Legal Mortgage Lien Release Form

For homeowners, one of the most significant moments in the journey of homeownership is the day they can officially claim their property free and clear of a mortgage. This pivotal occasion is marked by obtaining a Mortgage Lien Release form, a critical document that signifies the satisfaction of the homeowner's mortgage debt, thereby releasing the lien the lender held on the property. This process not only represents the culmination of years of mortgage payments but also the legal reassurance that the property is fully theirs, free from claims by the lender. The Mortgage Lien Release form is the key to updating public records to reflect this new status, ensuring that any future transactions involving the property can proceed smoothly. Understanding the steps to obtain and file this document, recognizing its importance in the realm of property ownership, and being aware of common pitfalls are essential for any homeowner looking to navigate this process successfully.

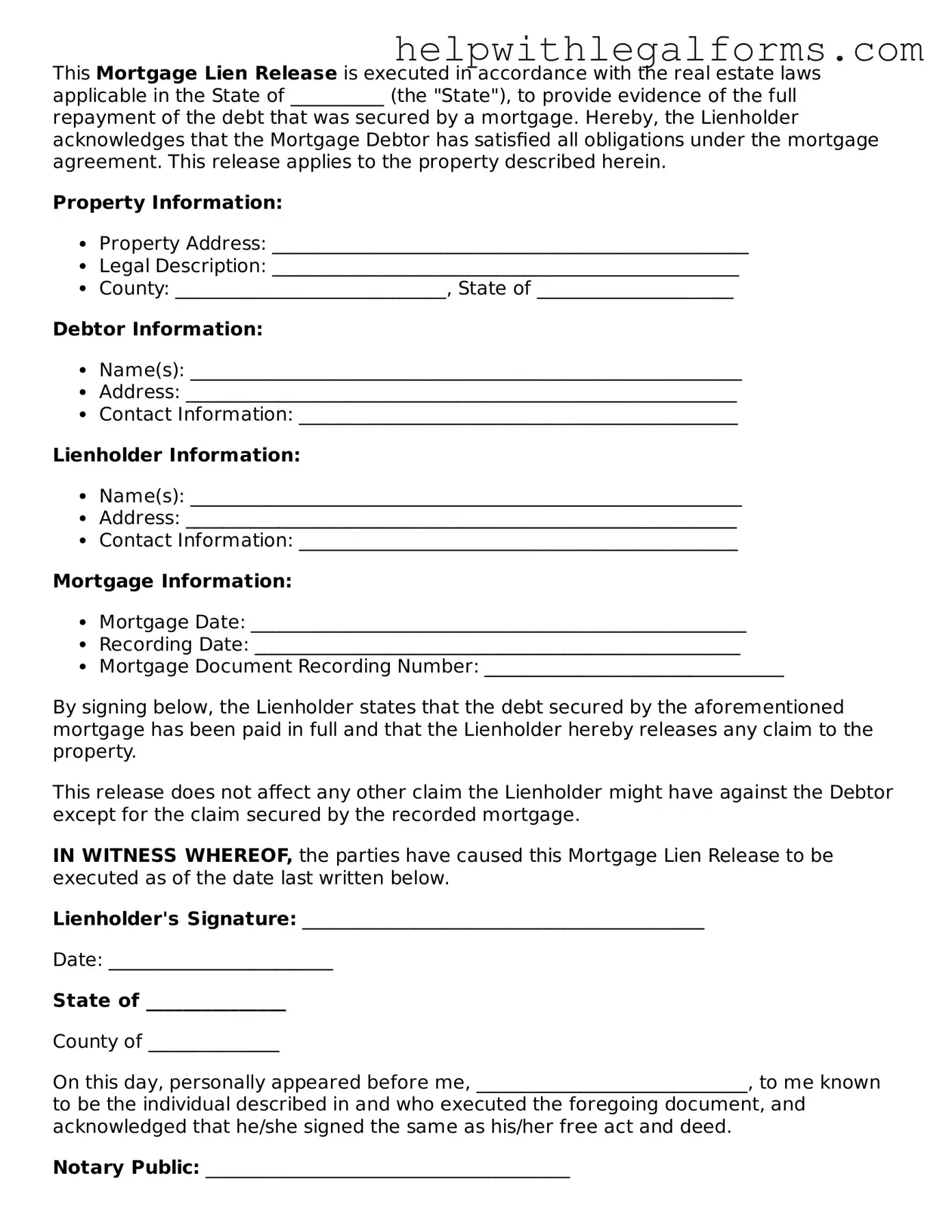

Example - Mortgage Lien Release Form

This Mortgage Lien Release is executed in accordance with the real estate laws applicable in the State of __________ (the "State"), to provide evidence of the full repayment of the debt that was secured by a mortgage. Hereby, the Lienholder acknowledges that the Mortgage Debtor has satisfied all obligations under the mortgage agreement. This release applies to the property described herein.

