Legal Vehicle Repayment Agreement Form

When an individual decides to purchase a vehicle through financing or needs to renegotiate the terms of an existing loan due to financial difficulties, a Vehicle Repayment Agreement form becomes an essential tool. This document serves as a formal agreement between the borrower and the lender, detailing the revised payment schedule, interest rates, and any other terms pertinent to the loan's repayment. Essential for providing both parties with clarity and legal protection, this form plays a crucial role in preventing misunderstandings and ensuring that the terms of the loan are clear and agreed upon by both sides. Its importance cannot be overstated, as it not only facilitates a mutual understanding but also helps in maintaining a positive relationship between the buyer and the financial institution or seller. By setting clear expectations and responsibilities, the Vehicle Repayment Agreement form helps in making the path towards financial recovery smoother for individuals facing challenges in keeping up with their original loan terms.

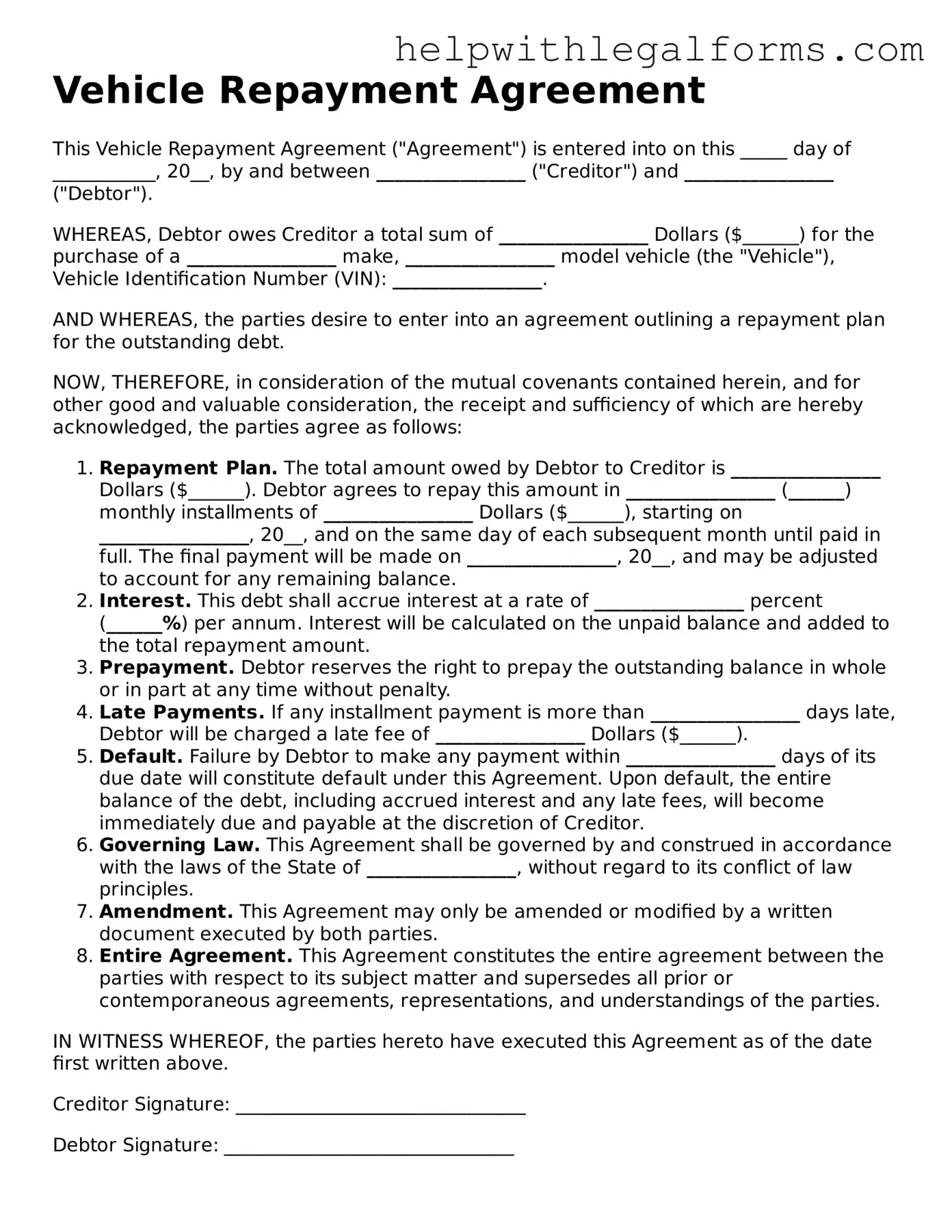

Example - Vehicle Repayment Agreement Form

Vehicle Repayment Agreement

This Vehicle Repayment Agreement ("Agreement") is entered into on this _____ day of ___________, 20__, by and between ________________ ("Creditor") and ________________ ("Debtor").

