Blank Real Estate Purchase Agreement Form for Texas

In the vast landscape of real estate transactions in Texas, a crucial document stands at the center, holding significant importance for both buyers and sellers: the Texas Real Estate Purchase Agreement form. This comprehensive document not only outlines the terms and conditions under which a property will be transferred but also serves as a legally binding contract that meticulously details the agreed-upon price, contingencies, date of possession, and other essential aspects of the sale. It acts as a roadmap, guiding both parties through the complexities of the transaction process, ensuring that each step is legally sound and in their best interest. Notably, the agreement sets forth specific obligations and protections for all involved, making it indispensable for successfully navigating the nuances of buying or selling property in Texas. As such, understanding the components and legal implications of this form is paramount for anyone looking to engage in real estate transactions within the state.

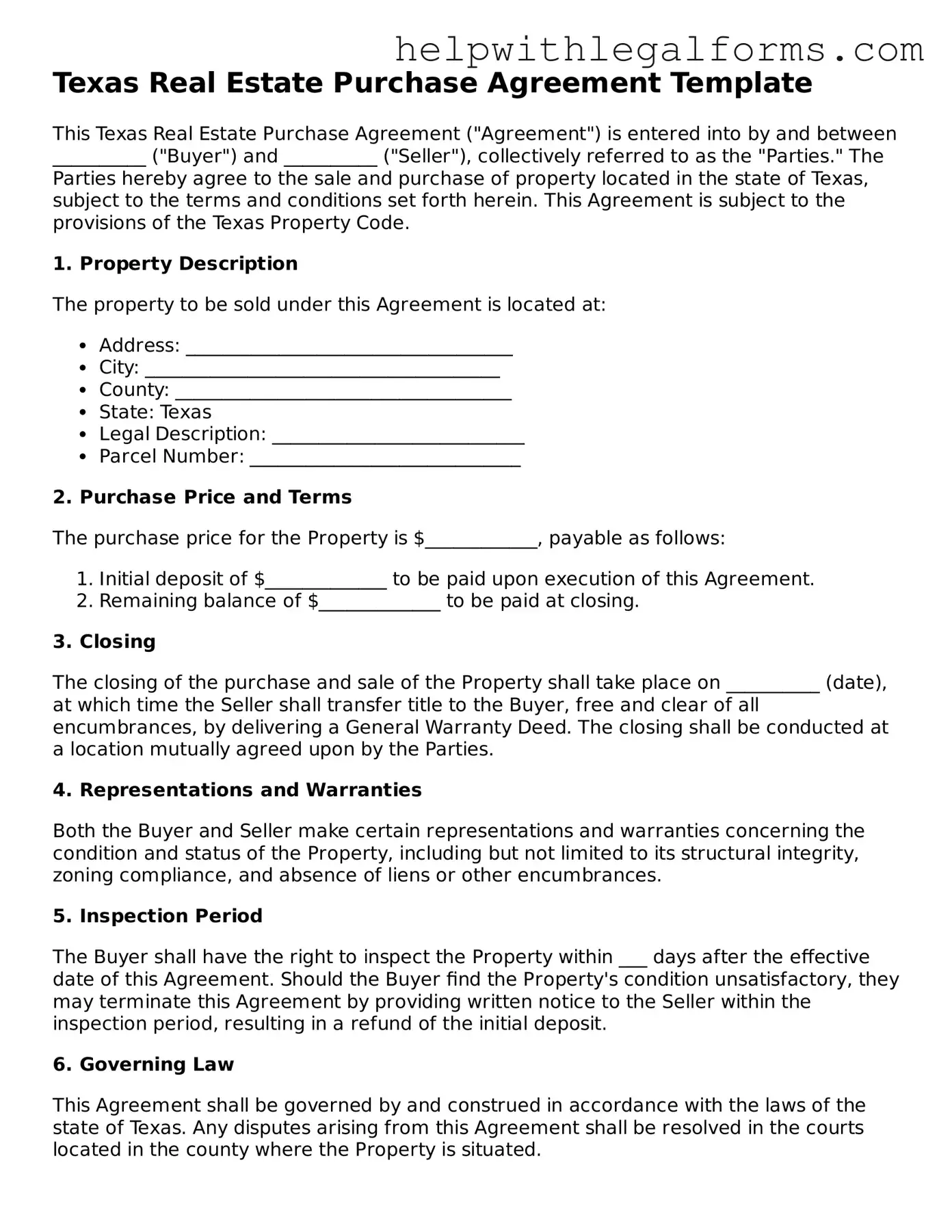

Example - Texas Real Estate Purchase Agreement Form

Texas Real Estate Purchase Agreement Template

This Texas Real Estate Purchase Agreement ("Agreement") is entered into by and between __________ ("Buyer") and __________ ("Seller"), collectively referred to as the "Parties." The Parties hereby agree to the sale and purchase of property located in the state of Texas, subject to the terms and conditions set forth herein. This Agreement is subject to the provisions of the Texas Property Code.