Property Information:

- Property Address: ___________________________________________________

- Legal Description: __________________________________________________

- County: _____________________________, State of _____________________

Debtor Information:

- Name(s): ___________________________________________________________

- Address: ___________________________________________________________

- Contact Information: _______________________________________________

Lienholder Information:

- Name(s): ___________________________________________________________

- Address: ___________________________________________________________

- Contact Information: _______________________________________________

Mortgage Information:

- Mortgage Date: _____________________________________________________

- Recording Date: ____________________________________________________

- Mortgage Document Recording Number: ________________________________

By signing below, the Lienholder states that the debt secured by the aforementioned mortgage has been paid in full and that the Lienholder hereby releases any claim to the property.

This release does not affect any other claim the Lienholder might have against the Debtor except for the claim secured by the recorded mortgage.

IN WITNESS WHEREOF, the parties have caused this Mortgage Lien Release to be executed as of the date last written below.

Lienholder's Signature: ___________________________________________

Date: ________________________

State of _______________

County of ______________

On this day, personally appeared before me, _____________________________, to me known to be the individual described in and who executed the foregoing document, and acknowledged that he/she signed the same as his/her free act and deed.

Notary Public: _______________________________________

My Commission Expires: __________________

PDF Form Attributes

| Fact Number | Description |

|---|---|

| 1 | A Mortgage Lien Release form is used to officially remove a mortgage lien from the property records after a mortgage loan is fully paid off. |

| 2 | This form must be filed with the county recorder's office or a similar local government body that handles property records. |

| 3 | The exact name and form requirements can vary by state, reflecting differences in state laws and recording practices. |

| 4 | In some states, the form might be called a "Satisfaction of Mortgage" or "Deed of Reconveyance" instead of a Mortgage Lien Release. |

| 5 | The document generally requires information such as the original mortgage date, the parties involved, the property address, and the recording information from the original mortgage. |

| 6 | Some states, like California, require the use of a notary public to witness the signing of the document, adding an extra layer of authenticity. |

| 7 | Failure to properly file a Mortgage Lien Release can lead to title issues, making it difficult to sell or refinance the property in the future. |

| 8 | There is usually a fee to record the document, which varies depending on the location and sometimes the document's length. |

| 9 | The laws governing Mortgage Lien Release forms include, but are not limited to, state-specific mortgage satisfaction statutes and recording statutes. |

Instructions on How to Fill Out Mortgage Lien Release

When a mortgage has been paid in full, the next crucial step is to ensure the lien is released from the property title. This process is finalized by filling out a Mortgage Lien Release form, a document that officially removes the lender's legal right to the property, allowing the homeowner full ownership. Completing this form accurately is fundamental in updating property records and avoiding future legal complications. Here are the detailed steps to help guide you through filling out the Mortgage Lien Release form correctly.

- Gather all necessary documents, including your mortgage account number, the payoff statement, and any correspondence with your lender regarding the loan's full repayment.

- Locate the appropriate Mortgage Lien Release form. This may be provided by your lender or obtained from your local county recorder's office.

- Begin by entering your personal information in the specified sections. This typically includes your full name, address, and contact details.

- Fill in the property information section, which requires the full address of the property, its legal description (often found on your original mortgage agreement or property deed), and the parcel or tax ID number.

- Provide detailed information about the mortgage, including the lender's name, the original loan amount, the account number, and the date the mortgage was paid off.

- Some forms may require information about the recording of the original mortgage, such as the book and page number or document number in the county records. This information can usually be found on your deed of trust or mortgage agreement.

- If applicable, fill in the section for the preparer's information. This may include the name and address of the individual or company that prepared the release document, if not filled out by the homeowner.

- Review the form thoroughly to ensure all provided information is accurate and complete. Mistakes or missing information can delay the lien release process.

- Sign the form in the designated area. Depending on your state's requirements, this signature may need to be notarized.

- Submit the completed Mortgage Lien Release form to the county recorder's office where the property is located. There may be a filing fee, which varies by county.

