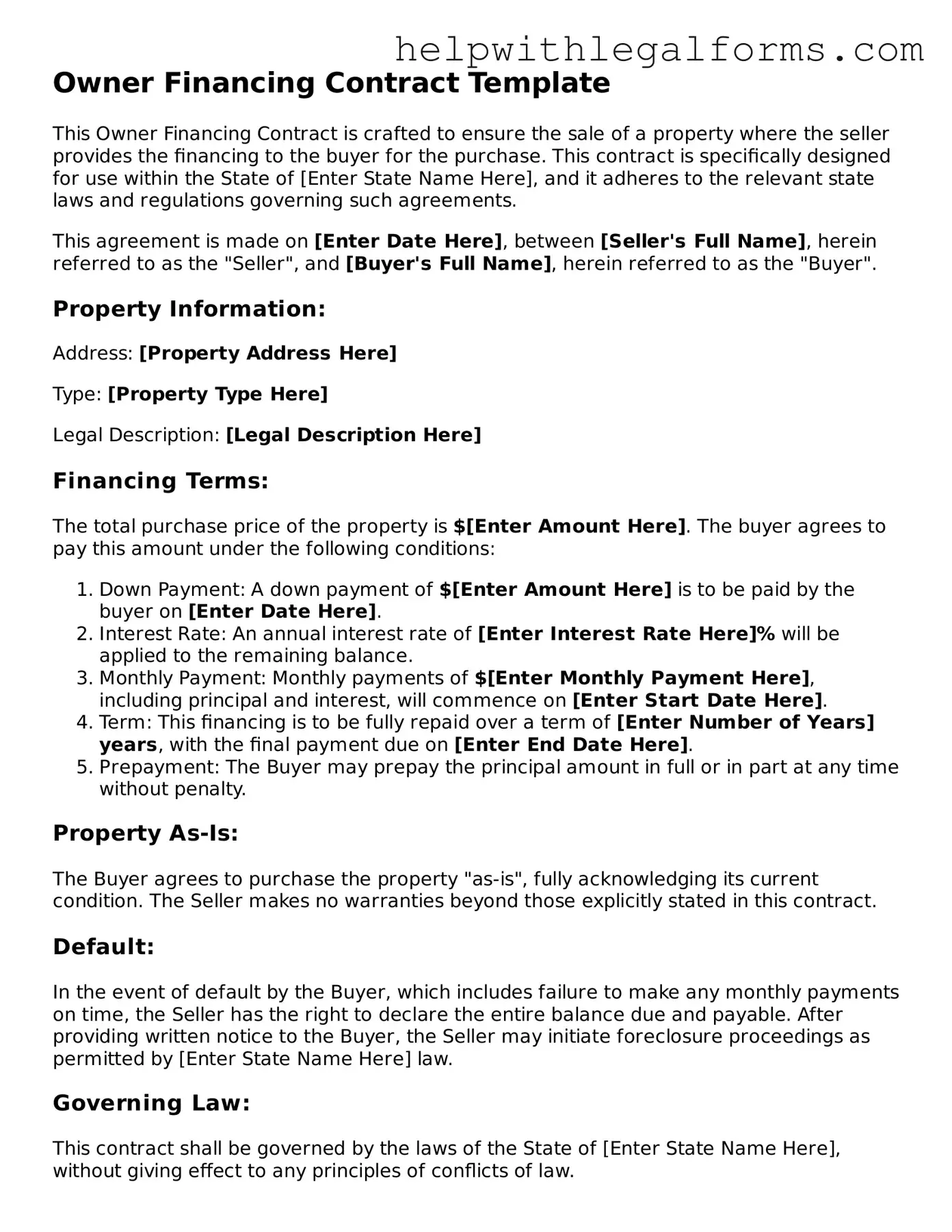

Owner Financing Contract Template

This Owner Financing Contract is crafted to ensure the sale of a property where the seller provides the financing to the buyer for the purchase. This contract is specifically designed for use within the State of [Enter State Name Here], and it adheres to the relevant state laws and regulations governing such agreements.

This agreement is made on [Enter Date Here], between [Seller's Full Name], herein referred to as the "Seller", and [Buyer's Full Name], herein referred to as the "Buyer".