WHEREAS, Debtor owes Creditor a total sum of ________________ Dollars ($______) for the purchase of a ________________ make, ________________ model vehicle (the "Vehicle"), Vehicle Identification Number (VIN): ________________.

AND WHEREAS, the parties desire to enter into an agreement outlining a repayment plan for the outstanding debt.

NOW, THEREFORE, in consideration of the mutual covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

- Repayment Plan. The total amount owed by Debtor to Creditor is ________________ Dollars ($______). Debtor agrees to repay this amount in ________________ (______) monthly installments of ________________ Dollars ($______), starting on ________________, 20__, and on the same day of each subsequent month until paid in full. The final payment will be made on ________________, 20__, and may be adjusted to account for any remaining balance.

- Interest. This debt shall accrue interest at a rate of ________________ percent (______%) per annum. Interest will be calculated on the unpaid balance and added to the total repayment amount.

- Prepayment. Debtor reserves the right to prepay the outstanding balance in whole or in part at any time without penalty.

- Late Payments. If any installment payment is more than ________________ days late, Debtor will be charged a late fee of ________________ Dollars ($______).

- Default. Failure by Debtor to make any payment within ________________ days of its due date will constitute default under this Agreement. Upon default, the entire balance of the debt, including accrued interest and any late fees, will become immediately due and payable at the discretion of Creditor.

- Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of ________________, without regard to its conflict of law principles.

- Amendment. This Agreement may only be amended or modified by a written document executed by both parties.

- Entire Agreement. This Agreement constitutes the entire agreement between the parties with respect to its subject matter and supersedes all prior or contemporaneous agreements, representations, and understandings of the parties.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first written above.

Creditor Signature: _______________________________

Debtor Signature: _______________________________

Date: __________________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Purpose of the Agreement | This form is used to outline the terms and conditions under which a vehicle will be repaid, usually in a private sale or when a loan is given for the purchase. |

| Governing Law | The agreement is governed by state law, and the specific laws applicable depend on where the vehicle sale or loan transaction takes place. |

| Key Components | Includes loan amount, interest rate, repayment schedule, late fees, and the rights and obligations of both the buyer and seller. |

| Interest Rates | Must comply with the state's usury laws to avoid illegal interest charges. |

| Repayment Schedule | Details how often payments must be made (e.g., monthly), the amount of each payment, and when the first and last payments are due. |

| Late Fees | Specifies any late fees for missed payments, which must also comply with state laws. |

| Security Interest | The seller may retain a security interest in the vehicle until the buyer completes all repayment terms, ensuring the vehicle can be repossessed if terms are not met. |

| Effect on Vehicle Title | A lien may be placed on the vehicle title to reflect the seller's security interest until the debt is fully paid. |

| Requirement for Notarization | Some states require the agreement to be notarized to increase its enforceability. |

| Modifications to the Agreement | Any changes to the agreement must be made in writing and signed by both parties to be valid. |

Instructions on How to Fill Out Vehicle Repayment Agreement

After deciding to outline a repayment plan for a vehicle, it's critical to formalize the agreement. This ensures that both parties clearly understand their obligations and commitments. A Vehicle Repayment Agreement form acts as a binding contract, detailing the loan amount, repayment schedule, interest rates, and other essential terms. By following the steps below, you can complete the form quickly and accurately, moving one step closer to a mutually beneficial arrangement.

- Start by filling in the date at the top of the form to signify when the agreement takes effect.

- Enter the full legal names and addresses of both the borrower and the lender in the designated areas, ensuring the information matches their official documents.

- Specify the vehicle details including make, model, year, VIN (Vehicle Identification Number), and current mileage to accurately identify the subject of the agreement.

- Outline the loan amount in dollars, ensuring both parties agree on the total sum being financed under this agreement.

- Detail the repayment schedule, including the start date, frequency of payments (weekly, bi-weekly, monthly), the amount of each payment, and the total number of payments to be made. If applicable, include the due date of the final payment.

- Describe the interest rate, if any, applied to the loan. Specify whether it's fixed or variable, and how it's calculated.