- Wait for confirmation that the lien has been released. This may be a stamped copy of the filed form or a separate document from the county recorder. Keep this confirmation for your records.

Once the Mortgage Lien Release form is correctly filed and processed, it marks a significant milestone in homeownership, securing your rights as the property's sole owner. It's essential to keep a copy of the lien release and any related documents in a safe place for future reference. If you encounter difficulties at any point in this process, consulting with a legal professional or your lender can provide clarity and assistance, ensuring that the lien release is completed smoothly.

Crucial Points on This Form

What is a Mortgage Lien Release form?

A Mortgage Lien Release form is a document issued by a lender to a borrower, indicating that the borrower has fully paid off their mortgage loan. This form effectively removes the lender's claim or "lien" on the property, granting the homeowner clear title. It's a critical document for homeowners, confirming they no longer owe the lender any payments against their property.

How do I obtain a Mortgage Lien Release form?

To obtain a Mortgage Lien Release form, you should first ensure that your mortgage has been paid in full. Upon the final payment, the lender is typically responsible for preparing and sending the Mortgage Lien Release form to the appropriate county office to be recorded. However, if the lender does not take this step, you may need to contact them directly to request the release. It's also advisable to check your local county recorder's office to see if the release has been filed.

What happens if the Mortgage Lien Release form is not filed?

If the Mortgage Lien Release form is not filed, the mortgage lien remains on your property, which means the property is technically still considered security for the loan. This can create complications when you try to sell or refinance your home, as it appears you still have a mortgage debt. To avoid potential challenges, it's important to ensure that the form is properly filed with your county's land records or registrar's office.

Is there a deadline for filing the Mortgage Lien Release form?

Yes, there are typically deadlines for filing the Mortgage Lien Release form, but they can vary by state or local jurisdiction. Most areas require the form to be filed within a certain period after the mortgage has been fully paid off. Failure to file within this timeframe can lead to fines or penalties. Homeowners should check with their local recording office for specific deadlines to ensure timely filing and avoid any unnecessary complications.

Common mistakes

Filling out a Mortgage Lien Release form is a critical step in the journey to owning your home free and clear. However, many people find this process challenging and are prone to making errors. Here are seven common mistakes made when filling out this form:

Not Verifying the Correctness of the Property Description: The legal description of your property must match the one on your original mortgage documents exactly. Misrepresentations, even minor ones, can invalidate your lien release.

Failing to Check the Accuracy of the Loan Information: It's essential to ensure that all loan information, including the loan number, original loan amount, and the borrower's name, is accurate and matches the details from the mortgage.

Overlooking Signatory Requirements: Different states have varying requirements on who must sign the Mortgage Lien Release form. Sometimes, both the lender and borrower need to sign, while other times, only the lender's signature is necessary. Misunderstanding these requirements can result in the rejection of the form.

Incorrectly Dating the Document: The release date should accurately reflect when the final payment was made on the mortgage. Incorrect dating can lead to processing delays or even the necessity to refile the document.

Neglecting to Find Out if a Witness or Notarization is Needed: Depending on jurisdiction, having the form witnessed or notarized might be a requirement. Skipping this step can lead to the document being considered invalid.

Submitting Incomplete Forms: All required fields on the form must be filled out. Leaving sections blank or partially filled can cause delays or outright rejection of the lien release process.

Failure to Confirm Recording Requirements with the Local Office: Once signed and, if necessary, notarized, the Mortgage Lien Release form often needs to be recorded with the local county clerk or similar office. Not confirming their specific filing requirements, such as fee payments or additional needed documents, can prevent the release from being officially recorded.

Being mindful of these common errors and taking steps to avoid them can ensure a smoother process in releasing the lien on your property. Proper attention to detail and adherence to the specific requirements of your jurisdiction help pave the way to achieving clear ownership of your home.

Documents used along the form

When a mortgage is fully paid off, a Mortgage Lien Release form is often just the last step in a series of documents that signal the end of a homeowner's loan obligations. This formal process involves several important documents, each serving a unique purpose in the transition from being a borrower to owning the home outright. Here, we'll explore some of these crucial documents that are commonly used alongside the Mortgage Lien Release form to ensure a smooth and correctly documented end to a mortgage.

- Original Mortgage Note: This is the borrower's promise to repay the loan. It is returned to the borrower once the mortgage is paid off.

- Deed of Trust: This document secures the mortgage note and ties the debt to the physical property. A release of the Deed of Trust is often required alongside the Mortgage Lien Release.