Property Information:

Address: [Property Address Here]

Type: [Property Type Here]

Legal Description: [Legal Description Here]

Financing Terms:

The total purchase price of the property is $[Enter Amount Here]. The buyer agrees to pay this amount under the following conditions:

- Down Payment: A down payment of $[Enter Amount Here] is to be paid by the buyer on [Enter Date Here].

- Interest Rate: An annual interest rate of [Enter Interest Rate Here]% will be applied to the remaining balance.

- Monthly Payment: Monthly payments of $[Enter Monthly Payment Here], including principal and interest, will commence on [Enter Start Date Here].

- Term: This financing is to be fully repaid over a term of [Enter Number of Years] years, with the final payment due on [Enter End Date Here].

- Prepayment: The Buyer may prepay the principal amount in full or in part at any time without penalty.

Property As-Is:

The Buyer agrees to purchase the property "as-is", fully acknowledging its current condition. The Seller makes no warranties beyond those explicitly stated in this contract.

Default:

In the event of default by the Buyer, which includes failure to make any monthly payments on time, the Seller has the right to declare the entire balance due and payable. After providing written notice to the Buyer, the Seller may initiate foreclosure proceedings as permitted by [Enter State Name Here] law.

Governing Law:

This contract shall be governed by the laws of the State of [Enter State Name Here], without giving effect to any principles of conflicts of law.

Signatures:

This agreement is entered into willingly by both parties on the date first written above, with full acknowledgment and consent of all terms herein.

Seller's Signature: ___________________________ Date: [Enter Date Here]

Buyer's Signature: ___________________________ Date: [Enter Date Here]

Witness (if applicable):

Witness's Signature: ___________________________ Date: [Enter Date Here]

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | Owner Financing Contract is a legal document that outlines the agreement between a seller and buyer for the purchase of real estate, where the seller provides the financing to the buyer under agreed-upon terms. |

| Key Components | This contract typically includes terms such as down payment, interest rate, repayment schedule, and consequences of default. |

| Advantages for Buyers | Offers an alternative to traditional financing, potentially with more flexible qualifications and negotiable terms. |

| Advantages for Sellers | Can expedite the sale process, offer tax benefits, and provide a steady income stream from the interest payments. |

| Governing Laws | Vary by state but generally include real estate laws, contract laws, and in some cases, usury laws that govern the maximum interest rates that can be charged. |

Instructions on How to Fill Out Owner Financing Contract

Filling out an Owner Financing Contract form is an important step in the process of buying or selling a property through owner financing. This contract will outline the terms and conditions of the sale, including payment schedules, interest rates, and the rights and responsibilities of both parties. It is critical to complete the form accurately and thoroughly to ensure a smooth transaction and to protect the interests of both the buyer and the seller. Following a step-by-step guide will help simplify this process.

- Begin by gathering all necessary information, including the legal names of the buyer and seller, the property address, and a legal description of the property.

- Specify the sale price of the property and the down payment amount agreed upon by both parties.

- Detail the financing terms, including the loan amount (sale price minus the down payment), the interest rate, the number of payments, and the schedule of payments (e.g., monthly).

- Outline the responsibilities of the buyer, such as maintaining property insurance, paying property taxes, and keeping the property in good condition.

- Clarify the consequences of default by the buyer, including any rights to foreclosure the seller may have.

- Include a clause about the transfer of title, specifying when and how the title to the property will be transferred to the buyer.

- State any warranties or representations being made about the property.

- Add a dispute resolution clause, detailing how any disagreements between the buyer and seller will be handled (e.g., mediation or arbitration).

- Ensure both parties have space to sign and date the contract, and consider having the signatures notarized for extra legal validity.

- Review the contract thoroughly with all parties involved to ensure accuracy and understanding before signing.

After completing and signing the Owner Financing Contract, the next steps involve executing the agreement as outlined. Payments should be made according to the schedule, and both parties should fulfill their respective obligations under the terms of the contract. It’s advisable for both parties to keep a copy of the signed contract for their records. Proper adherence to the contract terms will contribute to a successful and smooth transition of property ownership.

Crucial Points on This Form

What is an Owner Financing Contract?