- Include any late payment penalties, specifying the grace period before a late fee is charged and the amount of this fee.

- Document the conditions under which the agreement can be terminated early, and what the penalties, if any, would be for early termination.

- Both parties should read the agreement in its entirety to ensure understanding and agreement on all points.

- At the bottom, have the borrower and the lender sign and date the form. Witness signatures may also be required, depending on local laws or preferences.

With the steps above completed, the Vehicle Repayment Agreement is finalized, establishing a clear path forward. It's advised to keep copies of the signed document with each party involved for future reference. As circumstances change, remember that any amendments to the agreement should be made in writing and signed by both the borrower and the lender to remain enforceable.

Crucial Points on This Form

What is a Vehicle Repayment Agreement form?

A Vehicle Repayment Agreement form is a legally binding document between two parties, where one party, the borrower, agrees to pay back a certain amount of money borrowed from the other party, the lender, for the purchase of a vehicle. This agreement outlines the repayment schedule, the interest rate if applicable, and other terms and conditions related to the repayment of the loan.

Who needs to sign the Vehicle Repayment Agreement form?

The Vehicle Repayment Agreement form must be signed by both the borrower and the lender. In some cases, if there is a co-signer to the loan, they would also be required to sign the agreement. It is important that all signatures are obtained to ensure the enforceability of the agreement.

Can the terms of the Vehicle Repayment Agreement be modified after it is signed?

Yes, the terms of the Vehicle Repayment Agreement can be modified, but any changes must be agreed upon by both the borrower and the lender. It is highly recommended that any amendments to the agreement be documented in writing and signed by all parties involved, similar to the original agreement, to avoid any future disputes.

What happens if the borrower fails to make payments as agreed in the Vehicle Repayment Agreement?

If the borrower fails to make payments as stipulated in the Vehicle Repayment Agreement, the lender has the right to take legal action to recover the owed amount. Depending on the terms detailed in the agreement, this may include repossessing the vehicle. The agreement may also detail late fees or other penalties for missed or late payments.

Is a Vehicle Repayment Agreement legally binding in all states?

Yes, a Vehicle Repayment Agreement is legally binding in all states as long as it contains all the necessary elements required by law, including the signature of both parties. However, the specific requirements and enforcement may vary slightly from one state to another, so it's advisable to consult with a legal professional in your state to ensure the agreement meets all legal standards.

Common mistakes

Filling out a Vehicle Repayment Agreement form is a crucial step in ensuring a smooth process when agreeing to terms for vehicle repayments. However, many people tend to make mistakes during this process. Here are seven common errors to be aware of:

Skipping over details: Some folks rush through filling out the form and miss filling in some necessary details. Every piece of information asked for in the form plays a key role in the agreement.

Incorrect information: Entering wrong information, such as dates, amounts, or personal details, can lead to significant issues down the line. It's crucial to double-check all entries for accuracy.

Not understanding terms: Sometimes, people don't fully understand the terms they're agreeing to. This could be about interest rates, repayment schedules, or penalties for late payments. It's important to understand every part of the agreement or ask for clarification when needed.

Forgetting to specify payment methods: The form should clearly state how payments will be made (e.g., direct debit, cash, online). Not specifying this can lead to confusion and missed payments.

Leaving out penalties for late payments: Failing to specify what happens if a payment is late is a common oversight. This should be clearly outlined in the agreement to ensure both parties understand the consequences of late payments.

Not using clear language: Sometimes, people try to use overly complex or legalistic language, thinking it makes the agreement more official. However, this can lead to misunderstandings. It's best to use clear and simple language.

Failing to include a dispute resolution process: Disagreements can happen. Not including a clause about how disputes will be resolved is a common mistake. It’s beneficial for both parties to know upfront how potential issues will be handled.

By avoiding these mistakes, both the borrower and the lender can ensure a clearer, more enforceable agreement that protects both parties' interests.

Documents used along the form

When dealing with a Vehicle Repayment Agreement, it's not just about this document standing alone. This agreement is often part of a larger set of documents that span across various facets of vehicle purchase, ownership, and financial agreements. Each document plays a pivotal role in ensuring all aspects of the vehicle's purchase, ownership, maintenance, and liability are clearly understood and agreed upon by all parties involved. Here are some of the key documents that are often used alongside a Vehicle Repayment Agreement.

- Bill of Sale: This document is a key transaction record that outlines the details of the vehicle's sale from the seller to the buyer. It includes the purchase price, vehicle identification number (VIN), and specifics about the make and model.