- Final Amortization Schedule: This shows all payments made over the loan's life, proving the loan is fully repaid and justifying the release of the lien.

- Loan Payoff Statement: Issued by the lender, it details the exact amount required to pay off the mortgage, including any fees or additional charges.

- Cancellation of Debt (Form 1099-C): If any of the mortgage debt is forgiven, this form is necessary for tax purposes.

- Title Insurance Policy: Though not directly part of the mortgage payoff process, ensuring you have a title insurance policy is wise to protect against any future claims against the property's title.

- Homeowners Insurance Policy: Similarly, maintaining homeowners insurance is important, even after the mortgage is paid off, to protect the property from unforeseen damages.

- Property Tax Statements: These documents ensure all property taxes are paid up to date, which is crucial before a Mortgage Lien Release can be processed.

- Government Recording Fees: Receipts for any fees paid to record the Mortgage Lien Release and any other relevant documents in the public record.

- Receipt of Payment and Satisfaction Letter: This document from the lender acknowledges full payment of the mortgage and the closure of the loan account.

Completing a mortgage brings a deep sense of accomplishment and relief to homeowners. The documents listed above are key components in ensuring the mortgage payoff process is documented thoroughly and legally. Each plays a role in finalizing the homeowner's journey from borrower to outright owner, paving the way for a future free of mortgage payments. Navigating these documents can seem daunting, but they are all steps toward securing financial freedom and the full ownership of one’s home.

Similar forms

Deed of Trust Release: This document certifies the repayment of a loan that was secured by real estate. Like a mortgage lien release, it serves as evidence that the borrower has fulfilled their obligations under the loan, leading to the removal of the lien from the property title.

Satisfaction of Mortgage: Similar to a mortgage lien release, this document is issued by the lender once a mortgage is fully paid off. It acknowledges that the debt secured by the property has been satisfied, effectively clearing the title of the lien associated with the mortgage.

UCC Financing Statement Termination: Employed in the context of personal property rather than real estate, this form signals the end of a secured interest as outlined in a UCC Financing Statement. Analogous to a mortgage lien release, it indicates the debtor has repaid the secured debt.

Lien Waiver: Used in construction, this document is issued to state that a contractor or supplier has received payment and waives future lien rights to the property. While its use is generally for construction, its concept of releasing property from potential liens aligns with that of a mortgage lien release.

Release of Judgment Lien: This form is issued once a judgment debt (for example, from a lawsuit) is satisfied. Similar to a mortgage lien release, it effectively removes the judgment lien from the property title, indicating that the debt has been paid.

Automobile Lien Release: When a vehicle loan has been paid off, this document removes the lender's secured interest in the vehicle, similar to how a mortgage lien release removes a lender’s interest in real property once the loan has been repaid.

Deed of Reconveyance: Used in some states in place of a satisfaction of mortgage, this deed transfers the title of real property back to the borrower from the trustee, indicating the loan secured by the property has been paid in full. It accomplishes a similar objective as the mortgage lien release by removing the lien from the property.

Release of Mechanic’s Lien: This is provided once a mechanic or construction lien is settled. It resembles a mortgage lien release by confirming that the financial obligation which resulted in the lien has been satisfied, clearing the title of encumbrances related to the work performed or materials supplied.

Dos and Don'ts

Filling out a Mortgage Lien Release form is a critical step in the mortgage process, marking the point where a lien on property is officially removed, thus freeing the property from the claims of creditors. The accuracy and completeness of this form are paramount, as any mistakes can lead to delays or even legal challenges. Below are key dos and don'ts to consider when completing this important document.

- Do ensure all information is accurate. This includes the borrower's name, the address of the mortgaged property, and the original loan number. Incorrect information can invalidate the release form.

- Do verify that the loan is fully paid off before filling out the form. A lien release is only valid if the debt it secures is completely satisfied.

- Do include the date the mortgage was paid off, as this is often required to process the lien release.

- Do check with your local registry of deeds or similar authority to ensure the form meets all local and state requirements, which may vary.

- Don't leave any sections blank. If a section does not apply, it's better to write "N/A" (not applicable) than to leave it empty.

- Don't forget to sign and date the form. An unsigned form is usually considered invalid. Depending on the jurisdiction, a notary public may need to witness the signature.

- Don't ignore the need for a witness or a notary, if required by law. This step is crucial for the document's legal validity.

- Don't delay in filing the completed form with the appropriate government office. Timely filing is essential for the release to be reflected in public records, officially removing the lien from the property.