1. Property Description

The property to be sold under this Agreement is located at:

- Address: ___________________________________

- City: ______________________________________

- County: ____________________________________

- State: Texas

- Legal Description: ___________________________

- Parcel Number: _____________________________

2. Purchase Price and Terms

The purchase price for the Property is $____________, payable as follows:

- Initial deposit of $_____________ to be paid upon execution of this Agreement.

- Remaining balance of $_____________ to be paid at closing.

3. Closing

The closing of the purchase and sale of the Property shall take place on __________ (date), at which time the Seller shall transfer title to the Buyer, free and clear of all encumbrances, by delivering a General Warranty Deed. The closing shall be conducted at a location mutually agreed upon by the Parties.

4. Representations and Warranties

Both the Buyer and Seller make certain representations and warranties concerning the condition and status of the Property, including but not limited to its structural integrity, zoning compliance, and absence of liens or other encumbrances.

5. Inspection Period

The Buyer shall have the right to inspect the Property within ___ days after the effective date of this Agreement. Should the Buyer find the Property's condition unsatisfactory, they may terminate this Agreement by providing written notice to the Seller within the inspection period, resulting in a refund of the initial deposit.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the state of Texas. Any disputes arising from this Agreement shall be resolved in the courts located in the county where the Property is situated.

7. Entire Agreement

This Agreement constitutes the entire agreement between the Parties concerning the subject matter hereof and supersedes all previous agreements, promises, proposals, representations, understandings, and negotiations, whether written or oral, between the Parties.

8. Amendment

Any amendment to this Agreement must be in writing and signed by both Parties to be effective.

9. Signatures

This Agreement is executed by the Parties as of the ___ day of __________, 20__.

____________________________________

Buyer's Signature

____________________________________

Seller's Signature

PDF Form Attributes

| Fact | Description |

|---|---|

| 1. Definition | The Texas Real Estate Purchase Agreement is a legally binding document between a seller and buyer for the purchase and sale of real estate in Texas. |

| 2. Governing Law | This agreement is governed by the laws of the State of Texas, specifically the Texas Property Code. |

| 3. Essential Elements | It typically includes details such as property description, purchase price, closing date, and contingencies. |

| 4. Use of Form | Utilized for residential, commercial, and undeveloped real estate transactions. |

| 5. Mandatory Disclosures | Texas law requires sellers to disclose certain property conditions and defects to buyers, outlined in a disclosure form. |

| 6. Financing Terms | The agreement details the financing arrangements, including whether the purchase will be made in cash, through a new mortgage, or assuming an existing mortgage. |

| 7. Closing Costs | Specifies who is responsible for paying closing costs, such as title insurance, escrow fees, and real estate commissions. |

| 8. Signature Requirement | All parties involved must sign the agreement for it to be legally binding. |

| 9. Mediation Clause | Many agreements include a clause requiring mediation in the event of a dispute before taking legal action. |

Instructions on How to Fill Out Texas Real Estate Purchase Agreement

Filling out a Texas Real Estate Purchase Agreement form is a critical step in the process of buying or selling property in Texas. This document outlines the terms and conditions of the sale, including the purchase price, property details, and closing information. To ensure a smooth transaction, it's essential to complete this form accurately and thoroughly. Follow these steps to correctly fill out the form.

- Start by entering the date of the agreement at the top of the form.

- Fill in the full legal names of both the buyer and the seller in the designated sections.

- Provide a detailed description of the property being sold, including its address, legal description, and any additional identifying information.

- Enter the total purchase price in the space provided. Ensure this amount is accurate and has been agreed upon by both parties.

- Detail any earnest money deposit made by the buyer, including the amount and the institution holding the deposit.

- List the terms of the financing, if applicable, specifying whether the purchase will be made with cash, a loan, or other financing arrangements.

- Specify the closing date and location where the final transaction will take place.

- Include any contingencies or conditions that must be met before the sale is finalized, such as inspection requirements or the need to sell a current home.

- Outline the responsibilities of both the buyer and the seller regarding property taxes, utilities, and other fees until the closing date.