An Owner Financing Contract is a legal document that outlines the agreement between a seller and buyer when the seller provides financing to the buyer for the purchase of a property. This type of arrangement allows the buyer to make payments directly to the seller instead of obtaining a mortgage through a traditional lender. The contract details terms including the interest rate, repayment schedule, and consequences of default.

Who can benefit from using an Owner Financing Contract?

This form of financing can be advantageous for buyers who may not qualify for traditional bank loans due to credit issues or other reasons. It also benefits sellers who wish to sell their property quickly or are looking to generate a steady income stream from the interest payments. Additionally, it can be a useful tool in markets where buyers are scarce, providing sellers with a larger pool of potential purchasers.

What are the key components of an Owner Financing Contract?

Essential elements include the purchase price, down payment, interest rate, repayment schedule (including the length of the loan), and any balloon payments required. The agreement should also clearly state the responsibilities of both the buyer and seller regarding property taxes, insurance, and maintenance. It’s vital to specify the consequences of late payments or default by the buyer, including foreclosure procedures.

How does a buyer defaulting on payments affect the seller in an Owner Financing Agreement?

If a buyer defaults on payments, the seller has the right to initiate foreclosure proceedings to reclaim ownership of the property. This process varies by state but generally involves a legal process to terminate the buyer's equitable title to the property. The contract should outline the specific steps and timelines for default and foreclosure to ensure both parties are aware of the consequences.

Are there any risks involved with Owner Financing?

While owner financing can offer advantages to both buyers and sellers, it also carries risks. Buyers risk losing their investment and the property if they default on the loan. For sellers, the risk lies in the potential for buyers to default, requiring the seller to go through the foreclosure process. Additionally, if the buyer encounters financial troubles, it could delay payments, impacting the seller’s cash flow. It’s important for both parties to thoroughly assess their financial stability and understand the agreement fully before entering into an owner financing arrangement.

Common mistakes

When it comes to filling out an Owner Financing Contract form, a crucial document that outlines the terms and conditions of a property sale financed by the seller, many people stumble over common pitfalls. This process, while offering flexibility and potential savings, requires attention to detail and a clear understanding of the agreement's specifics. Here are five common mistakes to avoid:

Not verifying buyer or seller information: It's essential to double-check the accuracy of all personal information. This includes full names, addresses, and contact details. Incorrect information can lead to serious complications and delays.

Skipping over the legal description of the property: The contract must include a precise legal description of the property being sold, not just its address. This description should match the one on the property’s current deed to prevent any disputes over what is being sold.

Forgetting to specify the payment terms: The contract needs to clearly outline the payment schedule, interest rates, term of the loan, and any late fees. Vague or incomplete financial terms can lead to misunderstandings or legal challenges down the road.

Failing to include default provisions: It’s crucial to specify what constitutes a default on the loan and what the repercussions will be. Without this information, enforcing the contract or dealing with non-payment becomes much more difficult.

Not getting the contract notarized or failing to register the agreement: Many people overlook the importance of getting the contract notarized, which can lend authenticity to the document and protect against disputes. Additionally, not registering the agreement with the relevant local authority can affect the enforceability of the terms and the buyer's claim to the property.

Avoiding these mistakes will help ensure that the owner financing agreement is legally sound and clear to all parties involved. Both buyers and sellers should review the contract thoroughly, preferably with legal guidance, to ensure that their interests are well-protected and that the agreement complies with state laws. Remember, taking the time to fill out the contract correctly from the start can save a considerable amount of time, money, and stress in the future.

Documents used along the form

When entering into an owner financing agreement to purchase property, several additional documents and forms are often necessary to complement the Owner Financing Contract. These documents help to clarify the terms, provide legal protection, and ensure a smooth transaction process for both the buyer and the seller. Below is a list of common forms and documents that are typically utilized alongside the Owner Financing Contract.

- Promissory Note: This document outlines the details of the loan provided by the seller to the buyer, including the repayment schedule, interest rate, and the consequences of non-payment.

- Amortization Schedule: An amortization schedule provides a breakdown of each payment over the term of the loan, showing how much goes towards interest and how much towards reducing the principal balance.

- Mortgage or Deed of Trust: This document secures the loan and places a lien on the property, giving the lender the right to foreclose on the property if the borrower fails to comply with the terms of the loan.