By meticulously following these guidelines, individuals can ensure the Mortgage Lien Release process is smooth and successful, thereby avoiding potential legal and financial complications down the road. It's always a good idea to consult with a professional if you have any questions or concerns regarding your specific situation.

Misconceptions

Understanding the nuances of the Mortgage Lien Release form is crucial for homeowners. However, various misconceptions can lead to confusion and errors. Here are six common myths debunked to ensure clarity and accuracy in dealing with these forms.

Mortgage Lien Releases automatically follow full repayment. A prevalent misconception is that the Mortgage Lien Release form is automatically filed once a mortgage is paid off. In reality, borrowers must often initiate the process by contacting their lender to request this document, which releases the lien from public records.

Only the lender can file the Mortgage Lien Release form. While it's true that the lender or the servicing agent usually prepares and files this document, in some instances, the borrower might need to file the form at their local land records office, especially if the lender fails to do so within the stipulated time frame.

The Mortgage Lien Release form is the same in every state. The requirements, including the form itself, vary significantly from one jurisdiction to another. Some states have specific forms, deadlines, and procedures that must be followed to properly release a mortgage lien.

Filing the Mortgage Lien Release form is immediate. The misconception here is that the lien is released immediately upon filing the form. The process involves several steps, including verification of the full payment and the recording of the release in the public records, which can take weeks or sometimes months to complete.

A Mortgage Lien Release is not necessary for refinancing. This misunderstanding can cause significant issues. A new lender will require a clear title to refinance a mortgage, which means any previous liens, including those from paid-off mortgages, must be formally released.

There is a universal procedure for obtaining a Mortgage Lien Release. The process for obtaining and filing a Mortgage Lien Release varies widely, not just by state, but also by lender. Some lenders might send the form directly to the local recording office, while others might send it to the borrower to file. Always check with the lender for their specific procedure to avoid delays and errors.

It's essential for homeowners to recognize these misconceptions about the Mortgage Lien Release form. Understanding the correct processes and requirements ensures the smooth release of the lien, safeguarding the homeowner's rights and interests.

Key takeaways

When a mortgage is paid off, a critical step for the property owner is obtaining a Mortgage Lien Release. This document officially frees the property from the claim previously held by the lender. Understanding the process of filling out and utilizing the Mortgage Lien Release form is vital, and the key takeaways listed below will guide individuals through this process effectively.

- Importance of accuracy: Every detail entered on the Mortgage Lien Release form must be accurate. This includes the borrower's full name, address, legal description of the property, and the original loan number. Incorrect information can delay the process or invalidate the form.

- Verification of mortgage satisfaction: Before filling out the form, ensure the mortgage has been fully satisfied. This means all payments have been made, and there are no outstanding balances.

- Legal language is pivotal: The form contains specific legal terminologies that legally release the lien. Understanding or consulting with someone about these terms can prevent unintended errors or misunderstandings.

- Local laws and requirements: Lien release processes can vary significantly by jurisdiction. Some states or counties may have additional steps or requirements. Always check local laws to ensure compliance.

- Signature requirements: The Mortgage Lien Release form typically requires the lender's signature. In some cases, this signature must be notarized. Understanding the specific requirements in your area is crucial.

- Recording the release: After the form is filled out and signed, it must be recorded with the local county recorder's office or appropriate government entity. This step is vital for the lien release to become a part of the public record.

- Timeliness matters: There are often time frames within which the Mortgage Lien Release must be recorded after the loan is paid off. Missing these deadlines can lead to complications.

- Keep copies for your records: After the form is filed with the government office, ensure you obtain and keep copies for your records. These documents are proof the mortgage has been satisfied and the lien released.

- Seeking professional help: Given the legal nature of the form and the process, consulting with a legal professional or a real estate attorney can provide guidance and peace of mind throughout the process.

Accomplishing a Mortgage Lien Release is a significant milestone in property ownership. It officially declares the owner's freedom from mortgage obligations and the release of the lender's claim on the property. By following these key takeaways, property owners can navigate the process more smoothly and ensure that their rights are fully protected.

Discover Other Types of Mortgage Lien Release Documents

Conditional Lien Release - A Conditional Contractor's Lien Release form is a document that safeguards property owners, ensuring that a contractor cannot claim a lien on the property once paid for a specific amount of work completed, with the condition that the payment clears.

Generic Photo Release Form - Offers photographers a straightforward method to gain consent, ensuring images are used appropriately and legally.