- Sign and date the form. Both the buyer and the seller must provide their signatures to make the agreement legally binding.

After completing these steps, the next part of the process involves exchanging the signed agreement, along with any initial deposit, between the buyer and seller. This exchange marks the formal acceptance of the sale's terms and conditions. Subsequently, both parties should work towards meeting any contingencies outlined in the agreement and preparing for the closing date. Ensuring each step is completed attentively is crucial for a successful real estate transaction.

Crucial Points on This Form

What is a Texas Real Estate Purchase Agreement?

A Texas Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions of the sale and purchase of real estate property in the state of Texas. This agreement specifies the details of the transaction including the purchase price, property description, and the rights and obligations of both the buyer and seller.

Who needs to sign the Texas Real Estate Purchase Agreement?

The agreement must be signed by all parties involved in the transaction. This includes the buyer(s) and the seller(s) of the property. If the property is owned by more than one person or entity, each must sign the agreement to ensure it is legally binding.

Are there any disclosures required by law in Texas to be included in the Purchase Agreement?

Yes, Texas law requires certain disclosures to be made. These include disclosure of the property's condition, any known defects, and whether the property lies in a flood zone. The seller must also provide a lead-based paint disclosure for properties built before 1978.

What happens if either party wants to back out of the agreement?

If a party wishes to back out of the agreement, the consequences depend on the terms outlined in the agreement itself and the reason for termination. There may be financial penalties or earnest money may not be refunded. It's important to understand the termination provisions within the agreement.

How does earnest money work within the Texas Real Estate Purchase Agreement?

Ernest money is a deposit made by the buyer as a show of good faith. The amount and terms regarding the earnest money, such as how it will be held and conditions for its return, are detailed in the Purchase Agreement. If the sale proceeds, this deposit typically goes towards the purchase price of the home.

Is a Texas Real Estate Purchase Agreement customizable?

Yes, while there are standard forms available, parties can customize the agreement to include specific terms and conditions to suit their needs. However, it’s important to ensure that any additions or changes comply with Texas law and to possibly consult a real estate attorney.

What is the role of a real estate agent in the creation of the Purchase Agreement?

A real estate agent can facilitate the creation of the Purchase Agreement by ensuring all necessary information is included and that the document adheres to state legal requirements. However, an agent cannot provide legal advice unless they are also a licensed attorney.

How is the purchase price determined and documented in the agreement?

The purchase price is typically determined through negotiation between the buyer and seller and once agreed upon, is documented in the Purchase Agreement. This section of the agreement will outline the total purchase price, any deposits made, and the balance to be paid at closing.

What should be done if a dispute arises during the transaction process?

If a dispute arises, the first step is to refer to the dispute resolution process outlined in the Purchase Agreement. This may include mediation or arbitration. Consulting a real estate attorney can also help resolve disputes and provide guidance on legal rights and obligations.

Common mistakes

In the often complex process of buying or selling property in Texas, the Real Estate Purchase Agreement form is a critical document. It outlines the terms and conditions of the sale, including the purchase price, property description, and closing details. However, it's common for individuals to make mistakes when filling out this form, which can lead to delays, disputes, or the deal falling through altogether. Here are four common mistakes people make:

Not verifying all parties' legal names: It's crucial to use the full, legal names of all parties involved in the transaction. This includes middle names or initials if they are part of the legal name. Incorrect names can lead to issues with the title and other legal documents.

Overlooking property descriptions: The legal description of the property, not just the address, must be accurately included. This description is critical for identifying the exact boundaries and size of the property being sold and should match the one used in public records.

Failing to specify fixtures and non-fixtures: Items within the property that will be included in or excluded from the sale (like appliances, lighting fixtures, or window treatments) need to be clearly listed. This prevents misunderstandings about what is considered part of the property versus personal property of the seller.

Not setting a clear closing date: The agreement should specify a closing date, which is when the transaction is to be finalized. A vague timeline can cause confusion and conflicts between the buyer and seller, potentially delaying the sale.

Mistakes in a Real Estate Purchase Agreement in Texas can be costly and time-consuming to correct. Paying attention to these details can help ensure a smoother transaction for all parties involved.

Documents used along the form

When engaging in a real estate transaction in Texas, the Real Estate Purchase Agreement form is pivotal. However, it rarely stands alone in the complexity of such transactions. Various supporting documents and forms often accompany this key agreement to ensure a comprehensive, legally binding purchase or sale. These documents can help clarify terms, provide necessary disclosures, and offer protections to both buyers and sellers. Below is a list of up to eight other documents that are commonly used in conjunction with the Texas Real Estate Purchase Agreement.