- Title Search: A title search is done to ensure that the seller has a legal right to sell the property and that there are no undisclosed liens or encumbrances on the property.

- Title Insurance: Title insurance protects the buyer (and the lender, if applicable) from future claims against the property's title, such as undiscovered liens or discrepancies in the property's history.

- Home Inspection Report: A home inspection report provides a detailed assessment of the property’s condition, highlighting any areas that need repair or may cause concern in the future.

- Property Appraisal: An appraisal determines the property's market value to ensure the property is worth at least as much as the loan amount.

- Insurance Documents: Proof of homeowners' insurance is typically required, ensuring that the property is protected against damages or loss.

- Closing Statement: Also known as a HUD-1 or a closing disclosure, this document itemizes all the costs and fees associated with the transaction, paid by both the buyer and the seller.

These documents play critical roles in the owner financing process, safeguarding the interests of all parties involved. Each serves a specific purpose, from detailing the financial terms of the agreement to ensuring the property's condition and legal standing. When properly executed, they help to create a clear, enforceable, and fair transaction for the purchase of the property.

Similar forms

A Mortgage Agreement is similar because it also outlines the terms under which a borrower agrees to repay a loan for a property purchase. However, in a standard mortgage, a banking institution or lender is typically the one providing the loan, not the property owner.

A Deed of Trust shares similarities, as it serves as security for a loan related to real estate, involving a trustee who holds the property's legal title until the borrower pays off the loan. Like owner financing contracts, it's used in property transactions but involves a third-party trustee.

An Installment Sale Agreement is akin because it allows the buyer to make payments over time for the purchase of property, similar to the payer's obligations under an owner financing arrangement. It sets forth the purchase price, interest rate, and payment schedule.

A Promissory Note has parallels as it represents a borrower's promise to repay a sum of money to a lender. In an owner financing scenario, this document details the repayment terms between the property buyer (borrower) and the seller (lender).

The Real Estate Purchase Agreement is associated with an owner financing contract as it details the terms and conditions of a property sale, including price, closing details, and contingencies. The owner financing contract additionally outlines the financing terms directly between seller and buyer.

A Land Contract bears resemblance as it is an agreement where the seller provides financing to the buyer for purchasing land or a home, with the property deed transferring upon final payment. It shares the deferred payment structure of owner financing arrangements.

A Lease Option or Rent-to-Own Agreement is also comparable. It allows a renter the option to purchase the rental property during or at the end of the lease term, often with a portion of the rent going towards the purchase price. This provides a path to ownership akin to owner financing, albeit initially through a landlord-tenant relationship.

A Secured Loan Agreement is akin in that it ties the loan to collateral, securing the loan with the property being financed. In owner financing, the property itself acts as the collateral for the financing provided by the seller.

Dos and Don'ts

When engaging in the process of filling out an Owner Financing Contract form, it is essential to approach this task with diligence and attention to detail. The contract not only establishes the sale but also outlines the financing details provided by the seller to the buyer, making it a crucial document in the property transaction. Below are seven do's and don'ts to guide you through the proper completion of this form. Following these guidelines can help avoid common mistakes and ensure that the agreement stands on firm legal ground.

Do:

- Review all the sections thoroughly before filling out any information to ensure a comprehensive understanding of the terms and conditions.

- Use precise and clear language to avoid ambiguity, especially when describing the property and the terms of the financing.

- Include all relevant details about the payment structure, including the down payment, interest rate, monthly payment amounts, and the duration of the loan.

- Ensure that both parties’ full legal names and contact information are accurately noted to establish clear identification.

- Attach any required legal disclosures or additional agreements that might be relevant to the property or sale.

- Double-check all the numbers and legal descriptions to prevent costly errors.

- Consult with a legal professional or a real estate expert to review the contract before finalizing it.

Don’t:

- Overlook the need for a proper legal description of the property; a street address alone is not sufficient.

- Forget to specify who is responsible for taxes, insurance, and any other expenses related to the property.

- Leave blank spaces; if a section does not apply, mark it as “N/A” (not applicable) to avoid unauthorized additions later.

- Sign the contract without ensuring that the other party fully understands and agrees to the terms.