- Promissory Note: Often accompanying a Vehicle Repayment Agreement, a Promissory Note details the borrower’s promise to repay the lender. It includes the loan amount, interest rate, repayment schedule, and any penalties for late payments.

- Loan Agreement: This formal document outlines the terms of a loan provided for the vehicle. It includes details similar to the Promissory Note but is more comprehensive, covering legal recourse for both parties.

- Insurance Documents: Proof of insurance is crucial in the context of a vehicle purchase and financing. These documents verify that the vehicle is covered under an insurance policy, which protects the financial interests of both the buyer and the lender.

- Registration Papers: Vehicle registration documents confirm that the vehicle has been officially registered with the state. These papers are necessary for legal driving and must be updated to reflect the current owner and lienholder, if applicable.

- Title: The vehicle's title is a critical document that establishes legal ownership. When a vehicle is financed, the title may be held by the lender until the loan is paid off, at which point it is transferred to the owner.

- Warranty Documents: If the vehicle is under a warranty, these documents detail the coverage scope, including what components are covered and for how long, providing both parties with an understanding of maintenance and repair responsibilities.

- Privacy Notice: As per the Gramm-Leach-Bliley Act, a privacy notice may be required to inform the borrower about the sharing of personal financial information. It details how the financial institution collects, shares, and protects the borrower's personal information.

Understanding and properly managing these documents can significantly affect both the immediate and long-term aspects of a vehicle transaction. They collectively ensure that both buyer and lender responsibilities are clearly outlined and legally documented, thus safeguarding the interests of all parties involved. As such, the Vehicle Repayment Agreement is an important piece within a larger puzzle of financial and legal documentation associated with vehicle transactions.

Similar forms

A Loan Agreement is quite similar because it outlines the terms and conditions under which money is borrowed. The Vehicle Repayment Agreement specifies how the borrower agrees to repay the cost of a vehicle, making both documents fundamentally about terms of repayment.

A Lease Agreement shares similarities, particularly in the realm of vehicles. It details the conditions under which one party leases a vehicle to another. Key elements like payment schedule, interest rates, and consequences of non-payment are common to both documents.

The Personal Loan Agreement is another document that mirrors the structure of a Vehicle Repayment Agreement, focusing on the specifics of borrowing and repaying a sum of money between individuals, often with added details about collateral which could include a vehicle.

A Mortgage Agreement also has parallels, particularly in the financial arrangements and legal obligations it outlines. While focused on property, the structure of repayment, interest, and the role of collateral are elements it shares with vehicle repayment agreements.

The Promissory Note closely resembles a Vehicle Repayment Agreement in its promise of repayment under specified conditions. Though less detailed in terms of conditions and legal protections, it serves a similar function of documenting an agreement to pay a debt.

An Installment Sale Agreement is relevant, especially when the purchase of a vehicle is done through installment payments. This document outlines the buyer’s agreement to pay the seller in increments until the total sum is paid, including any interest charges, similar to vehicle repayment plans.

A Secured Loan Agreement holds resemblance, with the notable feature being the security interest granted in an asset, like a vehicle, to ensure loan repayment. It details how a borrower must repay their debt or risk losing the secured asset, a core principle also in vehicle repayment agreements.

A Debt Settlement Agreement reflects aspects of the Vehicle Repayment Agreement, primarily in the focus on resolving and settling an outstanding debt under agreed-upon terms. Though it often comes into play when modifying original repayment terms, the aim of defining a clear path to debt repayment aligns them.

The Consumer Loan Agreement can be similar, especially when it pertains to loans offered to individuals for personal, family, or household purposes, including buying a vehicle. It spells out the loan terms, repayment schedule, and the interest rate, reflecting key aspects of vehicle repayment agreements.

Dos and Don'ts

When filling out a Vehicle Repayment Agreement form, it's crucial to approach the process with care and attention to detail. This document formalizes the terms under which a vehicle repayment will be made, usually between a buyer and a seller or between parties settling a loan. Understanding what to do and what to avoid can make the difference between a clear, enforceable agreement and potential misunderstandings or disputes. Here are six dos and don'ts to consider:

- Do ensure all personal information is accurate and complete. This includes names, addresses, and contact details of all parties involved.

- Do clearly specify payment terms. This should include the total amount to be repaid, the payment schedule, and any interest rates applied.