- Addendum for Property Subject to Mandatory Membership in a Property Owners Association: This document is essential when the property in question is part of a homeowners association (HOA). It outlines the buyer's obligations to the HOA and any fees or assessments due.

- Seller's Disclosure Notice: Texas law requires sellers to provide this form, which discloses the seller's knowledge of the property's condition, including any known defects or malfunctions. It serves to inform the buyer and reduce liability for the seller.

- Third-Party Financing Addendum: When a buyer intends to finance the purchase through a lender, this addendum details the terms of the loan that must be secured for the transaction to proceed and may condition the sale on obtaining this financing.

- Amendment to Contract: This form allows both parties to make changes or corrections to the initial Purchase Agreement before closing. It can cover adjustments in the sale price, closing date, or other contract terms.

- Residential Service Contract: This document outlines the agreement between a homeowner and a service provider for the repair or replacement of home systems and appliances. Buyers often request sellers to provide a residential service contract as part of the transaction.

- Lead-Based Paint Addendum: For homes built before 1978, federal law requires this addendum, which discloses the presence of any known lead-based paint. It provides buyers with information about the dangers of lead-based paint and their rights related to lead paint disclosure.

- Notice of Termination of Contract: This form is used if either party chooses to terminate the agreement pursuant to its terms, specifying the reasons for termination and outlining any financial obligations that result from this action.

- Non-Realty Items Addendum: Items not attached to the property, such as furniture or appliances, that the buyer and seller agree to include in the sale of the property are listed in this addendum, making clear which items are part of the purchase.

Each of these documents plays a critical role in addressing specific aspects of a real estate transaction, complementing the Real Estate Purchase Agreement to ensure a smooth process. Whether you are a buyer or a seller, understanding these documents and how they interact with the main agreement will help you navigate the complexities of buying or selling property in Texas confidently and securely.

Similar forms

A Bill of Sale - This document, much like the Real Estate Purchase Agreement, is a formal instrument used to convey ownership of personal property from seller to buyer. Both detail the terms of the sale, including the price and description of the property being transferred.

A Lease Agreement - While a Lease Agreement pertains to renting property rather than buying, it similarly outlines the terms between two parties: the landlord and the tenant. Both agreements specify conditions, such as payment terms and duration of the agreement, creating a binding contract.

A Land Contract - A Land Contract is a form of seller financing for real estate transactions, closely related to the Real Estate Purchase Agreement. Both documents formalize an agreement between buyer and seller, establishing payment terms, responsibilities, and the transfer of ownership contingent on payment fulfillment.

A Mortgage Agreement - This document secures the loan provided by a lender to the borrower for purchasing real estate, establishing a lien on the property. Similar to a Real Estate Purchase Agreement, it outlines terms of the financial agreement, but it focuses on the loan specifics rather than the sale terms.

A Deed of Trust - Used in some states in place of a mortgage, a Deed of Trust involves a trustee, who holds the property's title until the loan is paid off. Like a Real Estate Purchase Agreement, it’s integral to the process of transferring property ownership, albeit focusing on securing a loan.

A Title Insurance Policy - While not a contractual agreement between buyer and seller, this policy safeguards against future disputes over property ownership, complementing the Real Estate Purchase Agreement by ensuring the buyer receives clear title.

A Home Inspection Report - Preceding or accompanying the Real Estate Purchase Agreement, this report details the condition of the property. It informs the terms of the agreement, particularly in negotiations over repairs and price adjustments based on the property's condition.

A Escrow Agreement - An Escrow Agreement is intermediary, ensuring that the buyer's funds are securely held until all conditions of the Real Estate Purchase Agreement are met. It plays a pivotal role in managing and finalizing the complex transactions detailed in the agreement.

A Property Disclosure Statement - Sellers provide this document to inform buyers of any known issues with the property. Though not a contract, it is closely tied to the Real Estate Purchase Agreement by influencing negotiations and safeguarding the buyer's interests through disclosure.

Dos and Don'ts

Filling out the Texas Real Estate Purchase Agreement form is a critical step in the process of buying or selling a property in Texas. This legal document lays out the terms and conditions of the sale, ensuring both parties are clear about their rights and obligations. To navigate this process smoothly, here are several do's and don'ts one should follow:

DO:- Read the Entire Form Carefully: Before filling out any section, ensure you understand every part of the agreement. This understanding will help prevent any mistakes or misunderstandings.