- Ignore state-specific legal requirements or clauses that might need to be included in the contract.

- Rely solely on verbal agreements — ensure that every significant element is captured in writing.

- Delay the registration or recording of the contract with the appropriate government agency, as required by law.

Misconceptions

Owner financing can be a game-changer in real estate transactions, allowing buyers to purchase directly from sellers under agreed-upon terms, without traditional bank involvement. However, several misconceptions surrounding Owner Financing Contracts can lead to confusion. Here's a clear-up of some common misunderstandings:

- It's only for buyers with bad credit. While owner financing can be a boon for those with less-than-ideal credit, it's also a strategic option for buyers seeking a faster transaction or those who want to avoid stringent bank requirements.

- The terms are always favorable to the seller. The terms of an Owner Financing Contract must be mutually agreed upon. Both parties have the power to negotiate interest rates, repayment schedules, and other conditions to their mutual benefit.

- There's no legal oversight. This is a myth. Owner financing must comply with federal and state real estate laws, including those governing interest rates and lending practices.

- Contracts are less formal. Despite the direct nature of the agreement between buyer and seller, an Owner Financing Contract is a legally binding document that should be as detailed and formal as any traditional real estate contract.

- Owner financing doesn't require a down payment. While some owner-financed deals may have lower down payment requirements, sellers often require one to secure the buyer's commitment and protect their interests.

- The seller can change the terms anytime. Once signed, the terms of the contract cannot be altered unless both parties agree to the changes. This includes interest rates, repayment schedule, and any other agreed-upon conditions.

- It's easier to foreclose on a buyer. Foreclosure laws still apply in owner financing agreements. Sellers must follow legal procedures, which can often be as complex and time-consuming as in traditional lender foreclosures.

- Owner financing is not reported on credit reports. This is only true if the parties involved choose not to report it. Both buyers and sellers can agree to report the transaction to credit bureaus, which can affect both of their credit scores.

- Insurance and taxes are the seller’s responsibility. Responsibility for property taxes, insurance, and maintenance after the sale varies by contract but typically shifts to the buyer, similar to traditional property purchases.

- Sellers offering owner financing are desperate. Many sellers opt for owner financing to expedite the sale, avoid lender fees, or invest in a potentially lucrative financing arrangement. It's an active choice, not a last resort.

Understanding these misconceptions about Owner Financing Contracts is crucial for both buyers and sellers considering this alternative financing option. It ensures that all parties enter into agreements with clear expectations and protects the interests of everyone involved.

Key takeaways

When it comes to navigating the complexities of owner financing, understanding the Owner Financing Contract form is crucial. This form acts as the bedrock of the agreement between the seller, acting as the lender, and the buyer. The following key takeaways help illuminate the most important aspects to consider.

- Before filling out the form, both parties should fully understand the terms and conditions laid out in the contract. This includes the purchase price, interest rate, repayment schedule, and any other conditions or contingencies tied to the financing arrangement.

- The contract should clearly state the legal names of all parties involved, including co-buyers if applicable. This ensures that the responsibilities and rights under the contract are legally attributed to the correct individuals.

- Attention to detail is key when specifying the financial aspects of the agreement. The document must accurately reflect the loan amount, interest rates, payment schedules, late fees, and any penalties for early repayment. Incorrect information can lead to disputes or legal challenges down the road.

- Security interests must be properly outlined in the contract. This section details the seller's right to reclaim the property if the buyer defaults on the loan. It should specify the conditions under which a default occurs and the process for foreclosure, if necessary.

- Both parties should review the final contract carefully before signing. It’s advisable to consult with a legal or real estate professional to ensure that the agreement complies with state laws and adequately protects both parties' interests. Once signed, the contract is legally binding, and both the buyer and seller should retain a copy for their records.

Understanding these key aspects of the Owner Financing Contract form can significantly streamline the owner financing process, ensuring clarity and fairness for both the buyer and seller. It’s a tool that requires careful consideration and accurate completion to effectively facilitate the transfer of property ownership under a financing arrangement directly negotiated between the parties involved.

Discover Other Types of Owner Financing Contract Documents

How to Fire a Realtor Example Letter - Enables a smooth transition out of a contractual agreement, facilitating easier recovery and movement into new opportunities.