- Do include a description of the vehicle. Be sure to list the make, model, year, VIN (Vehicle Identification Number), and any other details that uniquely identify the car.

- Don't leave any blanks on the form. If a section does not apply, mark it as "N/A" (not applicable) to indicate that it has been considered and intentionally left blank.

- Don't forget to outline the consequences of late payments or defaulting on the agreement. This ensures both parties understand the ramifications of failing to adhere to the terms.

- Don't omit signatures and dates. The agreement isn't legally binding until all parties have signed and dated the document.

Following these guidelines when filling out a Vehicle Repayment Agreement can help protect all parties involved, ensuring the agreement is fair and enforceable. It's always wise to review the document thoroughly before signing, and consider consulting with a legal professional if you have any doubts or questions.

Misconceptions

When it comes to understanding the Vehicle Repayment Agreement form, several misconceptions can lead to confusion or misinterpretation. Here's a list of common misunderstandings and the truths behind them:

Only the borrower needs to sign the agreement. In fact, both the lender and the borrower must sign the agreement for it to be legally binding. This ensures that both parties have agreed to the terms and conditions documented.

The form is non-negotiable. Contrary to this belief, the terms within a Vehicle Repayment Agreement can often be negotiated before signing. Both parties should discuss and agree upon the terms, including the repayment schedule, interest rates, and consequences of default, to suit their needs.

Printing the form is not necessary; digital signatures are sufficient. While digital signatures are becoming more widely accepted, it is crucial to check local regulations. Some jurisdictions may require a printed copy of the agreement with a handwritten signature for it to be considered legally binding.

Interest rates are fixed and cannot be adjusted. The truth is, interest rates in a repayment agreement can be flexible. The lender and the borrower can agree on a fixed rate or a variable rate that can change under certain conditions specified in the agreement.

A Vehicle Repayment Agreement guarantees the borrower will pay back the loan. Although the agreement is a legally binding document that outlines the borrower's commitment to repay the loan, it doesn't physically ensure that the borrower will do so. Lenders may still face risks of non-payment.

There is a standard form that everyone must use. While there are templates available, a Vehicle Repayment Agreement can be customized to fit the specific agreement between the lender and the borrower. It's essential to ensure that the agreement meets all legal requirements while also covering the unique terms of the deal.

Only monetary penalties can be imposed for late payments. The parties can agree on various consequences for late payments, including monetary penalties, interest rate adjustments, or even repossession of the vehicle under certain conditions. The specific penalties should be clearly outlined in the agreement.

The agreement does not need to mention the vehicle's condition. Actually, detailing the condition of the vehicle at the time of the loan agreement is essential. This information can protect both the borrower and the lender, particularly if disputes arise regarding the vehicle's condition later on.

Key takeaways

Understanding the Vehicle Repayment Agreement form is essential for anyone looking to structure a repayment plan for a vehicle. This document outlines the terms under which the borrower agrees to pay back the lender for the vehicle. Here are key takeaways to ensure its effectiveness and legality:

- Personal Information must be Accurate: It's critical to include accurate and up-to-date information for both the lender and the borrower. This includes full names, addresses, and contact information. Mistakes here could lead to legal complications or the agreement being contested.

- Vehicle Details are Essential: Clearly list the make, model, year, VIN, and any other relevant information about the vehicle. This specificity helps prevent any misunderstandings about what is being repaid.

- Repayment Terms need to be Clear: The agreement must specify the loan amount, interest rate (if applicable), repayment schedule, and the due dates for payments. Unclear terms can lead to disputes down the line.

- Consequences for Default: Clearly outline the consequences if the borrower fails to make the agreed-upon payments. This can include late fees, repossession of the vehicle, or other legal actions.

- Signatures are Vital: The agreement isn't legally binding until it has been signed by both parties. Ensure that the document is signed and dated, and consider having witnesses or a notary public for additional validation.

By paying close attention to these details, parties can create a comprehensive and enforceable Vehicle Repayment Agreement that protects both the lender’s investment and the borrower’s rights. Always consult with a legal professional if you have concerns or if the agreement involves significant sums or complicated terms.

Other Forms

California Motorcycle Bill of Sale - It may also include information about any warranties or guarantees offered by the seller, adding value for the buyer.

Purchase Contract - Details the mechanisms for adjusting the purchase price based on final inventory counts and asset valuations.

Printable Jet Ski Bill of Sale - In some jurisdictions, a Jet Ski Bill of Sale might be required to show sales tax was paid on the transaction.