- Use Clear and Precise Language: Ambiguity can lead to disputes. Be as clear and explicit as you can to describe the terms, conditions, and the property itself.

- Verify All Information: Double-check the property descriptions, legal names of the parties, prices, and dates. Errors in these areas can invalidate the agreement or cause significant delays.

- Consult a Real Estate Professional or Lawyer: If there’s any aspect of the agreement you’re unsure about, seeking professional advice can prevent legal issues down the line.

- Include All Relevant Attachments: This might include disclosures, addendums, or inspections reports. These documents become part of the agreement and must be acknowledged by all parties.

- Rush Through the Process: Take your time to ensure every piece of information is accurate and every necessary section is completed properly.

- Leave Blank Spaces: If a section does not apply, mark it as ‘N/A’ (not applicable) instead of leaving it blank. This approach prevents unauthorized alterations after signing.

- Forget to Initial Changes: Should there be any changes or corrections made to the agreement after the initial signatures, make sure all parties initial these changes to acknowledge them.

- Sign Without Understanding: Never sign the agreement if you have doubts or questions about its terms. Signing without a full understanding can lead to enforceable obligations you may not be prepared for.

Misconceptions

When it comes to buying or selling property in Texas, the Real Estate Purchase Agreement form plays a crucial role. However, several misconceptions surround this document, leading to confusion and misunderstanding. Here are five common misconceptions clarified for better understanding:

One size fits all: Many believe that the Texas Real Estate Purchase Agreement is a universal template that fits every transaction. In reality, this document should be tailored to the specific details of each deal, including terms, conditions, and any contingencies relevant to the parties involved.

Attorney involvement is not necessary: While it's true that Texas law doesn't require an attorney to draft or review the Real Estate Purchase Agreement, it's often in the best interest of both parties to seek legal advice. Attorneys can identify potential issues, ensure the agreement aligns with current laws, and protect the interests of their clients.

Verbal agreements are binding: Another common misconception is that verbal agreements regarding real estate transactions are enforceable in Texas. For a real estate purchase agreement to be legally binding, it must be in writing and signed by both parties. Verbal promises or handshake deals are not legally enforceable agreements.

The form is only about the sale price: While the sale price is certainly a crucial component of the agreement, the form encompasses much more. It addresses other critical aspects such as financing, inspections, repairs, contingencies, and closing details. Each of these sections plays a significant role in the overall transaction.

Amendments are straightforward: Some believe that changing the agreement after it has been signed is as simple as making a verbal agreement or a handshake deal. However, any amendments to the contract must be made in writing and signed by both parties to be legally effective. This ensures that all changes are documented and agreed upon, reducing the risk of future disputes.

Understanding these misconceptions can help buyers and sellers navigate their real estate transactions more smoothly. Ensuring all parties are on the same page and have a clear, written agreement can prevent misunderstandings and legal issues down the road.

Key takeaways

When navigating the process of buying or selling property in Texas, the Real Estate Purchase Agreement form plays a pivotal role. Here are six key takeaways to understand when filling out and utilizing this form:

- Accuracy is Crucial: Every detail entered into the Texas Real Estate Purchase Agreement must be accurate. This includes names of the buyer and seller, property details, and price. Inaccuracies could cause significant delays or legal complications.

- Legal Descriptions are Essential: The property's legal description goes beyond its street address. It includes detailed information that uniquely identifies the property in legal terms. This description ensures the correct property is being transferred.

- Understand Contingencies: Contingencies are conditions that must be met for the sale to proceed. Common contingencies include the buyer securing financing, the results of a home inspection, and the ability to sell an existing home. Each party should clearly understand these conditions.

- Disclosures are Required: Sellers are obligated to disclose certain information about the property's condition and history. These disclosures are necessary for informing the buyer and protecting the seller from future legal issues caused by undisclosed defects.

- Review Closing Costs and Fees: The agreement should itemize the closing costs and who is responsible for each. This can include taxes, agent commissions, and title search fees. Understanding these expenses in advance prevents surprises at closing.

- Seek Legal Advice: Given the legal complexities and significant financial implications, consulting with a professional experienced in Texas real estate law is advisable. This ensures that your interests are fully protected throughout the transaction.

Create Other Real Estate Purchase Agreement Forms for US States

Colorado Real Estate Commission - Facilitates the negotiation process by providing a framework for discussing the sale's terms.

Connecticut Real Estate Contract - The agreement details any included fixtures or personal property that will remain in the home, such as appliances or window treatments.